Yellen: Negative Rates are Not Off the Table; Safe-Havens Keep Rising; Global Stock Market in Bearish Bias

The dollar continues to depreciate against the majors, 4% down since January against the basket of major currencies as the worries for banking system culminated.The European Central Bank and the Bank of Japan are playing with negative interest rates, while the hawkish move by Fed to start “normalizing” monetary policy in December, rising interest rates became a nightmare. As the economic growth worsens and the central bank’s easing policies are effectiveness, investors are running to safe-haven assets like gold and yen.

Yellen doesn’t take off the table the negative interest rates

The Fed Chairwoman Janet Yellen is studying ways to prepare the economy for another recession or even a financial crisis as the financial sector is stressed of the global stock market steep drop. The policymakers will revise again the monetary policy and they would even look into negative interest rates if needed. “I wouldn’t take those off the table,” she said. At her testimony on Wednesday, she expressed her concerns that the recent global risk will weigh on the US economic activity. However, she said that the continuing employment gains and the strong wage growth could support the economy.

From my side, all these are translated to the willing of a weaker dollar for the economy to expand at a strongest and more stable pace and ways to prepare the market that they would postpone the series of gradual rate hikes. The central bank policymakers miscalculated the risks the economy was apt to and began the historical “normalization” procedure that is possible to turn negative for the economy if they do not manage it wisely. I wouldn’t expect negative interest rates in the near future but I wouldn’t be surprised if the central bank uses other tools to ease the monetary policy and boost the growth.

Euro mixed on absence of domestic data

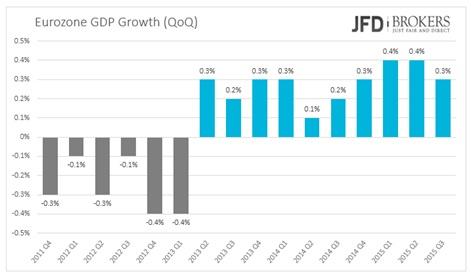

The single currency was traded mixed against the G10 currencies on Thursday and early Wednesday as the European Equities are falling and the forex traders were concentrated on Yellen’s testimony. Today, the German and Eurozone GDP will attract attention. The Eurozone’s GDP number for the fourth quarter is expected to slow down as well as the industrial production for December.

EUR/USD – Technical Analysis

After a brief move up to session highs of 1.1377, following Yellen’s testimony, the EUR/USD turned sharply down to trade at 1.1300, which coincides with the ascending trend line which started back in March 2015. A mixed session appears to be in store today, and with little news coming from Europe, it could be somewhat quieter. Having a look at the medium-term studies, the ADX has moved down significantly below the 25 level, suggesting a decreasing momentum. Note that the ADX only indicates trend strength and not trend direction. Furthermore, the MACD failed to hold in bullish territory and turned bearish again, while the Stochastic fell below the 20 level, indicating oversold conditions. These movements strengthen my conviction that we are likely to see a consolidation or a downward corrective wave, perhaps to test the 1.1235 – 1.1250 area. If it fails to achieve such a break, it could prompt a more aggressive move towards the key support level at 1.1380.

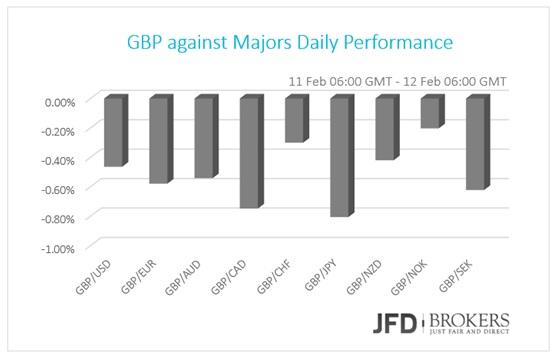

Pound tumbled against its major peers

The British pound slumped severely versus its counterparts on the same picture as the other major currencies. Not significant domestic macroeconomic update drove that move but the global risks and the fear of Brexit in collaboration with that risks. The UK has a strong banking system that relies on, mostly independent from the Eurozone, but the global slowdown will not leave it unaffected.

GBP/USD – Technical Analysis

Technically there is not too much change to the GBP/USD pair as it has moved quietly the last couple of days, however, the dollar failed to maintain its gains against the pound after it tested the key level of 1.4350. The pair managed to escape from the both the 50-SMA and the 200-SMA on the 4-hour chart and it seems now the new round of a bullish pressure could be seen. Therefore, the next level to watch will be the 1.4635, February high.

USD/JPY – Technical Outlook

Having made a new trend low at 111.00, the USD/JPY pair has made a partial recovery to close the day above 112.00. With the short term charts now looking a little more positive and following the aggressive move from the 122.00, it could be that the U.S dollar has a bit of a reprieve ahead of it, with the chance of a run towards 114.00. On the other hand, on a break below the 111.00 will negate any bullish scenario and I will start looking for a further correction towards the psychological level of 110.00.

Gold – Technical Analysis

The precious metal remains very heavy, with the gold trading down to a new trend high of $1,263, after having taken out the suggested target of $1,235. If we see a further correction, back below $1,235 would target $1,215. On the topside, if the precious metal can make it above the session high, then we could be in for a run towards the psychological level of $1,300.

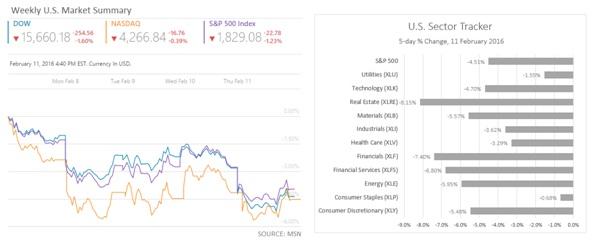

US Indices fell as the Risks for the Banking System increases

After the comments by fed Yellen written above, the US indices fell sharply after their opening. S&P500closed down 1.23% adding to its already above 10% YTD losses. However, currently, the worst performed shares that dragged down the index were not the energy-related but the financial services. Oil keeps falling but the greatest concern after the recent global economic slowdown is the banking system. The last five days the Financial Services shares dropped nearly 7% and major banks like JP Morgan Chase & Co (NYSE: JPM) are among the top losers with losses over 9%.

Dow Jones slumped by 1.60% for the day and sums up weekly losses of 3.40% with Boeing Company (NYSE: BA), Goldman Sachs Group Inc. (NYSE: GS) the major weekly drag to the downside as they fell more than 10%.

Nasdaq records the biggest drop from the three of them more than 15% since the beginning of the year despite that on Thursday posted the smallest drop.

Economic Indicators

Today, the EcoFin meeting will take place. The release of the German Consumer Price Index, the Harmony Index of Consumer Prices both for January and the Gross Domestic Product for the Q4 will provide a significant overview of the German economy. A while later, Eurozone’s preliminary GDP will attract significant attention.

In Eurozone, the industrial production for December will be out. In U.S. the retail sales for January will be released and are expected to have increased by 0.1% month-over-month from a drop of 0.1% the month before. The retail sales ex-autos are forecasted to remain flat while the flash Michigan consumer sentiment is predicted to show a small increase in February.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.