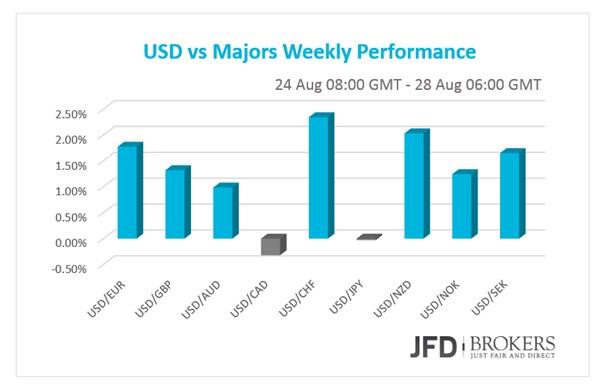

The greenback is rising against almost all of the other major currencies since Tuesday on hopes that Fed will raise interest rates on September’s Policy Meeting, despite the China’s financial stock crisis, as Chinese stocks started to stabilize and US Indices rebounded after a severe correction.The stronger than expected GDP report released on Thursday and the Durable Goods published the day before, enhance the portion of optimistic investors who expect Fed to raise interest rates in the next upcoming month.

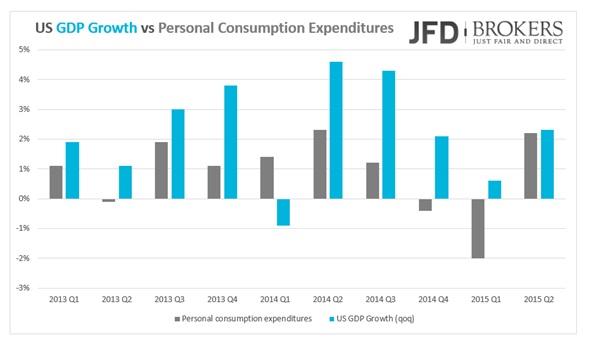

The second preliminary release for the GDP growth in Q2 was 3.7% on a quarterly basis, leaving behind both the first estimation of 2.3% and the market expectation of 3.2%. However, since the first quarter was weak for the US economy, the Annualized GDP growth is more reliable than the quarter over quarter indicator. The Annualized change in GDP was just 2.1%, also indicating a robust economy but not as outstanding as the quarterly based.

The second quarter, US economy gained momentum on the back of increased personal consumption expenditures. The Personal Consumption Expenditures was one of the main drivers of the economy out of the preceding quarter’s weakness. The preliminary number of the Personal Consumption showed an increase of 2.2% from a soft -2.2% the previous quarter.

The Durable Goods Orders increased by 2.0% in July while were expected to slow down by -0.4%. The Durable Good ex-Transportation surpassed expectations as well, rising by 0.6% missing market forecast of 0.4%.

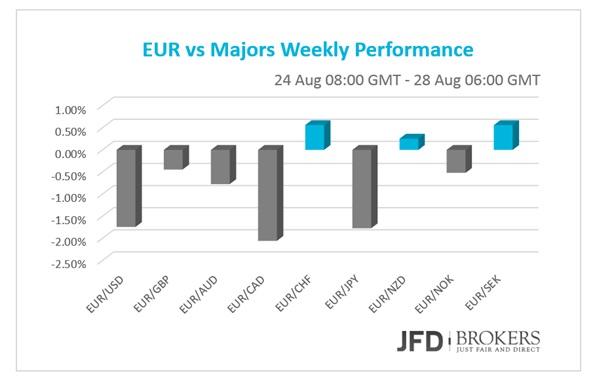

Euro fell influenced by global macro news

The shared currency was traded lower against most of the other G10 currencies the week just past, likely to be influenced by global macro news as the economic news from Eurozone failed to have a significant impact on the currency. After the recent turmoil many conservative traders closed their positions to stand off a while until the market calms down, but the latest days’ pick-up in the U.S. dollar drove back the USD bulls that sell the euro. The German economy advanced by 0.4% quarter over quarter as anticipated. The IFO Survey revealed that August’s Business Climate, Current Assessment, and Expectations surpassed initial forecasts while the Import Price Index for July worsened. Spanish GDP growth met market forecasts of 1.0% in Q2.

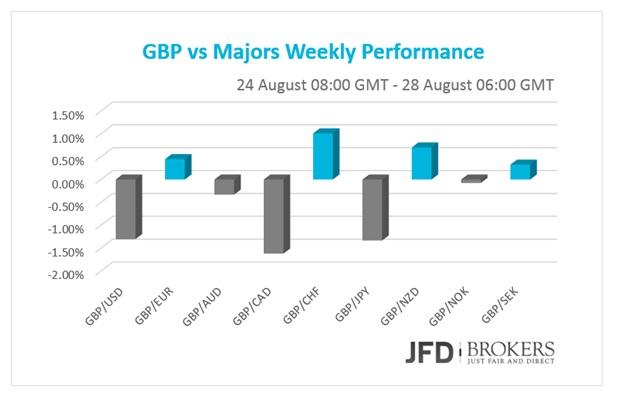

GBP on quiet week in terms of domestic economic news

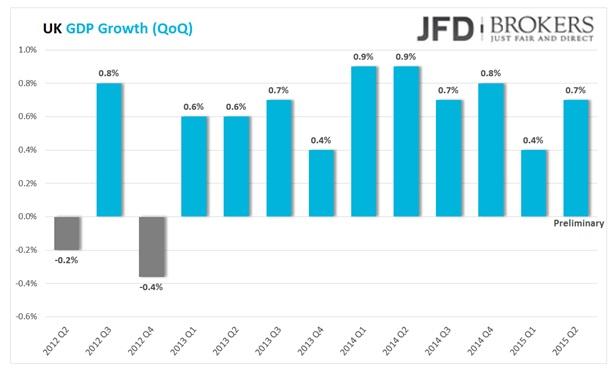

The sterling ends the week mixed versus its G10 counterparts in the absence of heavyweight numbers from UK. The only notable macro indicator is the preliminary GDP for the Q2, scheduled for release today. In the week just past, the BBA Mortgage Approvals met expectations of 46.0K in July and the Gfk Consumer Confidence surpassed market forecast, jumping to 7 in August from 4 before. The GBP/USD ended three consecutive days with losses, with the second to record a drop of 270 pips, shifting the weekly change to -1.50%. Currently, the pair is traded slightly above the psychological level of 1.5400.

China weekly route! What happened on “Black Monday”

With the opening of Asian’s session on Monday, Chinese Stocks plummeted to the steepest four-day decline since 1996. The day called "Black Monday" as the fear spread worldwide and dragged down the three major US Indices on an unprecedented correction in terms of basis points.

The Shanghai Composite Index plunged more than 30% from August 18 to August 26 (Wednesday). On Tuesday, August 25, People’s Bank of China cut its benchmark interest rate by 25bp to 4.6%, the for the fifth time in less than a year to calm down the Stock’s Market free fall. After the announcement of the rate cut the Shanghai Composite index picked up by 0.68%, but failed to The Shanghai Composite Index plunged more than 30% from August 18 to August 26 (Wednesday). On Tuesday, August 25, People’s Bank of China cut its benchmark interest rate by 25bp to 4.6%, the for the fifth time in less than a year to calm down the Stock’s Market free fall. After the announcement of the rate cut the Shanghai Composite index picked up by 0.68%, but failed to sustain its gains and continued to extend its losses. Finally, China’s main index stabilized on Wednesday overnight and ramped up on Thursday’s Asian session.

Economic Indicators

Today, the traders’ attention will turn to UK where the country’s second preliminary GDP for Q2 is scheduled for release. The British economy records a strong growth and if the numbers continue that way, it is very likely to see a sooner than expected rate hike.

In Eurozone, a number of economic indicators regarding sentiment in several sectors like Business, Services, Consuming and Economy in general for August will be eyed. Germany will publish its flash Inflation rate for August. In US, Personal Spending and Personal Income for July as well as the Michigan Consumer Sentiment for August will be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.