West Texas Intermediate (WTI) is looking bullish at the moment as is trading above the psychological level of $50.00. It’s remarkable that for the last five weeks the US crude added more than $10.00 a barrel as it rose for a fifth consecutive week after rebounding from the $42.00 level.

WTI for April traded up +18.50 percent at $56.40 a barrel, after touching a 2015 peak at $57.40 following a -8.71 percent in March. In a monthly report, OPEC said demand for its oil this year would be 80,000 barrels per day higher than previously thought as lower prices curb supplies in the United States and other non-member countries.

Oil prices plunged in the six months from June 2014 to January 2015, pushing WTI down more than 65 percent to almost $40 a barrel. However, the oil market has gradually recovered the last couple of months (Feb +4.13 percent) as lower prices have discouraged production, especially in United States and Europe.

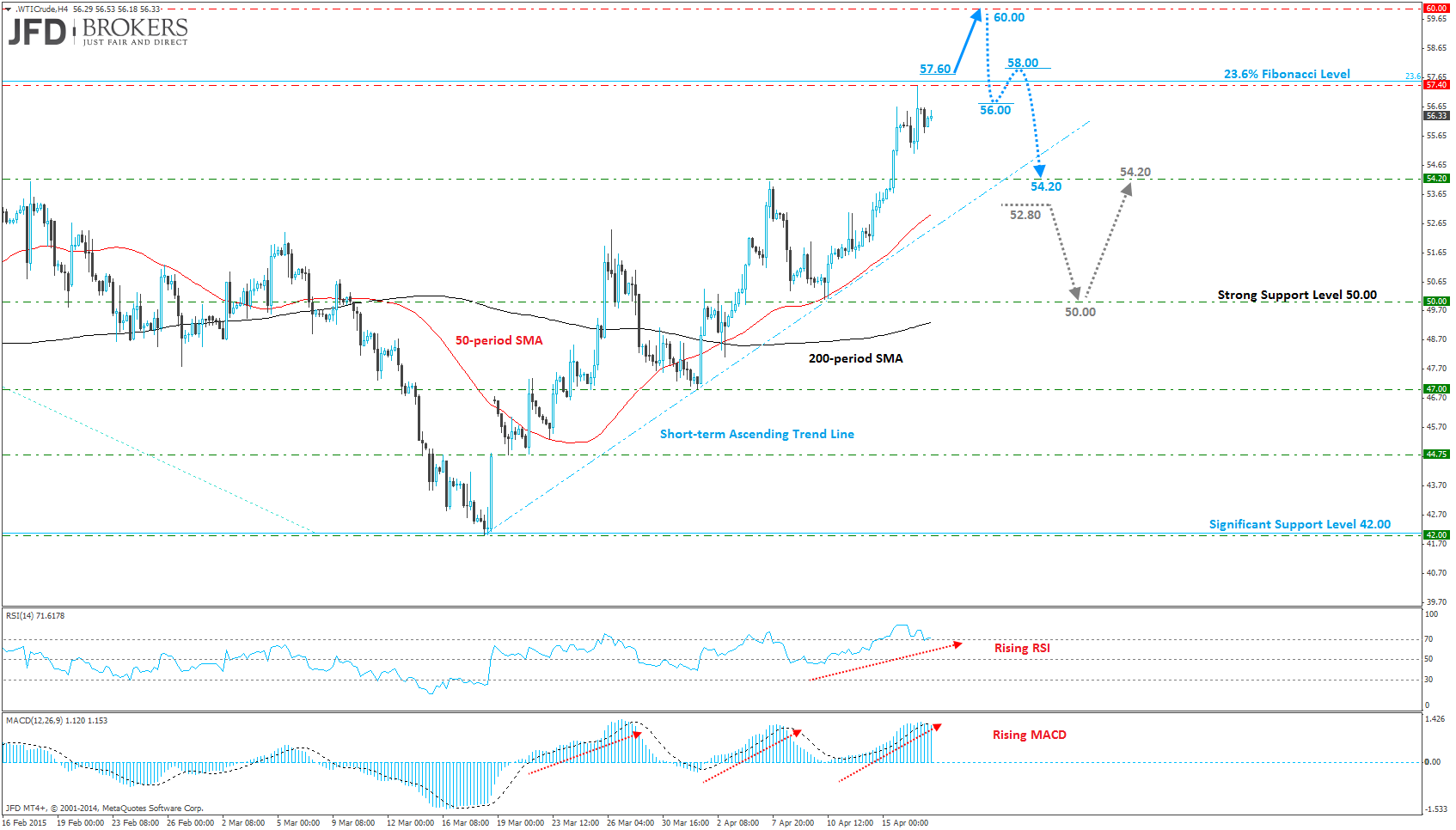

Technically, the medium term and long term trend remains a downtrend since the price still lies below the 200-period SMA, on both timeframes (daily and weekly charts). The break above the strong resistance level of $54.20 did not come as a surprise, following the powerful rally in the US crude after rebounding from the $42.00 region few weeks ago, which has seen it break through many significant resistance levels including $44.75, $47.00 and more recently the psychological level of $50.00.

The price is currently testing the 23.6% Fibonacci retracement level from the June 2014 high to March 2015 low. For now, I would expect the bulls to remain in control and to push the price further up and towards the psychological level of $60.00. Both oscillators support the notion since the MACD is rising in a bullish territory above its trigger line while the Relative Strength index is also rising above 50. The $60.00 level will be a crucial for the bulls as a break above there could suggest that we are in a more serious retracement, prompting a more aggressive move towards the $70.00 level, slightly above the 38.2% Fibonacci Retracement level.

Alternatively, if the bulls fail to break above the $60.00 level then I would expect the bears to drive the price back below the $54.20, plunging the price below the short-term ascending trend line and around the psychological level of $50.00.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.