Shares of Caterpillar (NYSE:CAT), the world’s leading manufacturing of construction and mining equipment, surged more than 10% the last 2 months, following the strong rebound from the significant support zone of $78.13 – $79.00.

Dow Jones, NASDAQ and S&P 500, closed at a record high on Thursday, but with very thin trading volumes. Dow Jones Industrial Average surged 0.34 points to 18,285, with top gainer the Caterpillar Inc. with +1.61% (NYSE: CAT). The S&P 500 edged up 4.97 points while the Nasdaq Composite Index rose 19.05 points, closing at 2,131.

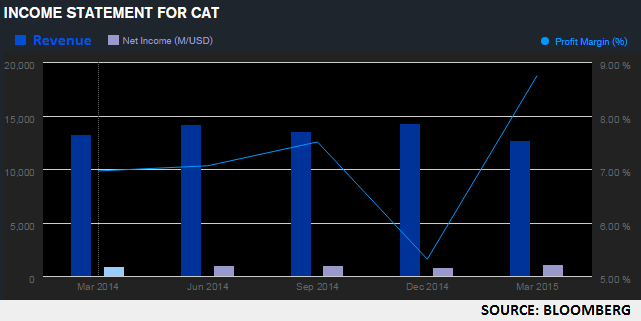

Shares of Caterpillar are on the rise, following the break above the psychological level of $80.00 after the machinery company posted a first-quarter profit that was well above Wall Street expectations by nearly 40%. Caterpillar reported (http://bit.ly/1LrH6Zb) on April 23, that it recorded $12.7 billion in first quarter revenue. Furthermore, the net profit for the first quarter came in at $1.1 billion resulting in earnings of $1.81 per share, an increase from profit per share of $1.44 in the first quarter of 2014.

The current momentum pushing Caterpillar’s stock higher is encouraging, however, CAT has underperformed the Dow Jones Industrial Average the last four years, and thus, it appears to be headed for another year of weakness since the stock has lost 12.60% in January and 3.46% in March, while the Dow Jones has appreciated 2.6% year-to-date.

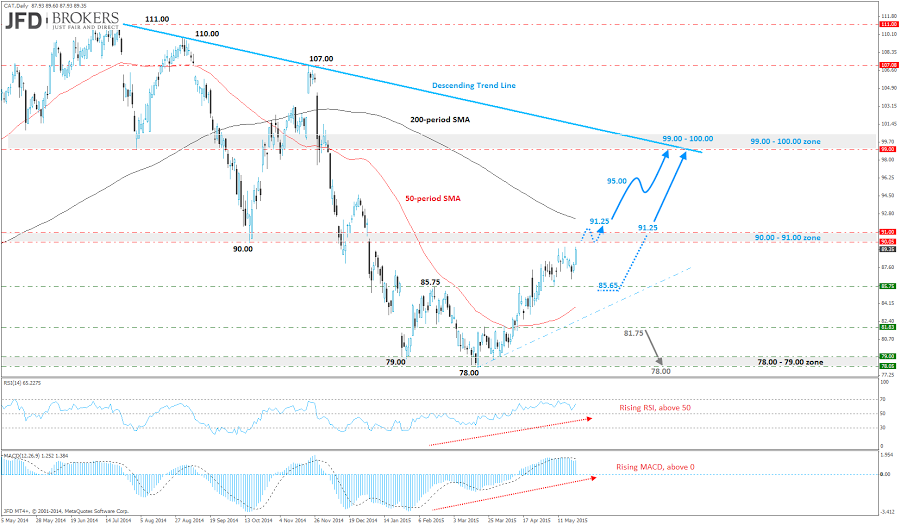

Technically, the retracement which started from the psychological level of $79.00 was halted by a new found resistance level of $85.75, which includes the 23.6% Fibonacci level. After the failed attempt to break above the latter level the stock has come back to record a fresh 2-year low below the $79.00, this time at $78.00. From there, aggressive buyers managed to push the stock above some significant obstacles, including the $81.80 barrier, which coincides with the 50-period SMA, the $85.75 level, and more recently above the psychological number of $89.00.

As it stands, the share price is currently struggling to break above a significant resistance level, including the psychological level of $90.00. This makes the 4-hour chart to look like a pattern formation, with the price currently finding support from the aforementioned obstacles.

Bearing the above in mind, if we see a close above the key resistance zone of $90.00 - $91.00, then we could see a bigger retracement, following a positive April +8.56%, prompting a more aggressive move towards the $99.00 - $100.00 zone. This is a significant zone as it includes the descending trend line which started back in June 2014.

On the other hand, the stock will only continue to be bearish, in such an overbought environment, when we see a close below the $85.75, which would be the first sign of weakness, and then will negate our bullish scenario when the bulls will lose the battle below $82.00.

All in all, Caterpillar Inc. shares look more reliable and attractive the last couple of months, which makes it a great stock to add in your portfolio, of course, if you believe in the buy-and-hold strategy. Thus, the psychological level of $100.00 it’s not far away and it could be achieved before our summer holidays.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.