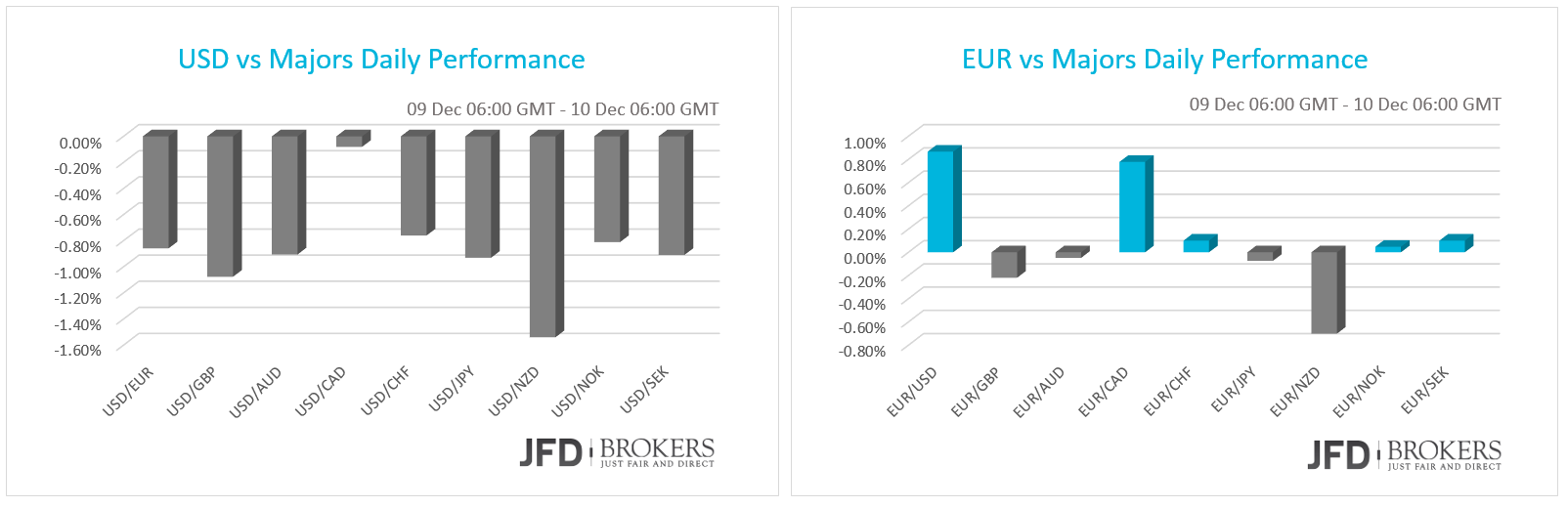

As the oil prices continue to decline impetuses the greenback lower against the other major currencies. On the other hand, Fed’s policy meeting is scheduled in less than a week ahead and the confidence among the investors that Fed policymakers will raise interest rates increases. Euro was ended the day virtually unchanged against the majority of the G10 currencies with significant gains against the US dollar and the Canadian dollar and severe losses against the New Zealand dollar.

EUR/USD - Technical Outlook

The EUR/USD extended is winning streak to two days on Thursday and in the process, it met our suggested target at 1.0950. The euro is looking much more bearish against the dollar this morning, having broken above the 50-SMA on the daily chart, before briefly consolidating around the 1.0850 area. The pair was facing significant resistance just above the 1.0800 level, which included both the 4-hour 50-SMA and 200-SMA. Having lock some profit the last couple of days (around 120 pips) a cautious stance is required.

EUR/GBP - Technical Outlook

Even though the pound gained against the dollar during yesterday’s session, it remained unchanged against the euro as it closed the day pretty much around the opening levels. For now, we could see that the EUR/GBP pair is struggling in a battle between both forces (the bulls and the bears) as it remains stuck below the 0.7280 for some time now. Yesterday, we saw a break attempt on the upside but without any success, highlighting the fact that the investors are cautious ahead of the BoE policy meeting later in the day. If the bulls fail to break above the 0.7270 – 0.7280 zone, then I would expect a further pressure towards the 0.7220 barrier and then towards the 0.7185 level.

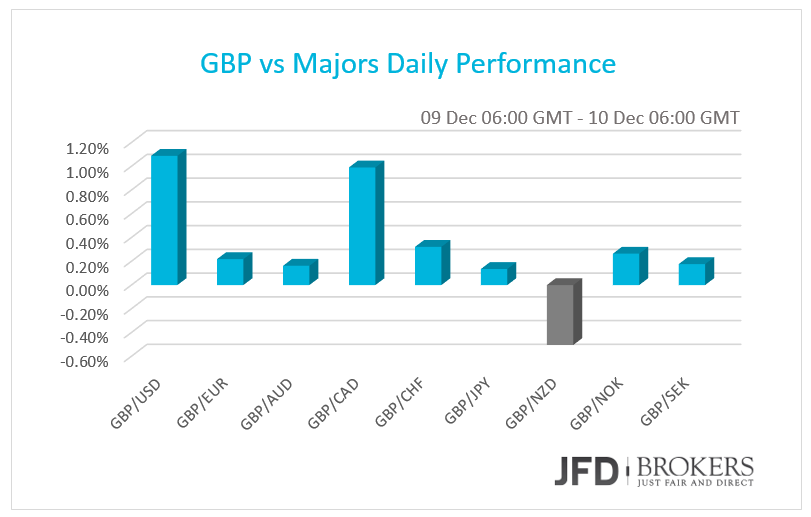

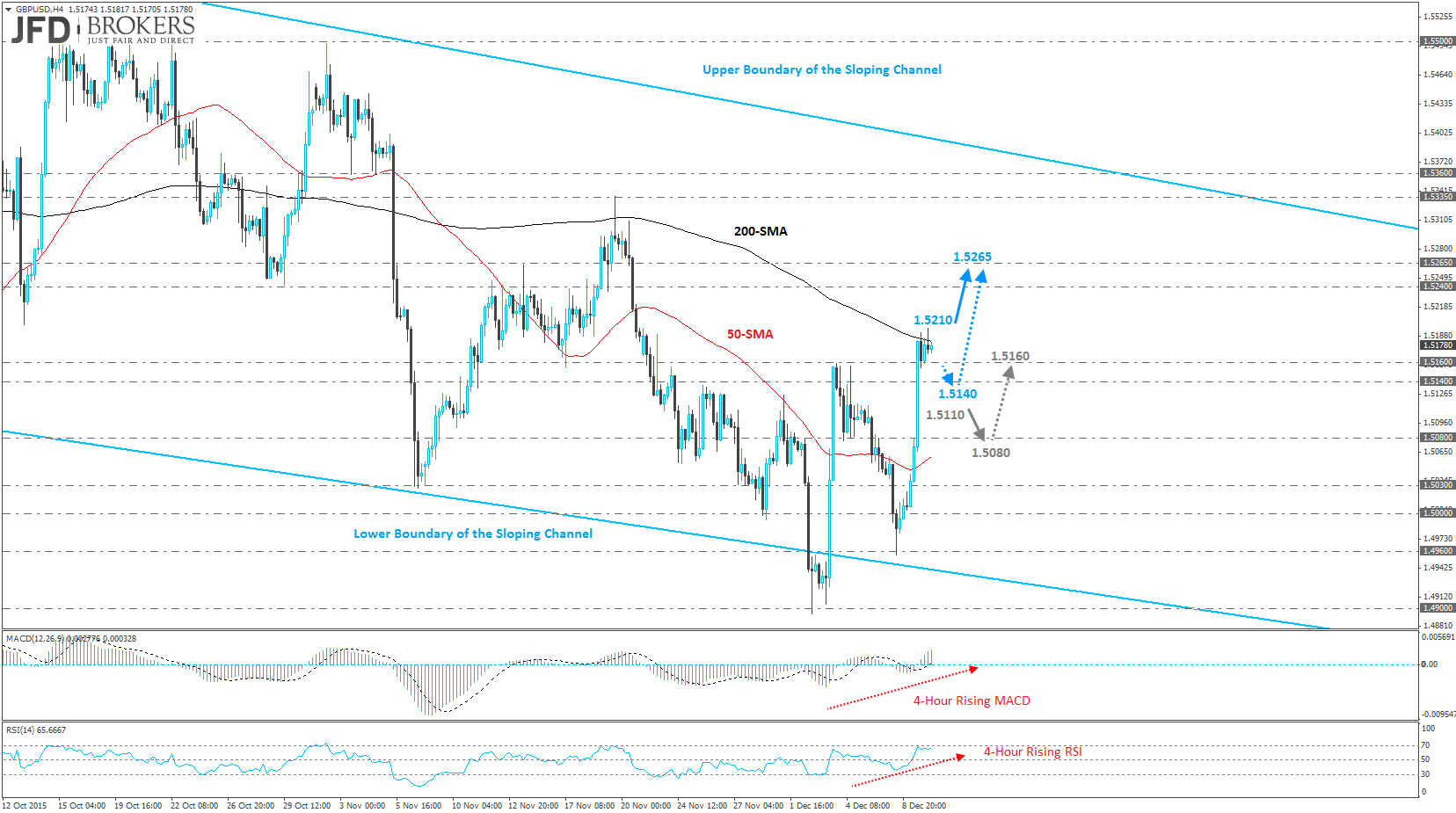

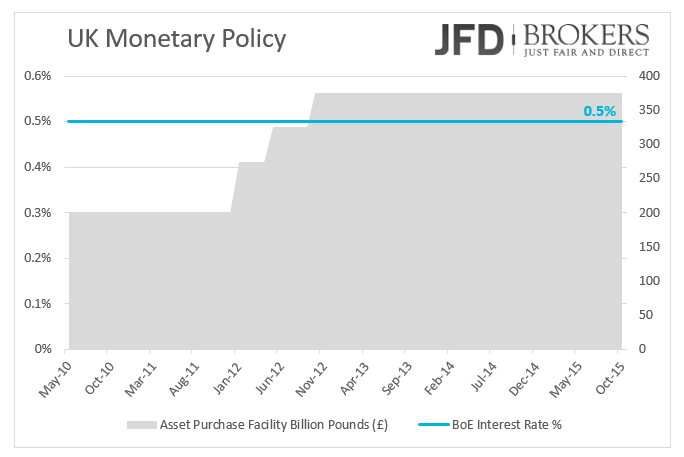

BoE Minutes ahead; Will BoE follow Fed's rate hike plans?

The British Pound soared on Wednesday despite the absence of market driver news. Today the Monetary Policy Committee of the Bank of England will vote for the country’s interest rates, no changes are expected. Though, the minutes of the policy meeting will be interesting as many economists wonder if BoE plans to follow Fed’s rate hike.

The GBP/USD pair has moved aggressively higher today and after holding above the psychological levels of 1.4900 and 1.5000 it is now up by almost 150 pips. The pound surged above the 50-SMA and the 200-SMA on the 4-hour chart, as well as above the key zone of 1.5140 – 1.5160 ahead of the BoE policy meeting. Given that we saw such an aggressive rally on mid-Wednesday, this move seems like a continuation inside the sloping channel and thus further upside is expected. I consider the 1.5140 – 1.5160 as a rebound area with further gains would suggest a run towards the 1.5240 – 1.5265 level.

Going lower, the 1-hour chart shows that the price is holding above its 50-SMA and 200-SMA, but the technical indicators have turned lower, suggesting a temporary pullback. Alternatively, if the price begins to edge lower, having failed to sustain any moves above the 1.5140, it should test 1.5100 and then 1.5080.

GBP/JPY - Technical Outlook

Over the last couple of months the GBP/JPY has established and traded within a trading range roughly around the key level of 184.00, whilst moving down to support at 180.30 and up to 188.40. Currently, the pair is testing the 183.60 within the channel. If the bulls are strong enough to push the price further up, I would expect extensions towards the 188.30 barrier, an area tested a few time the previous month. A failure to retest the latter level, then should prompt a move lower towards the 182.00, where a battle is expected by both market forces. Relying on short-term oscillators does not seem a solid strategy since they lie near their neutral levels.

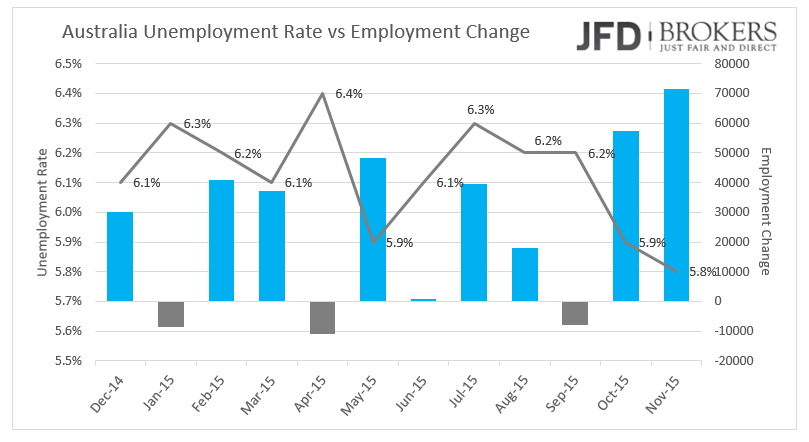

AUD Surged on Surprisingly Positive Data

The Australian dollar jumped above 0.7260 against the U.S. dollar after it shored up by the psychological level of 0.7200, on the positive data surprise. The consumer inflation expectation for the next twelve months increased to 4.0% from 3.5% before while the labor market surpassed expectations. The unemployment rate for November fell to a 19-month low of 5.8% from 5.9% before despite the expectations to have risen to 6%. The Employment Change beat forecasts by far, as it revealed that 71.4k are recently employed in Australia versus forecasts that 10k people had lost their jobs. On the top of that, participation rate increased by 0.3%.

However, the AUD/USD pair made a partial recovery, following the move above the 0.7300 and its now trading at 0.7280, which coincides with the 200-SMA on the 1-hour chart and the 50-SMA on the 4-hour chart. Given how aggressive the rally has been over the last few hours, we could see a brief period of consolidation below the 0.7330, yesterday’s high.

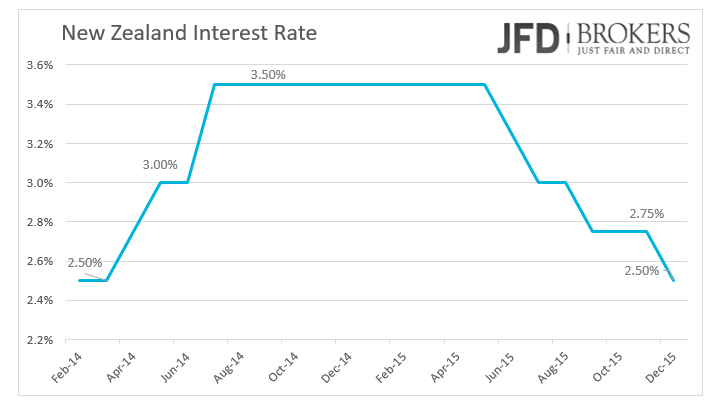

NZ dollar Gained Momentum on RBNZ rate cut and Upbeat Projections

The New Zealand dollar appreciated against the majors on Wednesday, during the Asian session, as the Reserve Bank of New Zealand cut interest rates by 25 basis points for the fourth time over this year. The RBNZ Governor Graeme Wheeler said that the economy has “softened” in 2015 due to the fall of international prices, as New Zealand is the largest dairy exporter. The NZ dollar has appreciated since August, reversing the depreciation occurred since April, and this is an extra hardship for the sustainable growth of the economy. According to the RBNZ Governor, “further depreciation would be appropriate” to bolster sustainable growth. The core inflation is below 1% to 3% central’s bank target range mainly due to the stronger domestic currency and “the 65% fall in world oil prices since mid-2014" he added. However, he was optimistic for the economic growth in the near future and the inflation rate which is expected to move inside the target rate from early 2016.

During the announcement the NZD/USD pair plunged below the suggested target of 0.6588, dipping as low as 0.6570, but few minutes later it gained momentum and surged above some significant levels, including the 0.6680, the 50-SMA and the 200-SMA on both the 1-hour and 4-hour charts.

From yesterday’s report ‘‘I remain bearish on this pair with a break below the aforementioned levels to open the way towards the 0.6588’’.

USD/CHF - Technical Outlook

The USD/CHF pair came under pressure and fell during yesterday’ session and ahead of the SNB policy meeting (happening as of writing). The move below the key support level of 0.9875 helped to lock our profit at 0.9840. Given the break below the 0.9875, this move seems like a continuation of the correction to the downside and thus further selling pressure is expected.

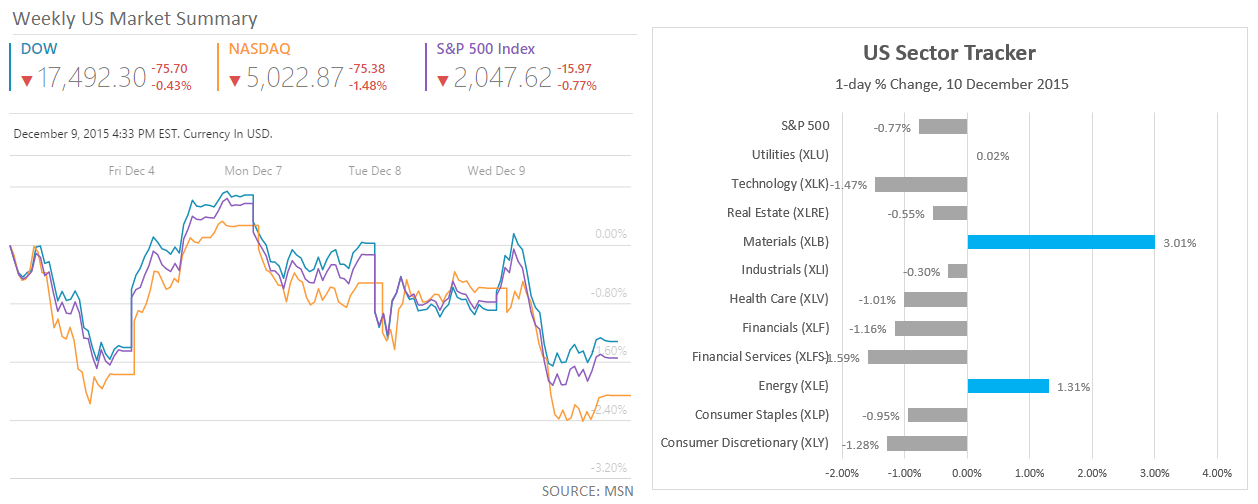

U.S. Indices: Third Day of Losses

The US stock indices traders seem that are looking to oil prices and await Fed’s next move in the coming week, recording the third day in a row that closes in the red. Dow Jones knocked out 75.70 points, 0.43% lower with energy stocks among the best performers this time. The energy sector posted daily gains of 1.31% in contrast with the last two days. Nasdaq fell 1.48% and S&P500 edged lower 0.77%.

Economic Indicators

The attention today turns to UK where the Monetary Policy Committee of the Bank of England will vote for the interest rates. The policymakers are expected to keep the same voting pattern of 8-1 in favour of unchanged rates and a rate hike respectively. The BoE minutes will be released a while later and will be eyed carefully.

The US jobless claims will be out, as usual, later in the day, as well as the monthly budget statement for November.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.