Market Overview

Could a cut in the OPEC oil production levels really be the catalyst for a market rally and improvement in trading sentiment? Overnight there have been suggestions that the OPEC cartel are ready to discuss the possibility of production cuts. The oil price has spiked higher and generally in the past couple of months, where oil goes, so does market sentiment. I have my reservations as to whether OPEC (who run around a third of global oil supplies these days) can even impact the oil price in any meaningful way now, especially with other countries such as the US and Russia perfectly equipped to take up any proposed shortfall. Despite this though it is a near term boost to confidence. Market sentiment has been running full steam negative and markets have been accelerating lower. However, looking at the bounce in the US 10 year yield may suggest that markets are close to unwinding.

Asian equity markets have been showing sweeping losses overnight although they are still playing catch up from an array of public holidays this week. European markets are stronger at the open and it will be interesting to see how this continues. Forex markets are fairly mixed in early moves, with little real trend. The yen is slightly stronger, but the euro is weaker. The Aussie is trading around the flat-line, whilst the Kiwi is off by 0.6% and that despite the jump in oil. Gold has given back some of its huge gains from yesterday but nothing yet that would suggest there is some serious profit-taking. Oil is standing around 4% higher currently.

The markets will be watching out for the flash reading of Eurozone GDP at 1000GMT which is expected to stay around 0.3%. However the main focus from an economic standpoint will be the US Retail Sales at 1330GMT. The expectation is that core Retail Sales (month on month ex autos) for January will be flat. With the recent pick up in wage growth, this should begin to translate through to improved retail sales. The number will have an impact on the dollar.

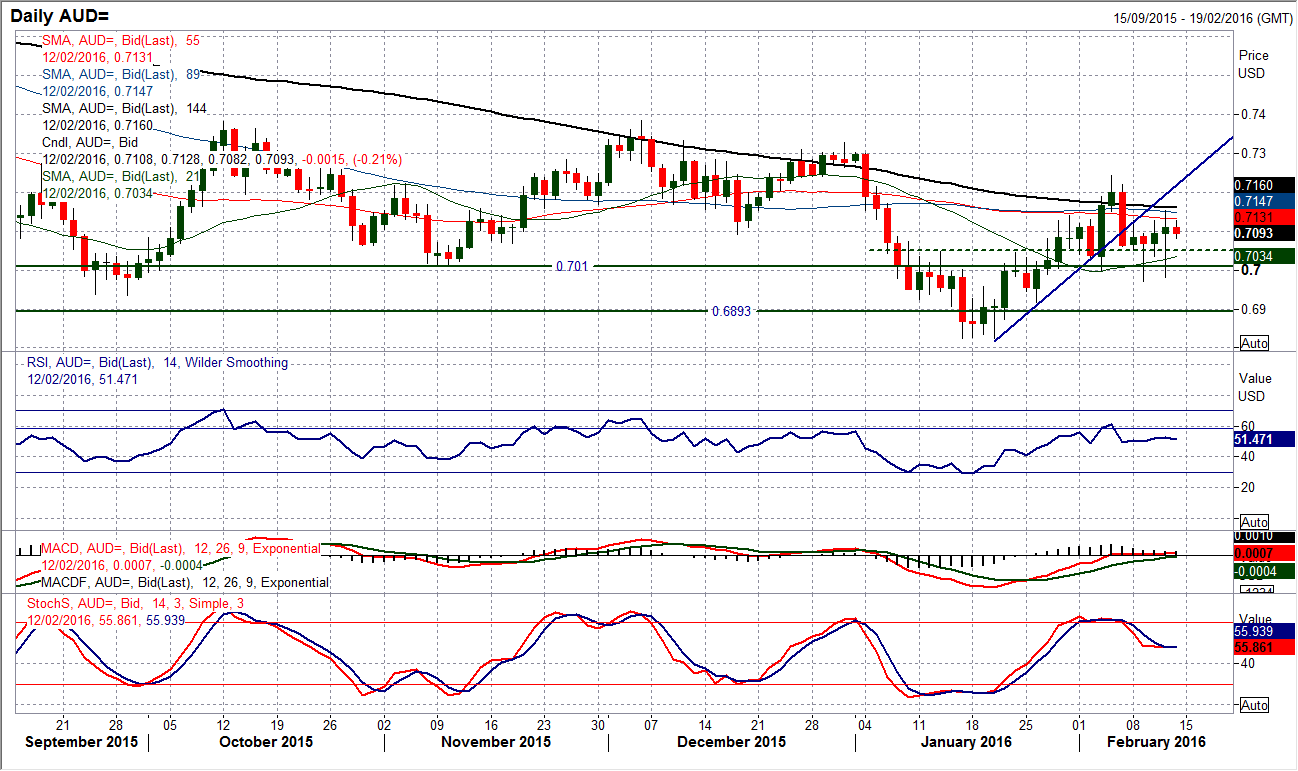

Chart of the Day – AUD/USD

I looked at the Kiwi dollar yesterday that is still trading within the uptrend that has formed since its January low. However, the same cannot be said for the Aussie. The technical outlook for the Aussie dollar is much weaker than it is on the Kiwi on a near to medium term basis. The uptrend on the Aussie was broken a week ago, whilst the concern is that the momentum indicators are looking far more corrective. The Stochastics are falling, the MACD lines are rolling over around the neutral point and the RSI is failing around the 60 mark. The candles in the past few days have had small bodies but long shadows which would suggest a real uncertainty over near term direction. Yesterday’s candle was a volatile 170 pips of daily range, but the only marginal move on the close formed a “doji” candle. The hourly chart shows a volatile range play under resistance at $0.7150 and above yesterday’s low at $0.6980. I am bordering on a slight bearish bias and a close below $0.7050 would put a more bearish slant on the outlook. Also with the daily Parabolic SARs in decline, but today’s trade could be pivotal for the next breakout direction. The levels of yesterday’s range hold the key to the outlook.

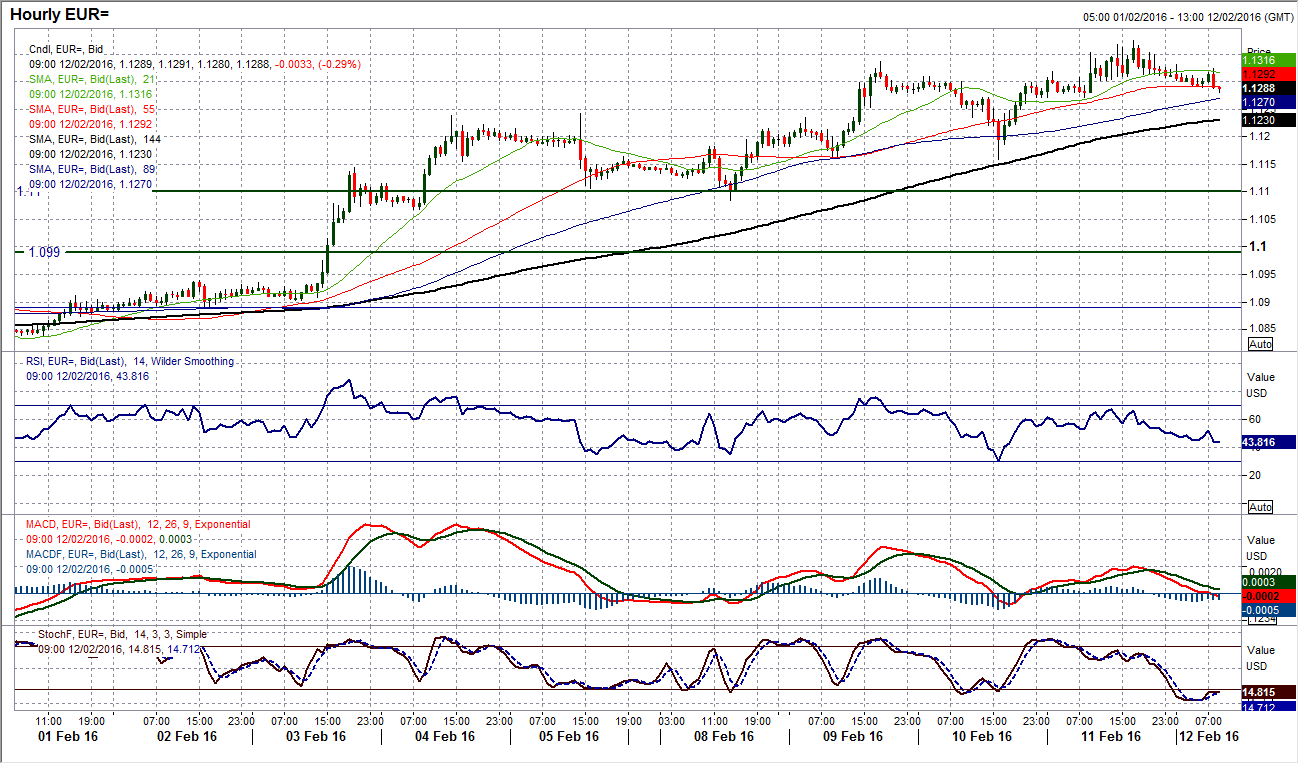

EUR/USD

The euro continues to creep towards the long term range highs and supported by the general flight into safe haven assets (which the euro continues to trade as), the path remains higher. Intraday dips are being bought into and the momentum indicators on the daily chart are set up positively. The only caveat you would say is that the RSI is lacking upside potential possibly around the 70 mark, however the bulls still remain in control and the trend is your friend. This lack of upside potential on the daily RSI is also just seeping through to the hourly chart too which shows that momentum is not as strong as it once was in this move higher. Initial support comes in at $1.1270 but the important reaction low is at $1.1160 which marked the nadir of Wednesdays trade in the wake of Janet Yellen’s testimony. Holding on to this will maintain the bull control. Near term resistance is with yesterday’s high at $1.1375 and whilst the momentum may not be as strong as it has been, I still expect further gains in due course.

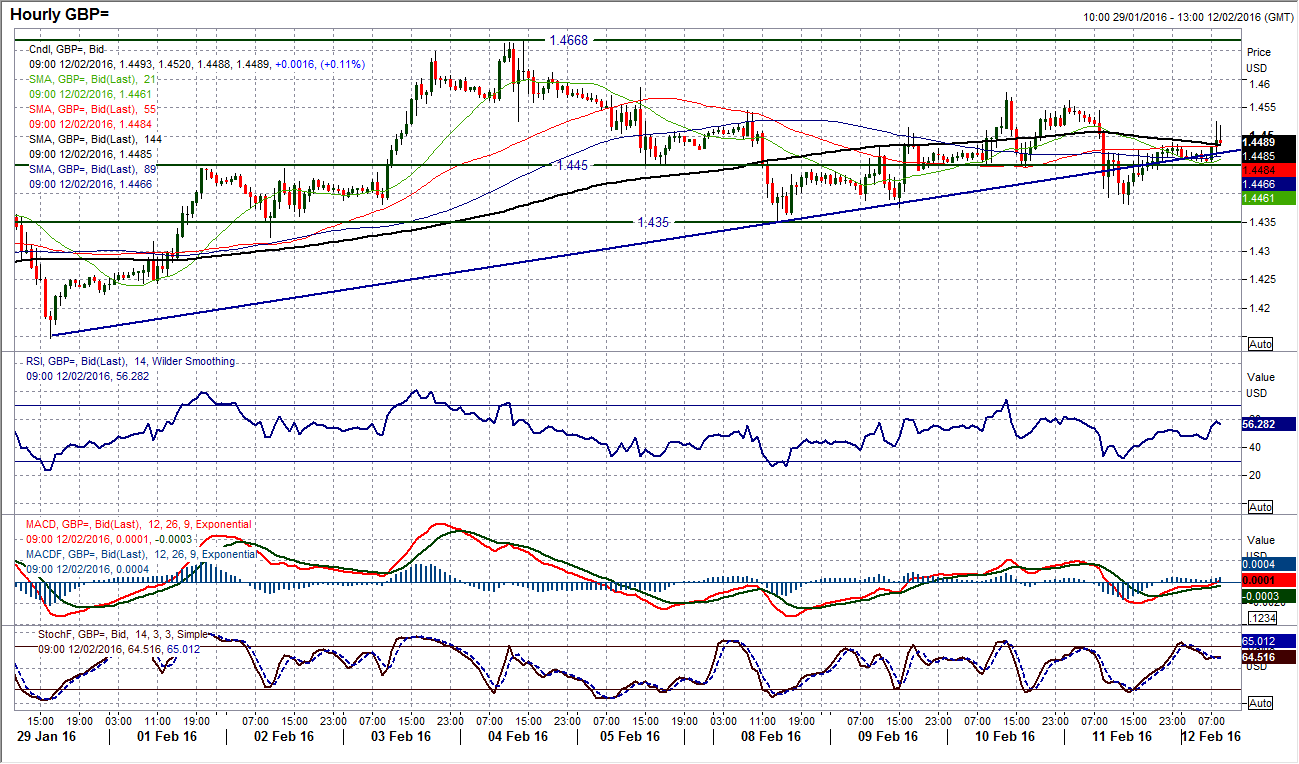

GBP/USD

The choppy consolidation on Cable continues. I have been talking about the key support at $14350 holding for a number of days now and this continues to be the case. However the bulls remain unable to gain any real traction in the move higher, for the second day finding resistance at the old crucial low of $1.4560.And so the momentum indicators are becoming increasingly neutral, with the RSI flattening around 50 and the Stochastics also flattening. Yesterday’s candle recovered from what had been quite a significant early bearish run to leave quite a long downside shadow within a negative candle. This puts the bulls under pressure today. Looking on the hourly chart, the moving averages have all converged to flatten off and the price is hovering around the $1.4450 pivot. It would see that the market is waiting for the next catalyst now. We need a breach of $1.4350 support or above $1.4575 resistance to constitute a break.

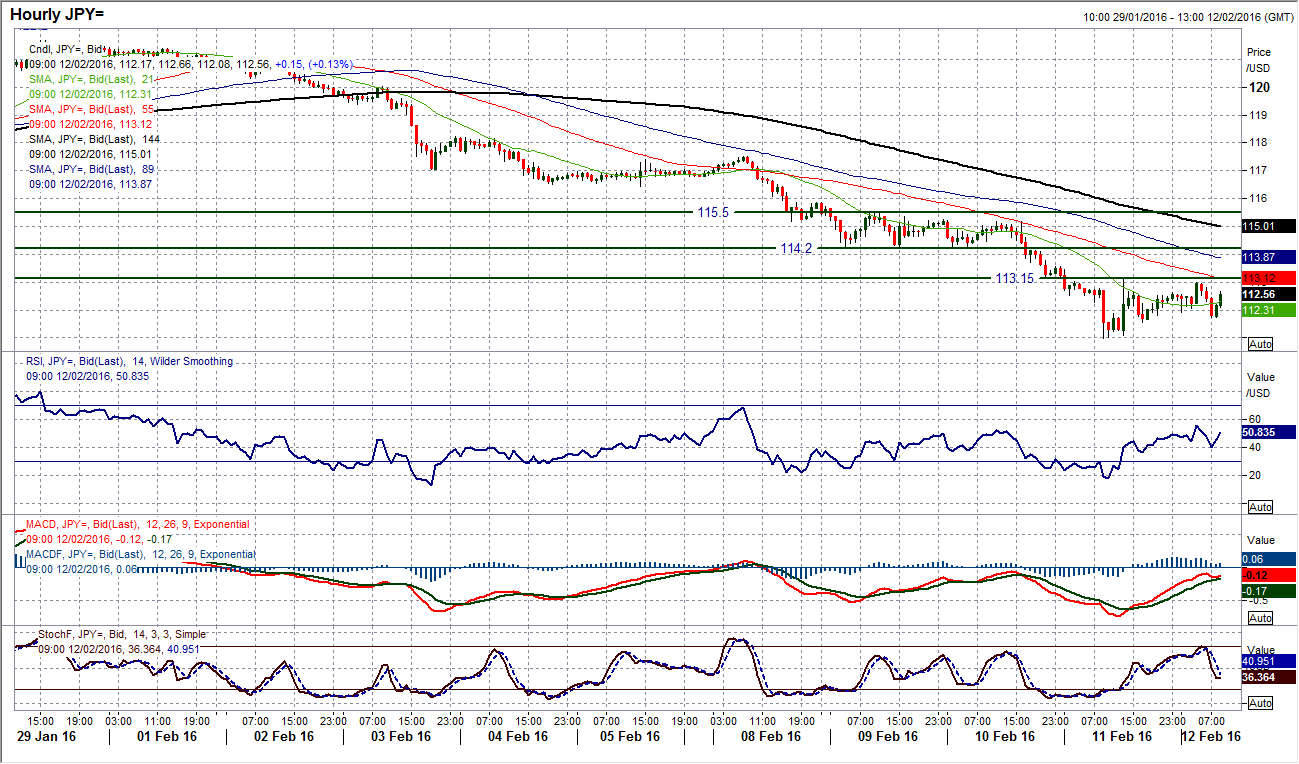

USD/JPY

Aside from a minor blip in the middle, we have now in our ninth bearish candle of the past two weeks. Dollar/Yen has plummeted as much as 1070 pips in those two weeks in an absolutely incredible sell-off which seems to have been the market sticking two fingers up at the BoJ’s negative interest rates shift. When will the run stop, or even for that matter pause for breath? Technical indicators are looking rather stretched, but this comes with the territory of a strong bear trend. Watching the run lower yesterday, it was interesting that there were two attempts to breach 111.00 in the past of a couple of hours and the support has since held. Hourly momentum indicators would tell you that this is merely a consolidation and that any rallies are simply unwinding oversold momentum to renew downside potential. As the European session takes over this is still the fear. Neat term resistance at 113.15 has held overnight and becomes a barrier to watch today. The market’s key sentiment indicator may well take the positives out of an oil price rebound today so this is the caveat to the bearish outlook. I continue to see a retreat towards 110 as likely in due course, whilst the conservative measure from the big two year top is 107.50. Once more, expect a volatile day.

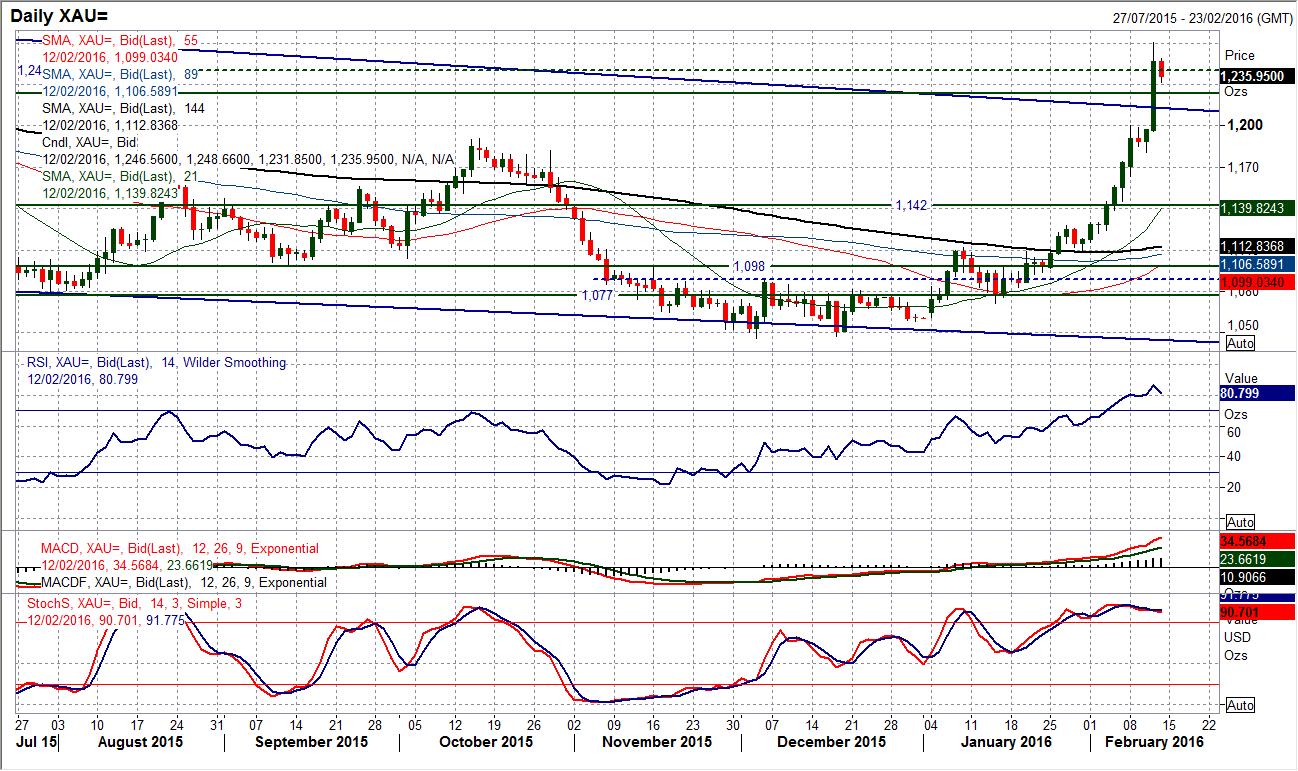

Gold

The incredible move higher on the yen has been mirrored by the huge gains also on gold which is almost now going exponential. The gold price added over $45 yesterday with enormous gains that have taken the RSI to 85, the highest since August 2011. This run is more than just technicals though, it is fear driven and whilst markets remain fearful, gold will continue to move higher. The RSI at 85 reflects the strength of the fear rather than any oversold position. The move is such that the long term downtrend channel has now been blown out of the water. The resistance at $1232 was being paid scant regard during yesterday’s bull run, however, it has been interesting that $1232 has been a reaction low during an early correction today before a bounce back again. This is clearly an initial support to watch. The Bollinger Bands show continued closing prices outside or just on the upper band, so as yet there is no signal to suggest a reversal signal. The caveat is that when a correction comes, there is much to unwind and it is likely to come very quickly, so be vigilant with stop losses and trade management. The next key technical level to watch is the $1306 January 2015 high.

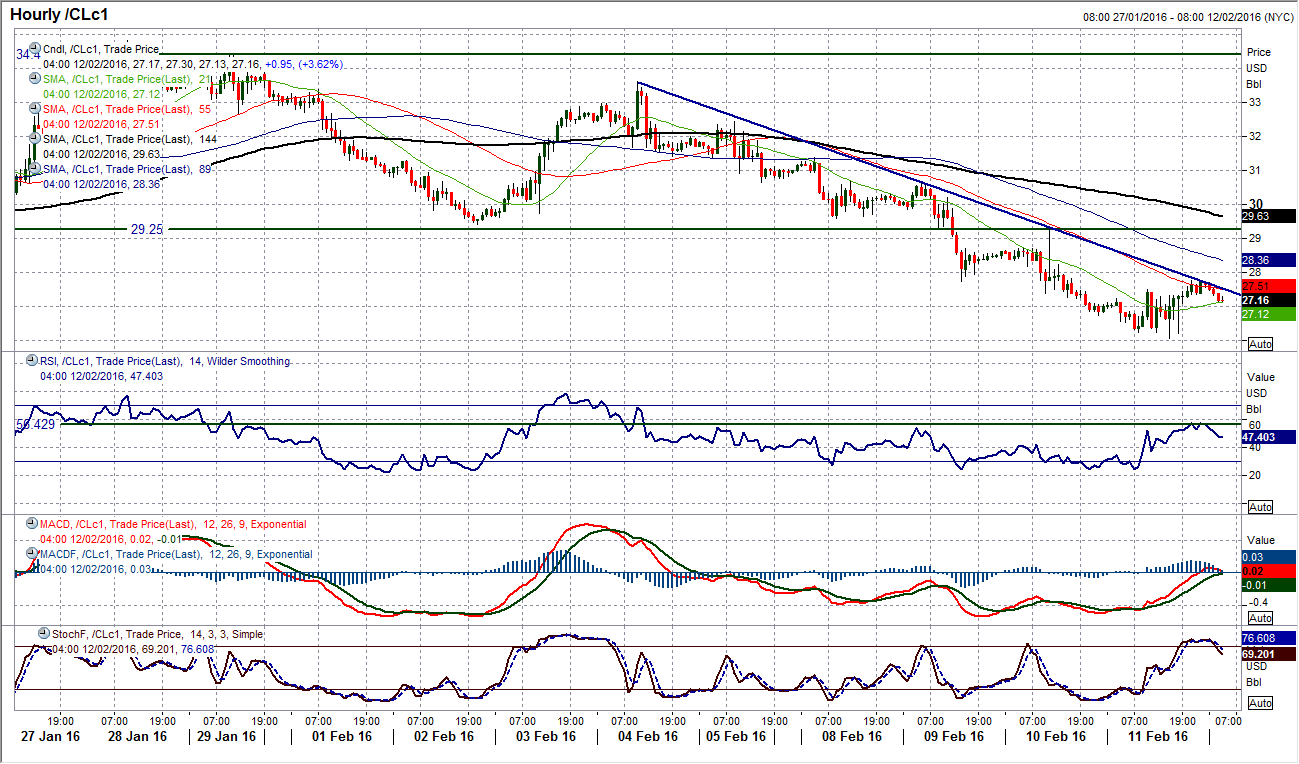

WTI Oil

The daily chart reflects the continued bearish pressure that the price of WTI finds itself in now. However, an early rally today threatens to end a run of six consecutive bearish candles. The move comes amid suggestions that OPEC is ready to start discussions over potential production limits. This has the potential to upset the rhythm of the bears, but whether it would make a lasting difference is another matter. For now, with this possible fundamental change afoot, it would be wise to take a step back and consider the reaction. The market will now be massively volatile around rumours again. Technically the outlook remains bearish and the key overhead resistance comes in at $29.25. Rallies remain a chance to sell so now, but perhaps it is best to play this one by ear for now. The technical bulls will be interested that the low at $26.20 was tested almost to the tick and held. The rally is into the initial resistance band $27.40/$27.75 and a failure to get above here could even induce some eager sellers to return.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.