Market Overview

Janet Yellen has done little to calm the nerves of the market driving safe haven demand but also dollar weakness. She may have tried to portray a “steady as we go” stance but the market has clearly taken her comments on the basis that nothing has changed. There was an initially supportive move for the dollar, but the oil price has subsequently come back under pressure, with safe haven plays once more the chief beneficiaries. The fact that Dollar/Yen fell again sharply into the close with the losses continuing overnight is a really concerning signal, along with gold regaining the upside initiative after previously threatening a correction. Equity markets are also seemingly no nearer to posting a key low, with Wall Street again showing little appetite for any buying. The bears remain in control with Treasury yields in decline and European equity markets strongly lower again in early trade.

Yellen’s testimony suggested that the Fed still had moderate growth expectations and the US on the path of gradual monetary tightening. Although she did not see the US cutting rates and that the risk of recession was low, she did also warn that if the current conditions continue in the global markets that it could impact on economic activity and the labor market. This all pretty much ties in with the market’s current concerns and that it is higly unlikely the Fed will be pushing ahead with rate hikes in the next few months.

Forex markets have subsequently taken this as a chance to sell the dollar again which has been chiefly shown through the euro and yen strength, although in Asian trading it is predominantly the yen that has continued this trend. The oil price has sharply moved lower again overnight whilst gold is maintaining a position above $1200.

Today there is not much on the economic calendar with Janet Yellen’s second day of testimony the main event (although it is unlikely that we will hear too much new information). The weekly jobless claims are at 1330GMT and are expected to show 287,000 (up from 285,000 last week).

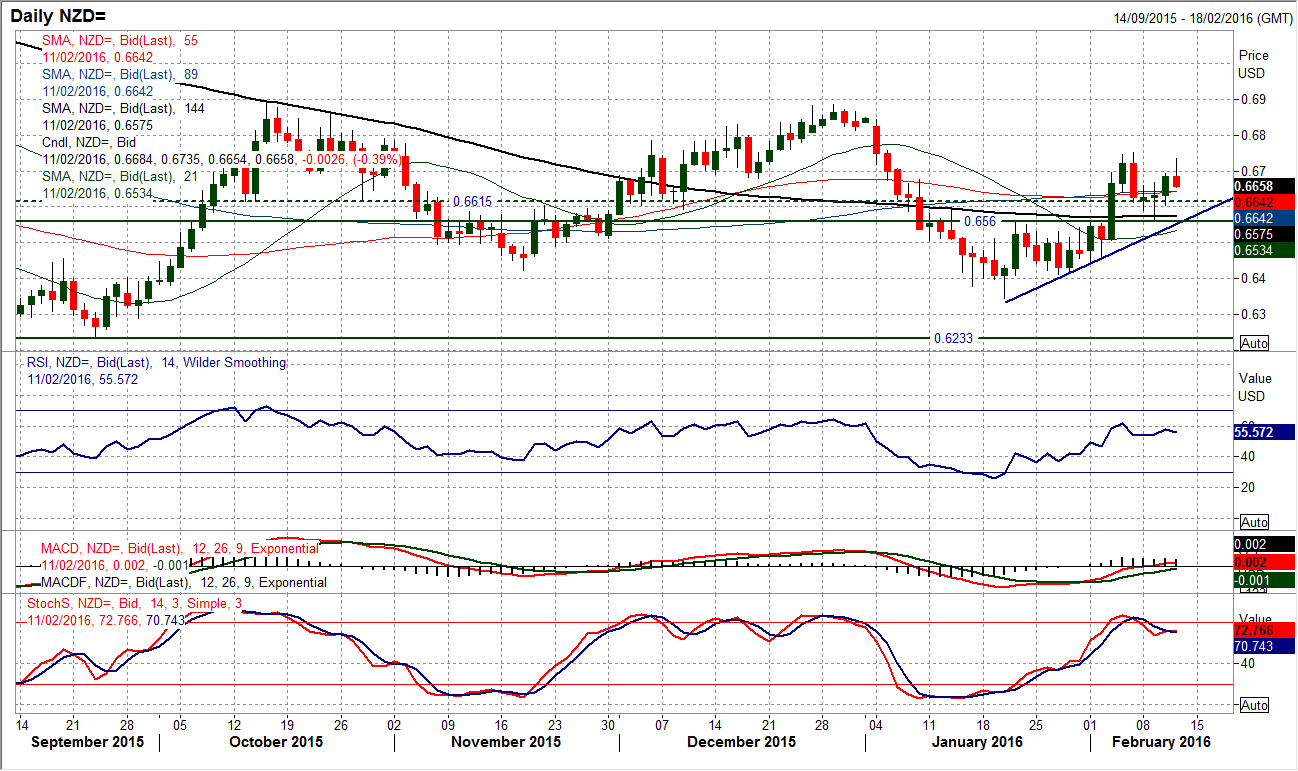

Chart of the Day – NZD/USD

The chart of the Kiwi dollar shows the difficulty in trading the commodity currencies at the moment, with the conflicting forces of dollar weakness but also reduced appetite for risk. Can the bulls maintain control in the recovery on the Kiwi? The rebound from the January low at $0.6345 looked to be coming under pressure in the wake of the big bearish engulfing candle from $0.6750 last week. This single day candle pattern still has a negative legacy on the chart, however the bull reaction to find support around the old resistance at $0.6560 and to then push on has been encouraging and this maintains the uptrend on the Kiwi over the past few weeks. We have also had a very strong bull candle yesterday. Momentum indicators which had threatened a bearish top have been turned around as the market has started to push higher again. This means that the Kiwi is on more of a positive outlook still in the near term and the resistance at $0.6750. The hourly chart shows more of a consolidation over the past few days as the buyers have got a foothold once more and the outlook is looking to use the breakout range $0.6660/$0.6667 as a basis of support now. More sizable support comes in around $0.6600 with $.06560 now key near term.

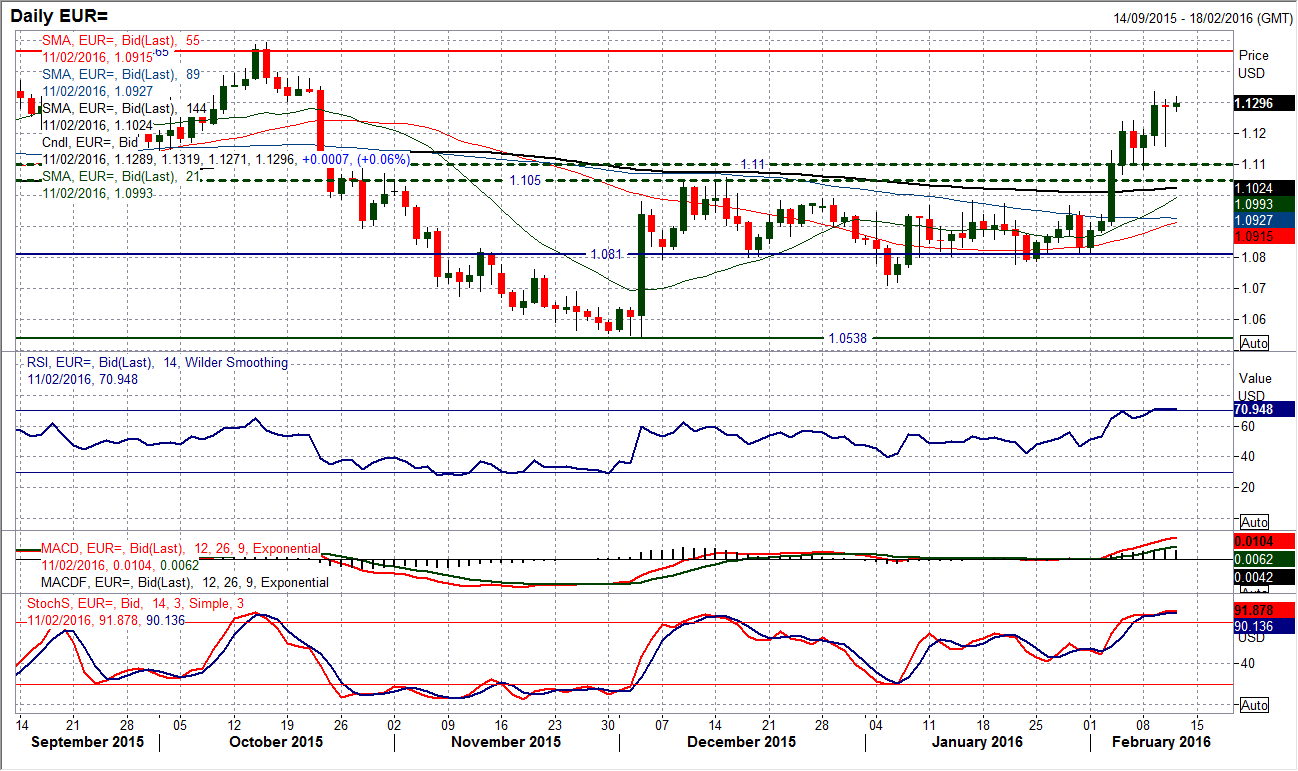

EUR/USD

The euro remains supported as the dollar weakness continues to pull the pair higher. The chart shows a doji candle with a long downside shadow which shows that the selling pressure in the wake of Janet Yellen’s testimony was reversed into the close with the market back on track. Although this is a warning signal to the bulls, the fact that the buyers returned so quickly certainly helps to reinforce the support around $1.1160. Momentum remains strong and the bulls will be eying the $1.1337 high as a breakout today would re-open the long term range highs around $1.1460. The hourly chart looks positive, trading above all the rising moving averages and corrections being bought into at higher levels. The bulls remain in control whilst the support at $1.1085 remains intact.

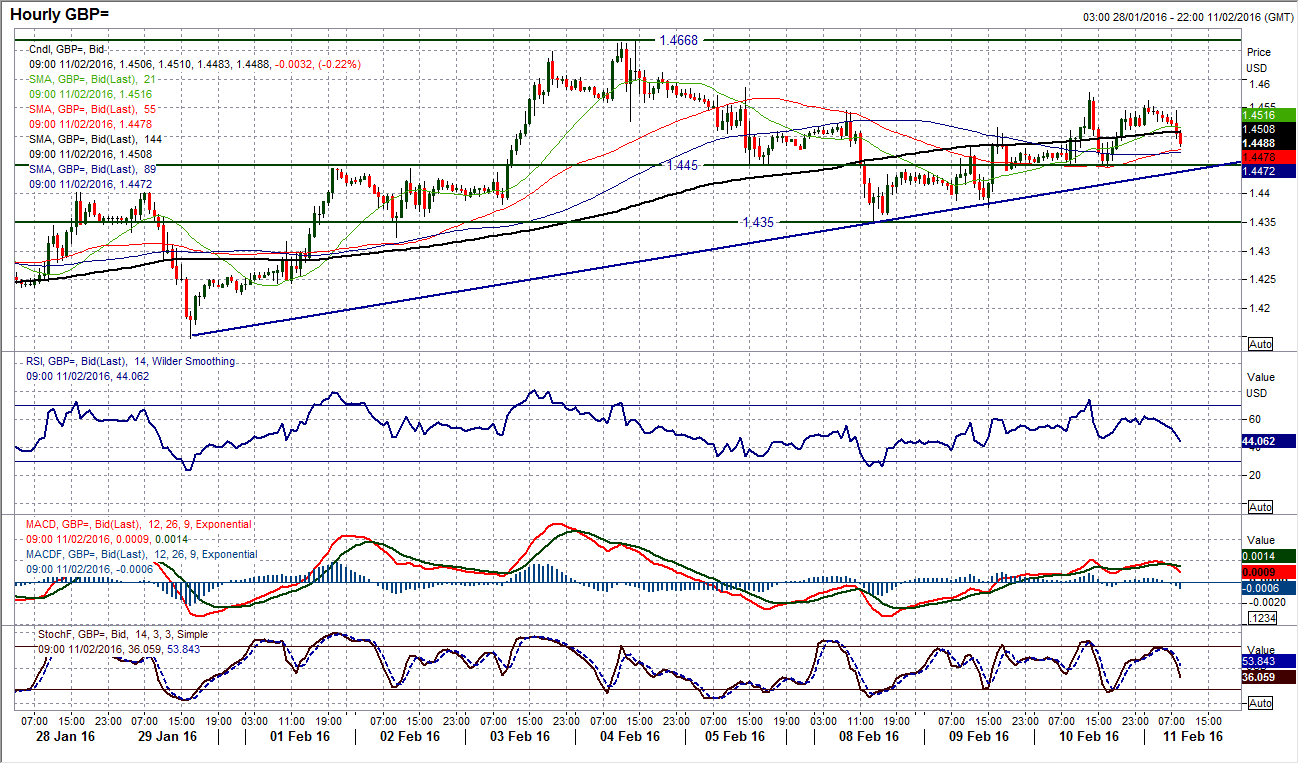

GBP/USD

The bulls are looking to regain control with a couple of positive candles in a row, however there is still some overhead supply to clean out before they can really be confident again. The support at $1.4350 has been bolstered and the 21 day moving average turning up is also a positive. However the daily chart shows a combination of the 38.2% Fibonacci retracement at $1.4520 and the resistance of the old key low around $1.4560 is holding back the advance. The momentum is though strong with the RSI advancing above 50 and the Stochastics turning higher again. The hourly chart does show that Cable has moved above the pivot level at $1.4450 and is now using it as a basis of support. Hourly momentum also suggests that rallies are a chance to buy. A push above yesterday’s high at $1.4577 would re-open the recent highs at $1.4670. The support at $1.4350 is now key.

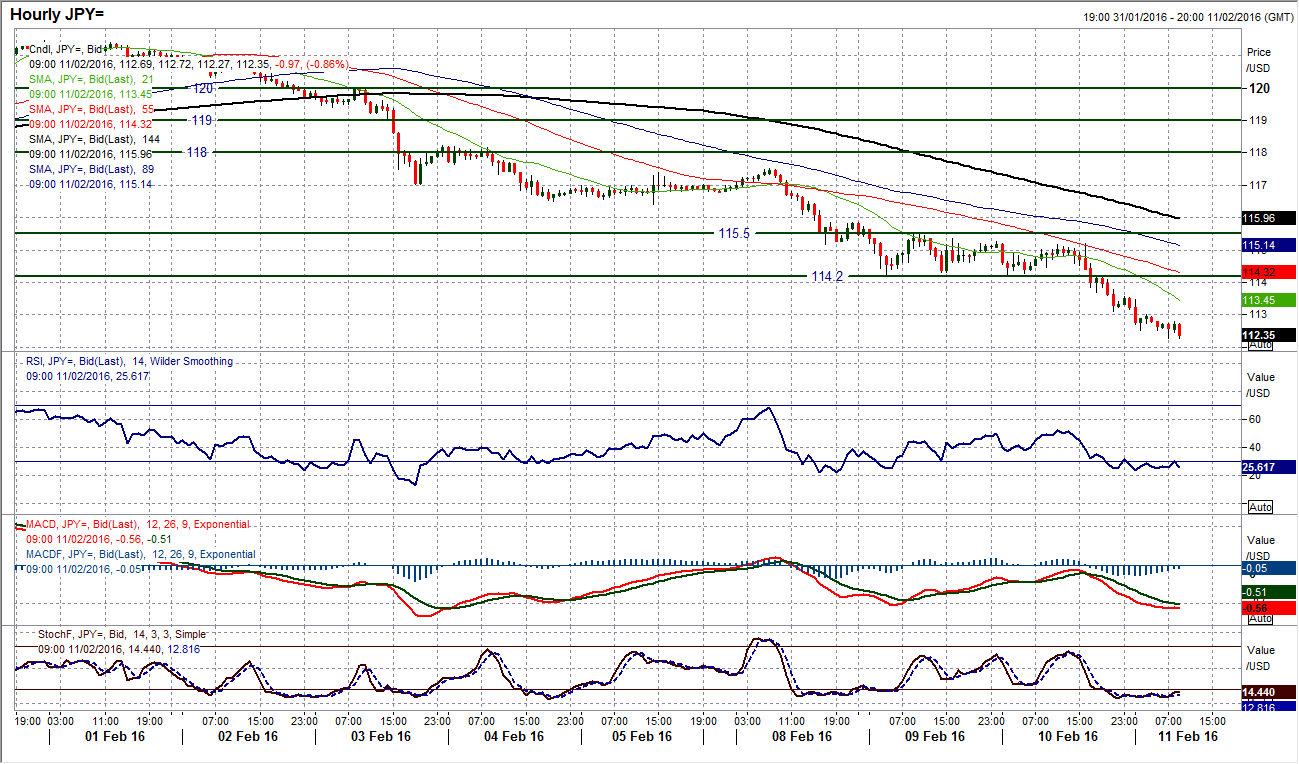

USD/JPY

The incredible sell-off continues. Yesterday I looked at the prospect that Dollar/Yen was consolidating and perhaps on the brink of a recovery but this seems to have merely been markets taking a step back in front of Janet Yellen. Her testimony has done nothing to calm the selling pressure on the dollar with the pair losing 180 pips yesterday and already today another 100. The initial support at 110 is already a very realistic prospect, whilst the long term downside target is around 107.50 and that is on a conservative basis. Daily momentum is incredibly negative and any rallies are getting sold into. When Dollar/Yen goes on a run it really does trend, so in the absence of any reversal signals, stick with the move for now.

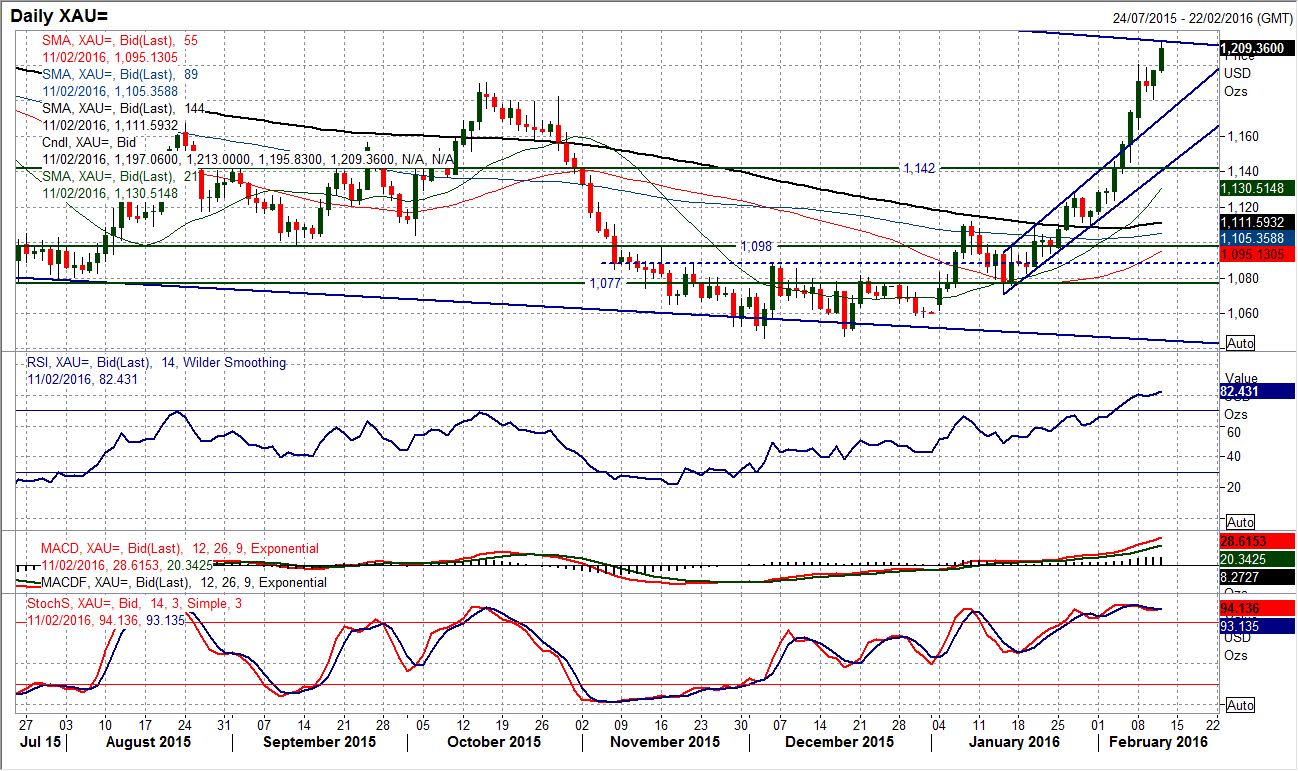

Gold

The safe havens are certainly still in favour in the wake of Yellen’s speech that has done little to calm market nerves. The consolidation on the gold price looked to be turning into a correction after a near term breach of support at $1185, however the gold price has once again just pushed on again to leave support around $1180. A move above $1200 has come with a breach of the June 2015 high at $1205 and now the key reaction high of the May 2015 high at $1232 comes into range. I remain mindful of the stretched look to the RSI, up at 82 now, however the trend is once more strong and this looks to be a run that is just going now. The hourly chart shows that gold has recovered its poise strongly now after yesterday’s early wobble and all indicators suggest that the bulls are back in charge. There is now a band of $15 of support below $1200 to help maintain the bull run. A move below $1180 would now be the signal for a serious change of sentiment.

WTI Oil

Old support becomes new resistance. The breakdown below key near term support at $29.25 was a key move and this is a level that has now become a source of overhead supply. Yesterday’s spike high on the back of the lower than expected oil inventories, hit this resistance almost to the tick before the selling pressure kicked in again. The oil chart looks increasingly bearish now this $29.25 level has become a pivot. The breakdown already suggests a retest of the $26.20 low whilst the projection from the near term top lower implies $5.60 of downside projection to $23.60. With daily momentum indicators in negative configuration, including MACD lines that have just crossed lower, the downside potential is there. Rallies are certainly a chance to sell with the hourly indicators all negatively configured, with the old intraday low at $27.75 providing near term resistance below the $29.20 level. Expect further (volatile) weakness.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.