The greenback is gaining momentum ahead of Fed policy meeting while euro is subdued despite the 7‐year high of Eurozone’s Industrial Production. The BoJ left kept the negative rate policy and hinted that may cut rates further or loose their QQE program while the pound declined ahead of the Annual Budget Report and the BoE policy meeting.

USD traders wait for Fed policy meeting tomorrow

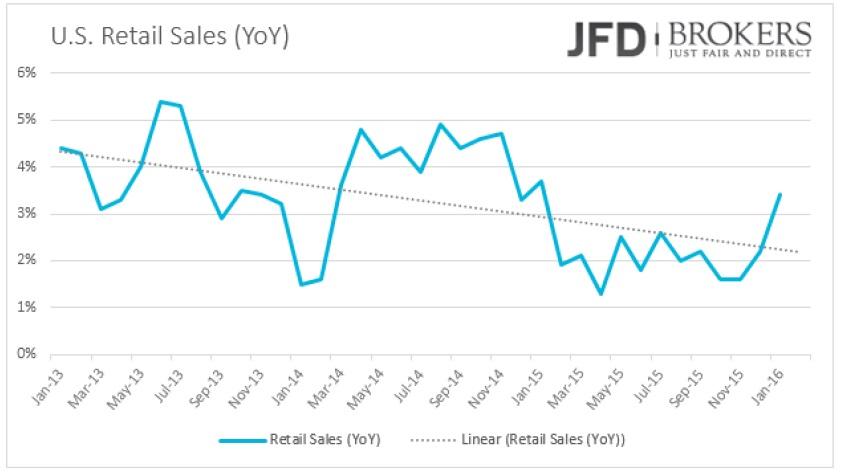

The U.S. currency was seen broadly stronger on a quiet Monday without macro drivers but ahead of the Retail Sales release and Fed policy meeting. The Retail Sales in February are expected to have declined by 0.1% mom in from a rise of 0.2% before. The two‐day Fed policy meeting ends tomorrow with traders being tuned to hear the accompanied press conference. Even though no changes to the current policy are expected, the minutes will reveal significant data for the global economic situation.

Eurozone’s Industrial Production at 6‐year high

The single currency was traded mixed against the G10 currencies on Monday and early Tuesday ahead of Fed policy meeting. The only notable macro‐update on Monday in the 19‐nation union was the Industrial Production for January that pushed the confidence higher. The production in Eurozone’s industries increased by 2.1% reaching a 6‐year high. The month before, the production declined by 0.5% and was expected to have increased by 1.5%.

The EUR/USD pair has been choppy and fairly directionless as it remains in the sideways channel, which started back in early February. Therefore, it leaves the outlook unchanged for now ahead of some significant data coming out this week from both, the U.S. and EU. Once again, we have little EU economic information to trade off and really won't see anything significant until Thursday's CPI figures. On the other hand, there is also a lot of economic data being released today in the U.S., although I’m not sure it will have quite the same impact that it ordinarily would ahead of tomorrow’s FOMC meeting. Technically, the pair is trading above the daily 50‐SMA and the 200‐SMA, near 1.1050 while on the upside the level to watch will be the 1.1218, last week’s high. Above there could see a run towards 1.1300 and then to the February high at 1.1375.

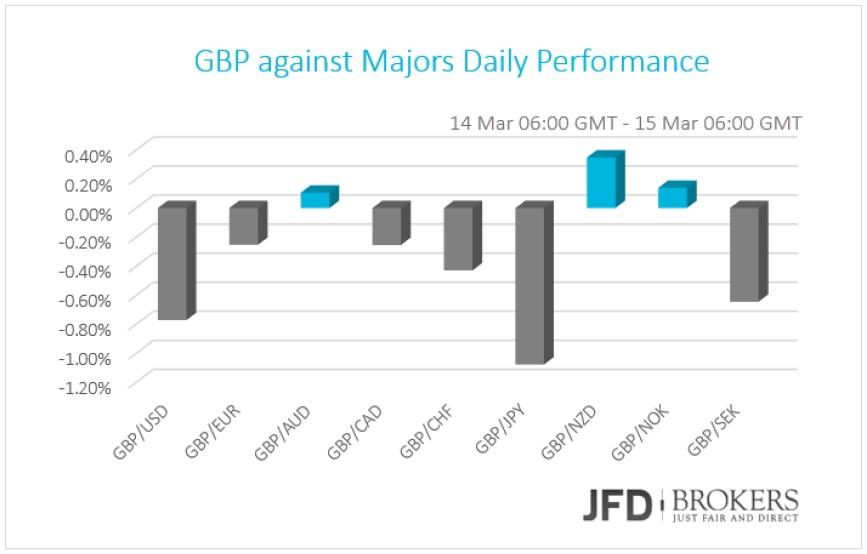

Pound declined ahead of Annual Budget Report and BoE Meeting

Two days ahead of Bank of England’s policy meeting and the day before the Chancellor of Exchequer publishes the Annual Budget, the sterling is losing ground against the currencies of the G10 basket, on a quiet day in terms of economic releases in the UK.

The GBP/USD pair is back down at 1.4300, and with the momentum indicators looking negative we could now be in for a test of 1.4200. This is a significant level since it coincides with the 4‐hour 50‐ SMA and the 200‐SMA. Technically, I do not expect any major moves as traders will be awaiting the UK Unemployment Rate and Budget Report, which both take place on Wednesday, although it will be the Bank of England Policy Meeting on Thursday that will draw all the attention this week. Therefore, the levels to watch remain pretty much the same, with the 1.4445 to cap any moves to the upside while the 1.4125 to prevent any moves to the downside.

Bank of Japan maintains Negative Rate Policy

The Bank of Japan kept its interest rates unchanged driving Japanese yen higher against its major peers. The bank maintained its negative rate policy of ‐0.1% and the same level of asset purchases under bank’s qualitative and quantitative easing (QQE) program of 50 trillion yen a year. The Japanese currency gained 0.40% against the U.S. dollar and the euro as well as 0.50% versus the pound in the next hours of the announcement. BoJ Governor stated at his press conference that they may ease further in the future, modifying the QQE program or the interest rates.

The USD/JPY pair is continuing to trade in a fairly tight range, with 114.60 – 114.85 capping any moves to the upside and 111.00 propping it up. Over the last couple of weeks, the pair hasn’t even reached these boundaries with the range appearing to have tightened further. The 200‐SMA is providing a strong resistance to the bears, near the aforementioned zone. On the downside, the first support will be seen at 113.00 and then at 112.60. A move back to 111.00 and to last week’s low at 112.20 seems unlikely today, but the medium‐term indicators remain positive and in the case that we do head back below the key level of 112.60 then we should wait for a run towards the key 111.00.

Gold – Technical Outlook

The precious metal plunged for a third consecutive session on Tuesday to its lowest in almost two weeks, as investors will be awaiting the FOMC minutes for further clarification on when interest rates might rise again. Gold came back in the range that was trading few weeks ago and is now trading roughly around the $1,230 level. The yellow metal earlier in the session fell to $1,224 an ounce, its lowest since March 3. Technically, the range that the XAU/SUD has been traded the last couple of weeks leaves the outlook pretty much unchanged, although the 4‐hour chart do suggest a pullback to the downside, with the next level to watch being the $1,215, which coincides with the 200‐SMA. On the upside, support will be seen at $1,236 and then at $1,250.

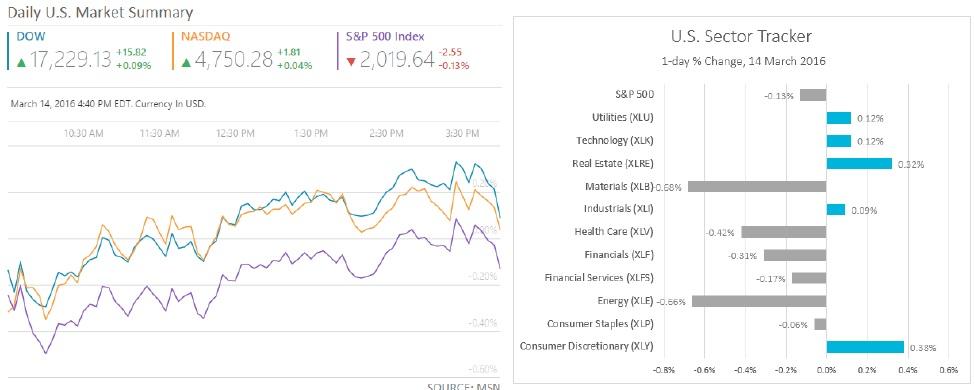

U.S. Indices were virtually unchanged

The U.S. indices ended Monday’s trading session virtually unchanged. The Dow Jones Industrial Average edged higher by 0.09% and closed near 17,230 while Nasdaq rose just 0.04% at 4,750. The S&P 500 declined by 0.13% at 2,020 dragged down mainly by energy and materials sectors’ stocks.

What to watch today

In the morning, Eurozone’s employment change for the fourth quarter will be out. In U.S., the Retail Sales will be released and are expected to have declined by 0.1% mom in February from a rise of 0.2% before. The Produce Price Index for February, Business Inventory for January and NAHB Housing Market Index for March will be also eyed.

In New Zealand, attention among the market participants will turn to Fonterra's Global Dairy Auction.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.