The greenback rose against its G10 rivals during Tuesday and early Wednesday on the back of the outperformed US economic data and amid Greek fears while the euro is traded mixed versus the majors.

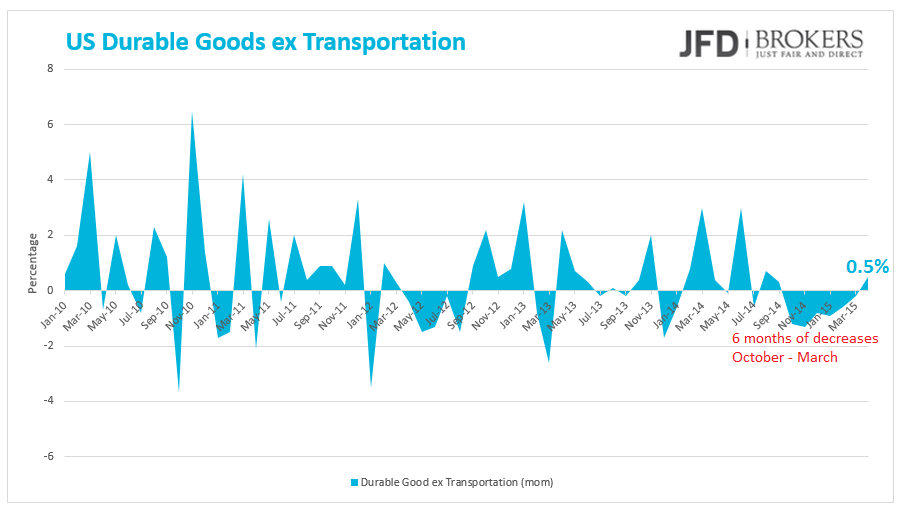

The dollar was boosted by various economic indicators indicating notable improvement. The Durable Goods Orders for April came in line with the expectations at -0.5% while the Durable Good ex Transportation grew in a steeper than expected pace by 0.5% from beating expectations of 0.3%.

The S&P/Case-Shiller Home Prices Indices has rose by 5.0% in March, above expectations of 4.8%. The New Home Sales returned back with an increase in April after a small pullback in March that worries the Housing sector participants. The New Home Sales increased by 6.8% at 517k in April while the previous month have declined by -10.0%. Consumer Confidence shows an increased morale among the investors for May, raising hopes that the upbeat US economic news will continue to come up, strengthening the dollar.

Pound broadly higher despite the absence of UK economic data

The sterling ticked higher in almost all of its major rivals on Tuesday and early Wednesday despite the absence of important economic news. The only G10 currency that performed better than the pound was the US dollar, GBP/USD declined 0.42% while the Swedish Krone was virtually unchanged against the British pound. The only new out from UK was the CBI Distributive Trades Survey which elevated to 51 for May better than anticipated to have risen to 17 from 12.

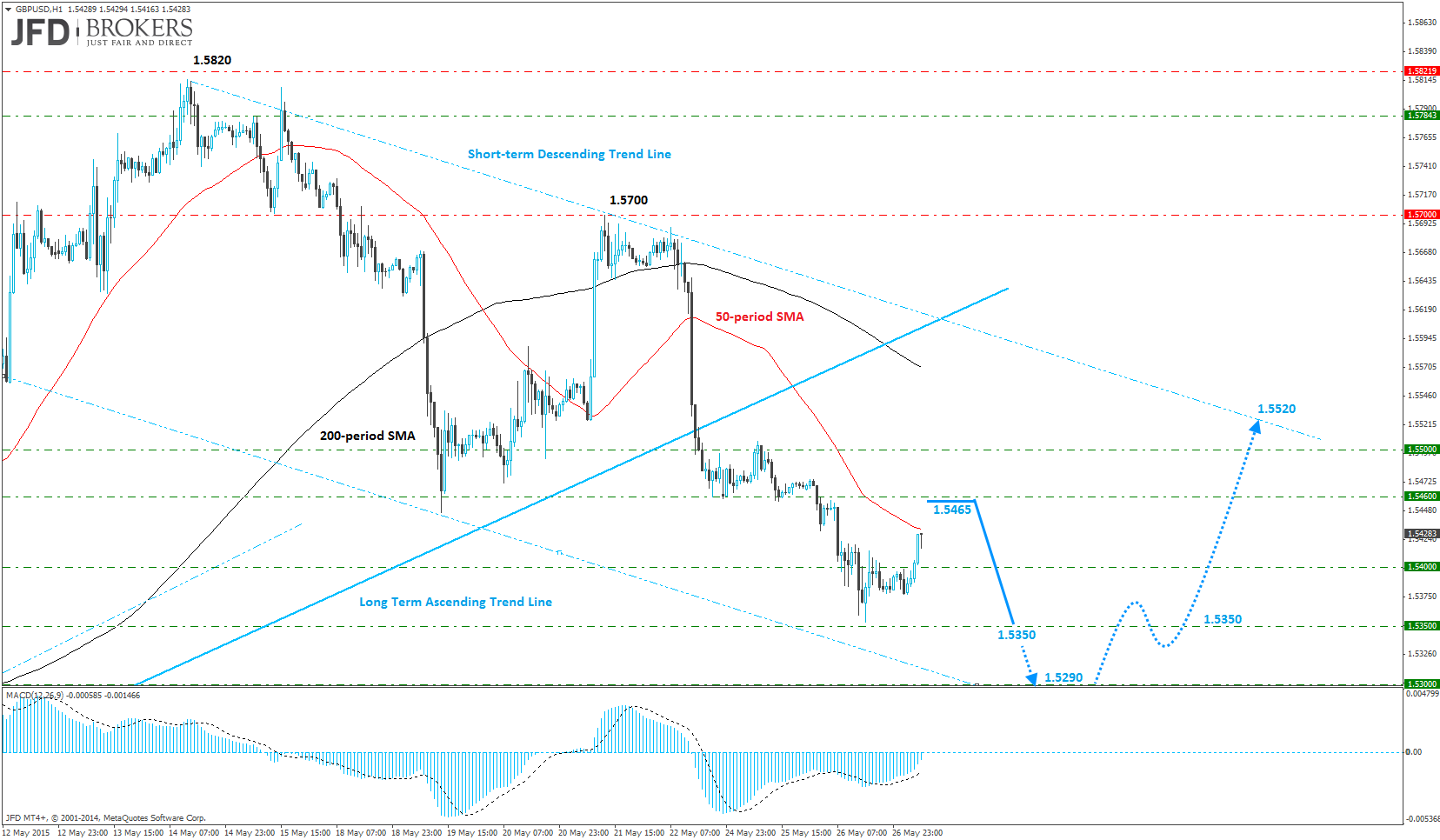

GBP/USD gained an upward momentum during the Asian session, following the drop below the psychological level and of 1.5400, and surged above the latter level, which coincides with the 200-period SMA on the daily chart. As it is, I think we need to see further confirmation before determining that the bias in the market has changed from bullish to bearish and that the correction which started back in mid-April has ended. Moreover, there is a clear battle going on around the 1.5400, which coincides with the 50-period SMA, but still it’s not clear at this stage who has the upper hand, the bulls or the bears. There are many traders that are waiting the price to continue the correction towards the psychological level of 1.5300, which includes the 38.2% Fibonacci level, before resuming upwards and towards the descending trend line, which started back in mid-May. Therefore, I would expect the pair to drop back below the psychological level of 1.5400 and to challenge the key support level at 1.5360.

Commodity Currencies drop as USD bulls return

The Commodity Currencies are tumbled as USD appreciated in the fear that Greece will default on its debt repayments. While the Greek officials are not come up with a final solution, the US dollar is becoming the safe choice for most of the investors. The AUD/USD pair dropped 1.17% on Tuesday and early Wednesday, the NZD/USD declined 0.96% and the USD/CAD rose 0.99%. The three commodity currencies have also fallen against the shared currency.

The Australian dollar has lost ground against the US dollar and is now trading below the 50- and the 200-period SMAs. The bearish move came following the break of the psychological 0.7800 level, which prompted a move back towards the 0.7700 level. Furthermore, the AUD/USD pair is trending downward the last couple of weeks, currently finding support from short-term ascending trend line which started back in early May. As it stands, I would expect the AUD to depreciate further.

The NZD is currently trading on a weaker footing against the USD, with the buck having moved below some significant obstacles including the 0.7330 and 0.7280 barriers, as well as below both, the 50- and the 200-period SMAs. All in all, the USD is continuing to appreciate vs. the NZD, although we’re still seeing no sign for a trend reversal. Therefore, I would expect the pair to test the key support level at 0.7190 anytime soon.

USD is continuing to climb higher this morning against the CAD, after breaking through the 1.2250 resistance level as well as above the psychological level of 1.2300, which coincides with the 50-period SMA on the 4-hour chart. There’s been a lot of buying pressure after the pair rebounded from the key support level of 1.1925, which includes the 200-period SMA on the daily chart. Therefore, unless we see a significant break below this level, the outlook for the pair will continue to look bullish, with the next target being the 1.2670 barrier and then the key resistance level of 1.2830.

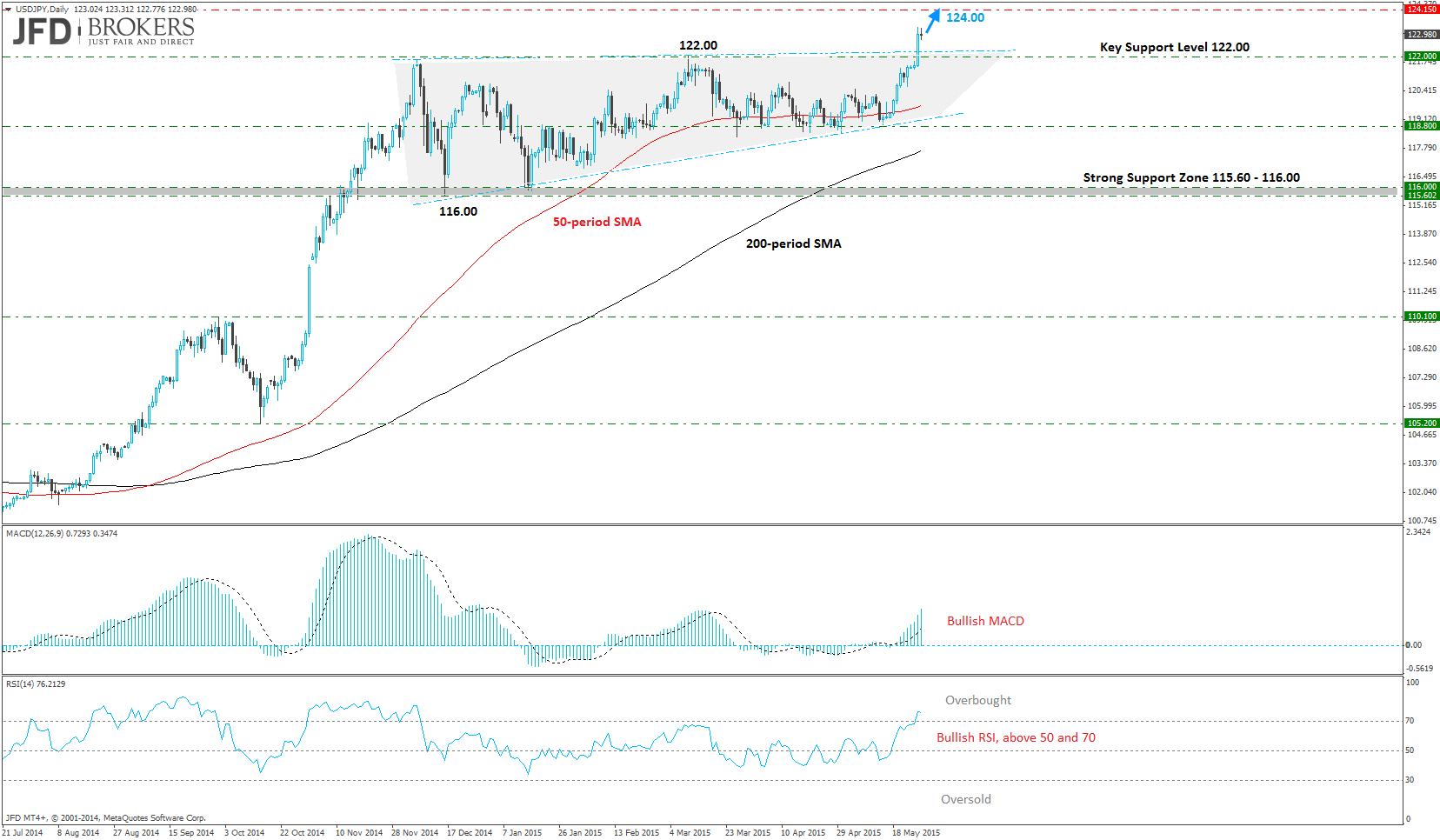

USD/JPY rallies above 122.00 as expected!

The USD/JPY pair finally breached the 122.00 level and surged to its highest level since 2007, as market participants bought the breakout above the psychological level of 122.00, as expected. In yesterday’s analysis we said: ‘Therefore, the psychological level of 122.00 and the 122.50 barrier would be the confirmation for the further USD/JPY appreciation. Such a move could easily spark a run towards the ultimate price target at 124.00.’ (http://bit.ly/1Rjg4GG). The pair is trading slightly above the psychological level of 123.00 and the next key level to look out for will be the 124.00, which is where 2007 highs lie.

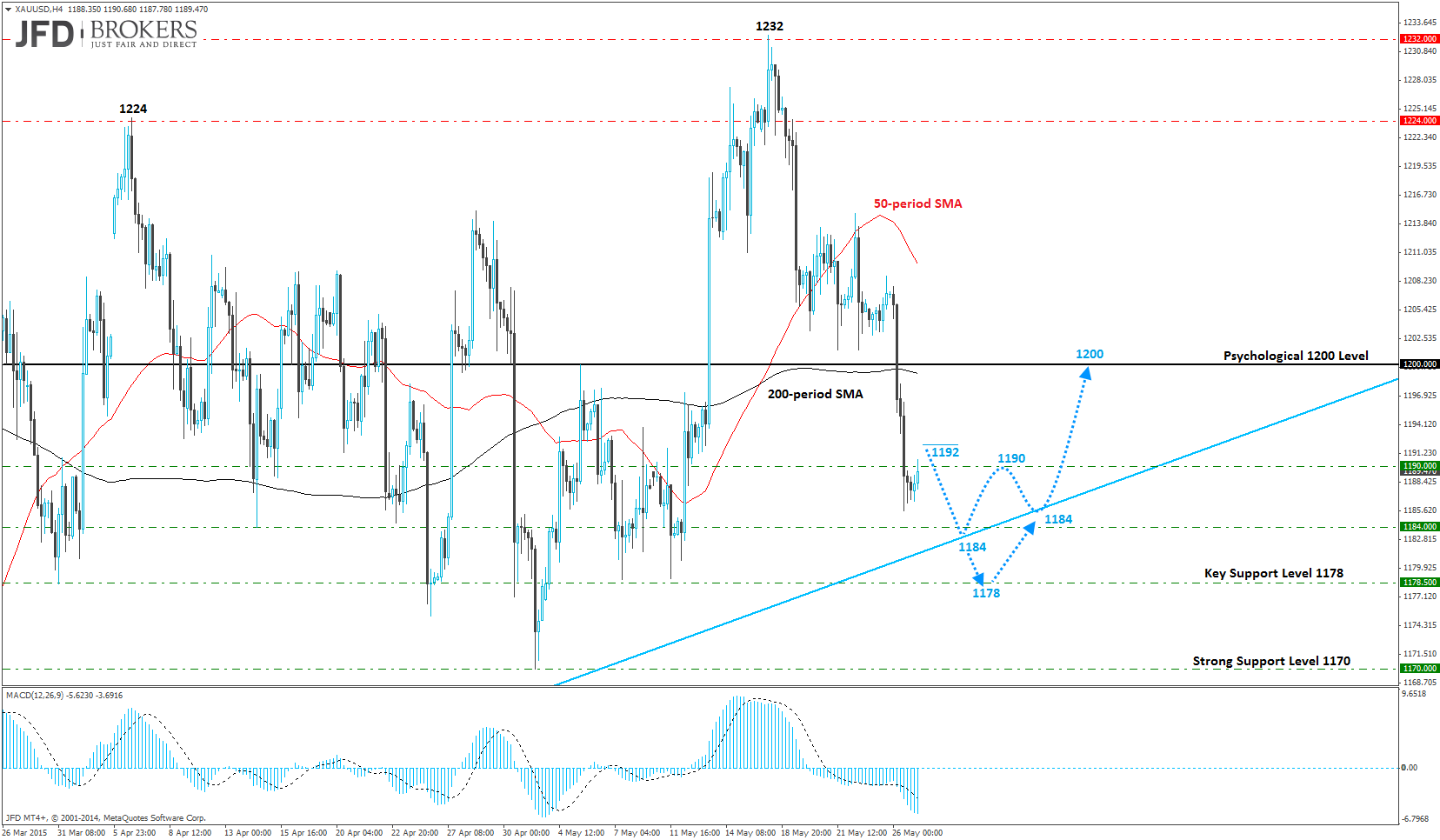

Gold plunges below $1,200 on stronger Dollar

Gold finally surrendered to the stronger dollar, as it plunged below the psychological level of $1,200 and ended the day around the $1,185 region. If the dollar appreciates further then it could push the precious metal lower and towards the next support level at $1,180. On the upside, the $1,200 and the 200-period SMA will be the main obstacles for the bulls. However, the momentum in the metal seems to be building and this will be the fifth attempt at breaking the barrier of $1,200 over seven months. Again, a close above $1,200 will only give bulls more conviction.

U.S. Dollar Index

The ICE U.S. Dollar Index (DXY) recorded the higher increase during yesterday's trading session since early in March following a strong week. The DXY ticked 1.25% higher as the US dollar is turned to be the safe-haven currency. The dollar index has been sliding since it find resistance at 97.47 and is now trading back below the key support level of 97.25. If we see an hourly close above the latter level which also coincides with the 50-period SMA on the 30-M chart, I would be much more bullish on the dollar index.

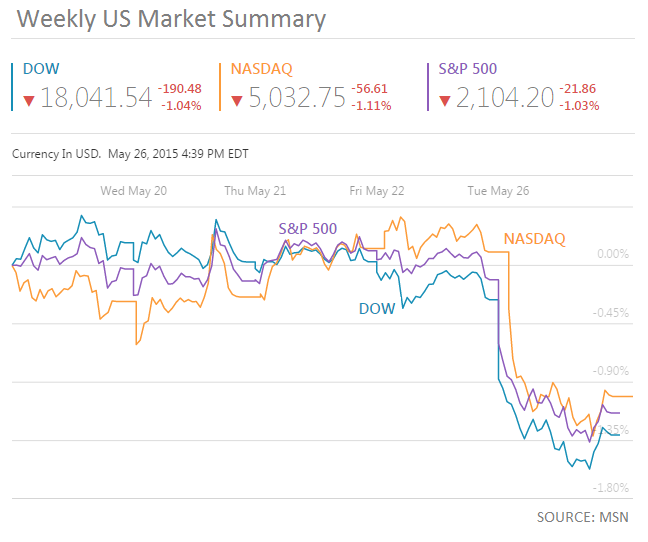

U.S. Indices

The three U.S. Indices, Dow Jones Industrial Average, Nasdaq Composite and S&P 500 slipped for the second consecutive day as U.S. dollar recovers. The biggest losses along the three indices recorded by Nasdaq Composite Index of -1.11%, -56.61 points. The other two indices dropped virtually the same. DJIA, the blue-chip index decreased by 1.04%, -190.48 points, ended at 18,042 while the S&P 500 ended 1.03% lower at 2,104.

Economic Indicators

Today, the Bank of Canada will release its Rate Statement with its monetary policy decisions and the headline of the report will be the Bank’s decision for its Interest Rate. Later, during the European night, the Ministry of Economics in Japan will announce the Retail Trade numbers for April and the Large Retailer’s Trade.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.