BoE Carney Underlines Brexit Consequences; BoC and RBNZ Policy Meetings Today!

China’s economic updates dominated once again the market headlines as their exports fell more than 25% in February, halting U.S. stocks increase while the oil erased some of its gains. The major currencies have been in a subdued volatility, expecting tomorrow ECB meeting to gauge the market’s direction.Today there are two monetary policy announcements coming from Bank of Canada and New Zealand. The other macro updates will be closely eyed are the UK NIESR GDP estimate for the three months to February as well as the Manufacturing and Industrial Production in January.

Eurozone’s GDP above expectations

The single currency has been in a choppy session, traded mixed versus its major counterparts despite thepositive GDP surprise. The final annualized GDP showed that the economy expanded by 1.6% above market’s forecast of 1.5% for the third consecutive quarter while the quarterly indicator remained at 0.3%. The greenback was broadly but limited higher against the other G10 currencies due to the absence of the market driver updates on the macroeconomic front.

The EUR/USD pair remained unchanged following the false breakout above the key support level of 1.1030, however, the last couple of days the pair has been trading in range without much direction as traders await the ECB policy meeting due tomorrow. The levels are pretty much the same, with the 200-SMA on the 4-hour chart, near 1.1030 to be once more the first obstacle for the bulls while the 50-SMA, around 1.0950 to be the first support to the downside.

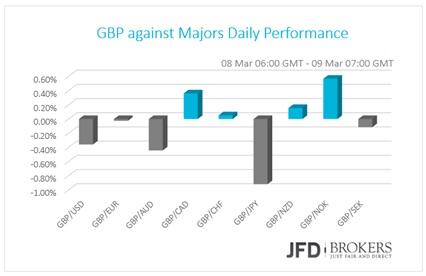

BoE Carney warned for Brexit consequences

The pound was traded mixed versus its G10 peers despite BoE Governor Mark Carney’s warnings for Brexit. The BoE Governor warned that Britain’s exit from the European Union will be the “biggest domestic risk to financial stability” and he said that in his judgement the global risks, including from China, are bigger than the domestic risks. The central bank’s ability to control inflation will be affected negatively and the pound will drop as well as many banks will move abroad. However, if the Britain votes to leave the 19-nation union, Carney stated that the Bank of England will do everything in their power to discharge their responsibility to achieve monetary stability and financial stability.

The GBP/USD pair is back down at 1.4200 and with the momentum indicators looking negative we could now be in for a test of 1.4125. The 200-SMA on the 4-hour chart is capping any moves to the upside and 1.4100 – 1.4125 propping it up. Ahead of the UK Industrial and Manufacturing Production figures, I would expect the pair to react and probably test the aforementioned zone, however, I would expect the move to be limited while waiting for the ECB policy meeting tomorrow.

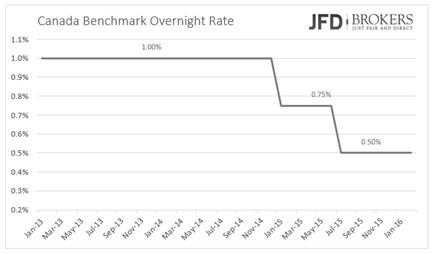

Loonie dropped ahead of BoC policy meeting

The Canadian dollar fell versus the U.S. dollar ahead of today’s central bank’s policy meeting. The country’s economy looks improved compared to the time of the previous meeting. The inflation improved, the GDP showed bigger expansion of the economy, housing starts and building permits shored up while oil gain significant ground. The BoC Governor was concerned about the global recession the previous policy meeting, however, the commodity rise suggests increased sentiment for the domestic macroeconomic front. Based on the data above, I wouldn’t expect any kind of easing of the current monetary policy but to leave it unchanged at the overnight rate of 0.5%.

The USD/CAD pair recovered yesterday following the rebound from the key support level of 1.3260 and ahead of the BoC policy meeting due later in the day. The pair plunged more than 3% in February and is down -0.87% so far this month, however, the pair managed to turn the weekly performance to positive, 0.80%, following seven consecutive negative weeks. The pair is now testing the 200-SMA on the daily chart and the 50-SMA on the 4-hour chart, near 1.3400. If the bulls manage to achieve a close above the aforementioned obstacles would bring a more bullish outlook for the pair where the 1.3500 and 1.3560 provide clear targets for any upside momentum.

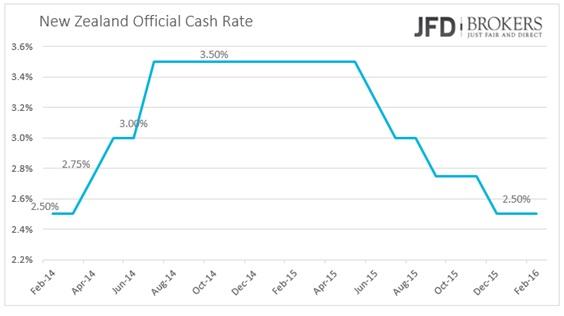

RBNZ to leave the current monetary policy on hold for now

Later in the second half of the trading session, the Reserve Bank of New Zealand will announce its rate decision followed by a press conference of the RBNZ Governor Wheeler. No changes are expected for now as the general picture of the economy looks brighter than in January. The labour market improved according to the unemployment rate that decreased to the lowest since March 2009. The global dairy index entered the positive territory for the first time in 2016 and the business activity in general improved, according to the Business PMI. Even though the growth of the average hourly earnings slowed down and the business confidence worsened. The current official cash rate is 2.50% since December.

The choppy conditions once again dominated trade for the NZD/USD pair on Tuesday ahead of the RBNZ policy meeting which comes 5 hours after the BoC meeting. The pair is moving lower, following a failed attempt to break higher few hours ago. To the upside, strong resistance will arrive at 0.6800 and then again at 0.6825, which I do not foresee a break to take place this week, unless something extremely occurs from the RBNZ policy meeting. On the downside, the initial support will be seen at the 50-SMA on the 4-hour chart, near 0.6680 and then around 0.6600, which includes the 200-SMA.

U.S. Indices winning days halted on China’s data and oil’s fall

Chinese poor data and oil’s fall put a cap in the longest winning streak in five months of the S&P 500, as it slid 1.12% and recorded the first negative performed day in March. The energy stocks were by far the biggest drag of the index, falling overall 4.20%. The S&P 500 failed to gain momentum above the 200-SMA on the daily chart which coincides with the psychological level of 2,000 and ended the day slightly below the aforementioned level.

The Dow Jones Industrial Average edged 0.64% lower as it tries to gain momentum above 17,000 for the fifth straight day. The 100-SMA, as well as the 200-SMA on the daily chart, provide significant support to the index halting preventing severe declines for now. The worst performed stock was by far the Caterpillar Inc (NYSE: CAT) that dropped by 4.07% followed by Goldman Sachs Group Inc. (NYSE: GS) that fell by 2.41%.

Nasdaq closed the day lower by 1.26%, 59.43 points close to 4,650 followed yesterday’s losses of 0.19%, after four winning days. On the downside, the initial support will be seen at the session low of 4240 and then at 4180, a significant level which includes the 200-SMA on the 4-hour chart. On the upside, if the bulls manage to sustain the price above 4240, then we will be looking for a test of the critical resistance level around 4360.

What to watch today

During the morning, the UK Manufacturing and Industrial Production for January are scheduled for release. The manufacturing sector is expected to expand by 0.2% from a contract of 0.2% before, mom, while the industrial sector mom, to expand by 0.5% versus -1.1% in December.

On the second half of the trading day, the NIESR GDP for the three months to February will be eyed. In U.S., the Wholesale Inventories for January are expected to slow down again by 0.1% as the month before. TheBank of Canada will review its interest rate decision but no changes are expected.

Later in the day, the Reserve Bank of New Zealand will announce its interest rate decision accompanied with the monetary policy statement and followed from a press conference.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.