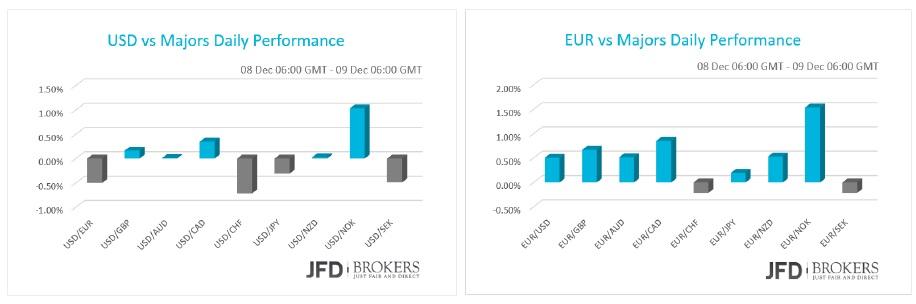

The last three days the world’s most commonly traded commodity, oil, dropped more than 12% to its lowest level over the last 7 years. The dollar was mixed against the majors amid a quiet day without any significant market news while the euro maintained the gains posted after the ECB policy meeting. The sterling was broadly lower on mixed data ahead of the BoE policy meeting on Thursday. It's suffered losses against the Swiss franc and surged versus the Norwegian krone. Gold halted a sixâ€Âweek losing streak and closed last week positive. US Indices fell for the second consecutive day, totalling more than 5% losses.

Euro Higher on Good GDP

The Euro recorded moderate gains against the majority of the G10 currencies on Tuesday and early Wednesday as the GDP indicator for Q3 posted an expansion of 0.3% quarterâ€Âoverâ€Âquarter and 1.6% yearâ€Âoverâ€Âyear.

The EUR/USD pair has been gradually moving higher the last couple of days following a strong rally the past week, where we saw the pair gaining more than 3% of its value. Following the strong rebound from the psychological level of 1.0800, which coincides with the 4â€Âhour 200â€ÂSMA, the bulls gained momentum and pushed the price above the 1.0900 barrier (recommended target https://www.fxstreet.com/analysis/dailyâ€Âtechnicalâ€Âanalysisâ€Âandâ€Âforecasts/2015/12/08/).

Going forward, I do expect to see further gains in the near future, at least for temporary, with the price reaching the 1.0950 (1â€Âhour chart) level. However, it is very important the bulls to manage and sustain the price above the key level of 1.0900 in today’s session.

Alternatively, given how aggressive the rally has been over the last few days, we could see a brief period of consolidation, with a move back below the 1.0900 to open the way towards the 1.0850 barrier, which includes the 1â€Âhour 50â€ÂSMA.

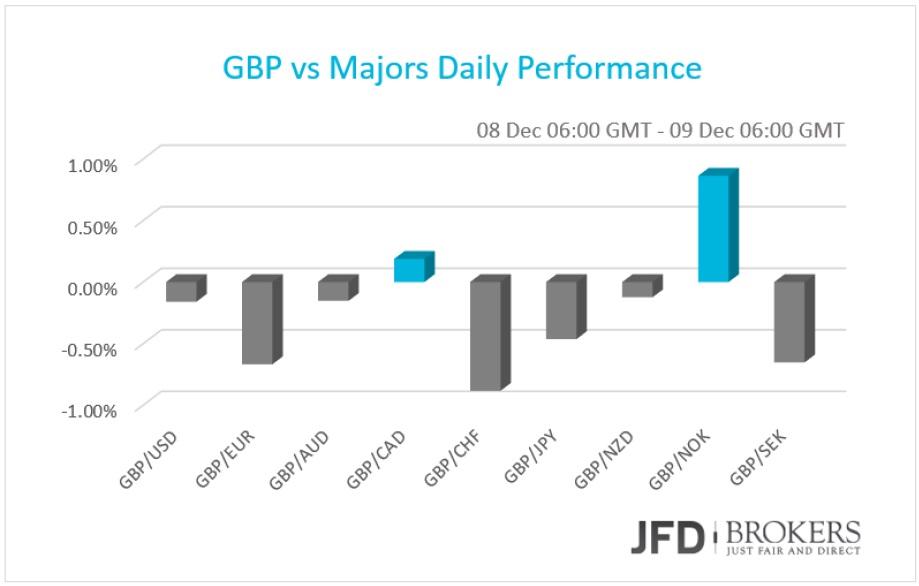

British Pound dropped on Mixed Data

The sterling tumbled against most of its G10 peers on Tuesday and early Wednesday, on the back of mixed data. The main pound affecting event this week is tomorrow’s BoE policy meeting. The Manufacturing production came in line with the expectations contracting by 0.1%, although it was the less contraction over the last four months. Industrial production expanded by 1.7% above predictions of 1.2%. The GDP growth for the three months to November confirmed a stable growth of 0.6%.

Once again, we have little UK economic information to trade off and really won't see anything significant until Thursday's BoE policy meeting. In the meantime, the sterling bulls are trying to hold onto recent price support which coincides with the lower boundary of the sloping channel. The levels to watch today for the GBP/USD will be the 1.4960, 1.5000 and 1.5030 while the 50â€ÂSMA on the 4â€Âhour chart is ready to provide a significant resistance to the price action above the aforementioned levels. Having locked recent profits (1.5030 & 1.5000 recommended targets), a cautious stance is required since the area between 1.5000 and 1.5150 is considered to be risky in order to determine the real direction of the trend, inside the downward sloping channel.

Japanese Yen Rose on strong Machinery Orders

The Japanese Yen managed to gain ground against the other major currencies, as the Machinery Orders came out yesterday completed the positive situation created earlier in the week from the Gross Domestic Product. The Machinery Orders grew by 7.5% in October, rebounding from a drop of 5.7% the month before. It is the first increase in four months and the highest gain since March of 2014.

The USD/JPY pair has moved quietly the last couple of days, however, the dollar failed to maintain its gains against the yen, after it tested the key level of 123.00, which includes the 50â€ÂSMA on the 4†hour chart. The pair is trading in a tight range between the 122.20 and 123.60 range with both the 4†hour 50â€ÂSMA and 200â€ÂSMA to provide a strong support near the 122.20 and 123.00 levels.

The tops and the bottoms of trading ranges are very difficult to identify, as well as support and resistance levels inside the channels. Unfortunately, trading ranges are very difficult to trade profitably. Therefore, as long as the price is trading between the aforementioned levels we remain neutral as we expect the pair to continue trading in this range for the coming weeks or until the Fed meeting in midâ€ÂDecember.

AUD Falls as Oil Depreciates

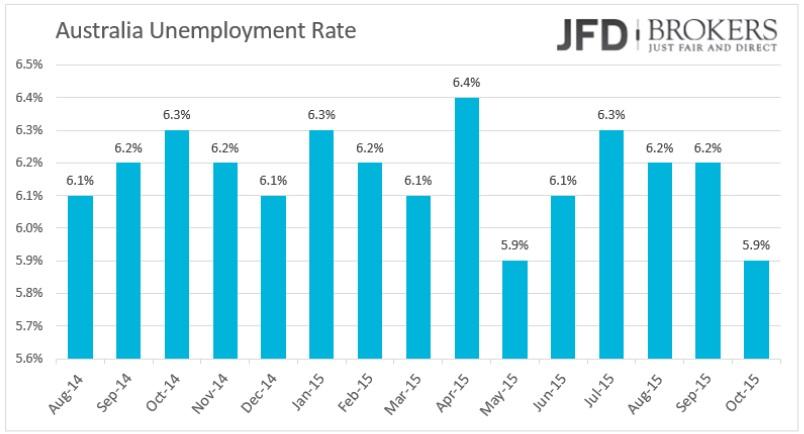

The Australian dollar dropped severely against the US dollar over the last week as the oil depreciates reaching a sevenâ€Âyear low. The Home Loans decreased by 0.5% in October from an increase of 2.0% before. Moreover, the Westpac Consumer Confidence slumped 0.8% to 100.8 in December from 101.7 before after an increase of 3.9%. During the Asian session today, the employment report is scheduled for release and is expected to reveal a slowdown in the sector. The unemployment rate is forecasted to increase to 6.0% from 5.9% before and the employment change to show a decrease of 10k from an increase of 58.6k before.

AUD/USD is back below the 0.7240, which coincides with the shortâ€Âterm ascending trend line that started back in midâ€ÂNovember, after having traded a range of 0.7185 – 0.7240, leaving the points to watch pretty much unchanged. Market participants will be focused on significant data coming from Australia, including the employment report, as well as the Consumer Inflation Exaptation for December.

The sellâ€Âoff seen the last couple of days in the pair has brought us back into the key support level of 0.7185, which coincides with the 200â€ÂSMA on the 4â€Âhour chart. Tonight’s employment report which seems weak might be the catalyst AUD/USD needs to make a move below the significant level of 0.7185. For the AUD to rally on the jobs report, we need job growth to exceed 60.0k. If any part of this equation is off, investors will be reluctant to buy Australian dollars.

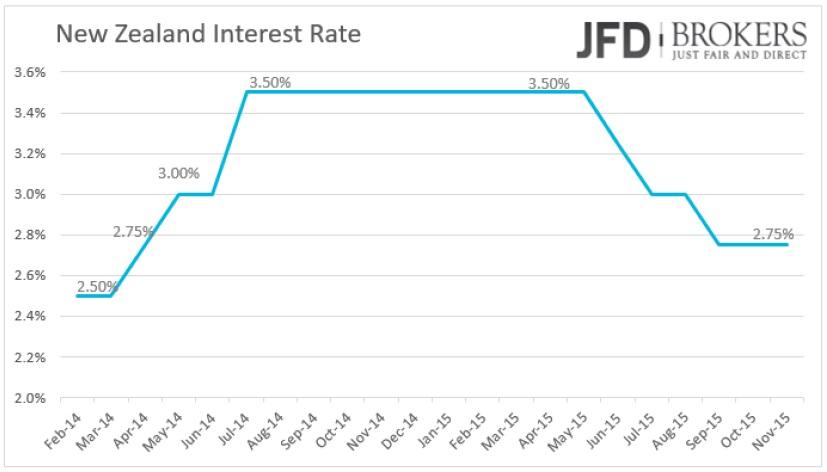

We remain strong NZDâ€Ânegative

The New Zealand dollar fell on the plunging oil prices and ahead of the RBNZ policy meeting later in the day. The market expects the central bank to lower interest rates by 25bp to 2.5% from 2.75% now. If that happens will be the fourth rate cut over a year.

Nothing changed to the NZD/USD pair as it has had an aggressive move lower since reaching its spike top of 0.6787 on Friday, and currently sits at session lows of 0.6625 ahead of the RBNZ policy meeting due Wednesday night. The key to watch for now will be the 0.6620, which includes the 1†hour 200â€ÂSMA, the 4â€Âhour 50â€ÂSMA and the 200â€ÂSMA, as well as the daily 50â€ÂSMA. Below here, the shortâ€Âterm rising trend line is ready to provide a significant support to the price action in case of a pullback and I believe is likely to come in play later today or early tomorrow. I remain bearish on this pair with a break below the aforementioned levels to open the way towards the 0.6588 and then a further pressure to challenge the 0.6550 barrier. On the upside, the 0.6685 level will be the next obstacle for the bulls.

A similar picture prevails in EUR/NZD. A break above the psychological level of 1.6500, will open the door towards the 1.6580 and then to 1.6600. The 4â€Âhour and the daily 50â€ÂSMA and the 200â€ÂSMA, are ready to provide a significant support from below. Therefore, we remain NZDâ€Ânegative.

Swiss franc rises on SNB Policy Meeting

The Swiss franc is traded higher versus some of the major currencies on Tuesday and early Wednesday as the Swiss National Bank has a policy meeting tomorrow morning. It is expected to leave its deposit interest rate on hold at the record low of â€Â0.75%. The deposit rate stands there since January where the central bank surprised with a sharp ease of the monetary policy.

Not much movement in USD/CHF with prices trading within 0.9870 – 1.0000 in the past 4 days hours ahead of tomorrow’s SNB policy meeting. This is in stark contrast to what we have seen in the previous week where the pair traded aggressively lower following the peak around the 1.0300 level. The RSI fell below 50, while the MACD, even though in positive territory, crossed below its trigger line. These movements strengthen my conviction that we are likely to see further consolidation or a downward corrective wave, perhaps to test the 0.9840 area. However, the structure of higher highs and higher lows remains in progress thus I consider the mediumâ€Âterm path to be to the upside.

Gold halted a sixâ€Âweek losing streak

Gold prices have steadied the last couple of days, trading above the 4â€Âhour 50â€ÂSMA and the $1,070 level in the European session. After impressive gains the previous week, the yellow metal has reversed directions, however, is still looking quite bullish. Given the move back above the $1,070 resistance level, further gains seem likely unless the price moves back below the 50â€ÂSMA around $1,060. The next level to watch in case of a rise will be the psychological level of $1,100, which coincides with the 200â€ÂSMa on the 4â€Âhour chart. Note that the gold halted a sixâ€Âweek losing streak as it managed to close up 2.73% the previous week.

Oil plunged more than 5% after OPEC meeting

Oil prices plunged by more than 5% after the OPEC’s meeting on Friday which failed to result in agreement on output targets. The OPEC will keep pumping about 31.5 million barrels a day. UK Brent Crude and US WTI closed at its lowest levels since February 2009, when the collapse of Lehman Brothers triggered the most severe recession since the 1930s. The lowest close back then was $33.96 on February 12, 2009. US crude fell as low as $36.63 a barrel while the UK Brent ended 1.3% lower at $40.30 a barrel, after dipping below $40.00 in intraday trade. The fact that oil price is breaking through some significant obstacles provides clues that further downside could be yet to come. On the other hand, only a daily close back above $42.20 for Brent and $40.00 for WTI would bring a more bullish outlook.

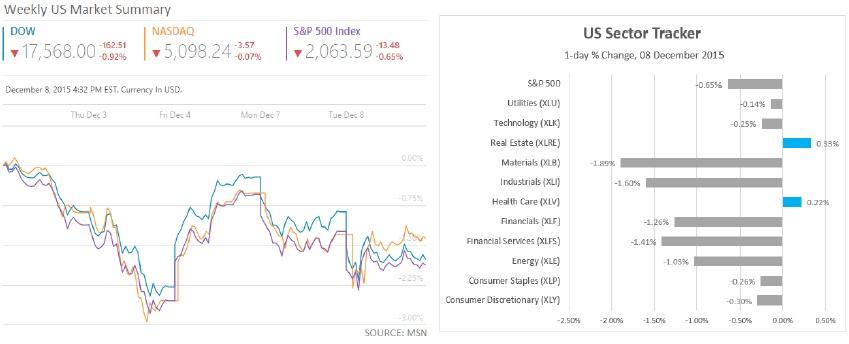

U.S. Indices Plunge for the Second Day

The US indices continue to be under pressure of the declining oil prices, closing at the red. The Dow Jones Industrial Average closed more than 160 points down, â€Â0.92%, with Exxon Mobil Corporation (NYSE: XOM) the stock with the biggest losses for one more day. The Exxon Mobil plunged by 2.86% on Tuesday and 2.83% on Monday. The S&P500 fell 0.65% while the Nasdaq was marginally lower by 0.07%.

The S&P500 index is not too far removed from yesterday’s levels, after a range above the key support level of 4580, as the market goes on hold while waiting for the Fed meeting on December 16. Since last week the index is increasing the attempts to break above the key level of 4735 and I think it’s going to take at least 2â€Â3 more attempts before we see a break above here. To the downside, below the session low of 4635 would then open the way to a move towards 4578, which includes the 50â€ÂSMA on the daily chart.

Economic Indicators

In US, the Wholesale Inventories for October will be published. During the Asian session, the Reserve Bank of New Zealand will announce its interest rate decision, followed from a monetary policy statement and a press conference. The market expects a rate cut of a quarter to 2.5% from 2.75% now.

During the night, the Melbourne Institute will release the Consumer Inflation Expectations for Australia. A while later, the labour report that will be published is expected to have an impact on the Australian dollar. The unemployment rate is predicted to rise slightly to 6.0% from 5.39% before while the employment change is forecasted to be â€Â10k.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.