Market Overview

Politicians appear to be more positive than at almost any other time over the past few months that a deal with Greece could be close. There is much that needs to be done (according to Merkel at least) but there has been a serious proposal submitted by the Greeks and it is possible that a deal could be done this week that would avert the threat of an imminent default. The sentiment on financial markets has though taken a significant shift back towards the US dollar overnight. This comes as US Treasury yields (and German Bund yields for that matter) have continued to push higher amid a move away from safer haven assets (such as gold and the yen). The talks will continue over the coming days and markets are likely to react to any rhetoric coming out of the meetings , but there is finally light at the end of a long and tediously dark tunnel.

Wall Street closed higher (although not in the same vein as European markets) with a solid 0.6% on the S&P 500. Asian markets have again been strong overnight, perhaps helped also by the pick-up in the HSBC China flash Manufacturing PMI which moved to 49.6 from a final 49.2 last month and ahead of the 49.4 expected. European markets have opened mixed to positive with the DAX and CAC again leading the way.

In forex trading the dollar has made a comeback today and is making gains against all the majors, although it is interesting that the commodity currencies are relatively sturdy today, perhaps in the wake of the China data. Traders will also be looking out for the Eurozone flash PMIs early this morning, but the main focus will be on the US Durable Goods Orders at 1330BST. The forecast is for the ex-transport data to improve month on month by +0.6% (last month +0.5). The US flash manufacturing PMI at 1445BST is expected to improve to 54.2 (from 53.8).

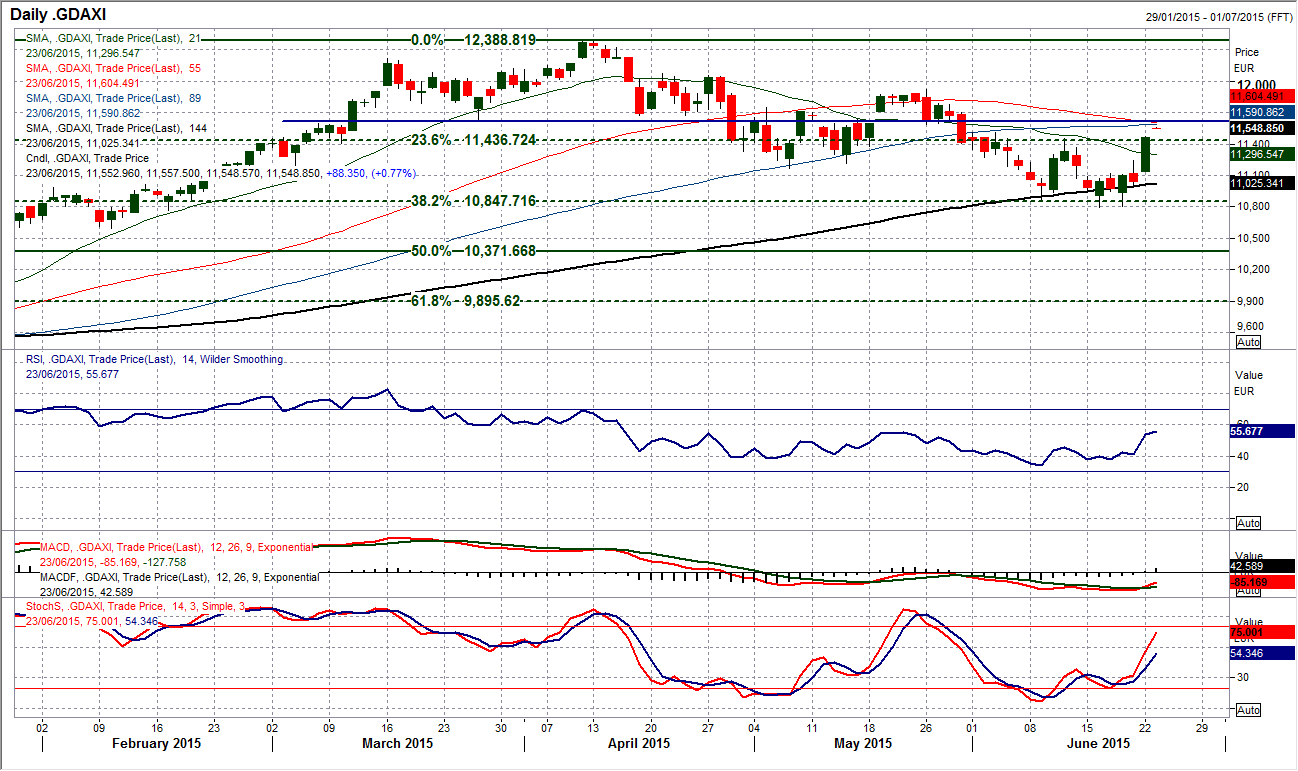

Chart of the Day – DAX Xetra

After such a strong move yesterday I thought it would be good to see if the rebound has done anything to impact on the outlook for the DAX. There has certainly been a pick-up, which has now broken the sequence of lower highs as there was a close above 11,420 yesterday. This move was also confirmed on the RSI and Stochastics, whilst the MACD lines are also looking to bottom (with a potential bull cross). The intraday hourly chart shows a move above 11,420 was very late into the close yesterday which is a bullish sign, but I think it would need to have a two day close above the resistance (ie. a positive close today) in order to confirm the move. I have said this previously, that the day following a huge bullish candle is just as important because you need to see confirmation in the cold light of day following the euphoria. That is why today is very important for the DAX and the potential for a continuation of this rally. If there is a second day of a closing breakout today then this move could be talked upon as a double bottom which would imply around 600 ticks to the upside from the breakout (c. 12,000). At the very least it would re-open a test of the key May high at 11,920. The intraday hourly chart shows there is now good support in place between 11,200/11,270. The DAX has clearly improved but there is still much to be done to suggest a sustainable improvement.

EUR/USD

After a third session of little real conviction, today has started off with a degree of selling pressure. The consolidation over the past few days has done little to provide us with any sign of intent, but the euro continues to shy away from a test of the crucial resistance at $1.1465. This does pose a few questions over how confident euro traders are. I continue to focus on the fact that the daily RSI is failing to push above 60 (ie. failing to drive into strong momentum) as this consolidation continues. The intraday hourly chart is also beginning to show some signals that questions the strength of the bull control. The overnight breach of the support at $1.1290 looks to be completing a small top pattern which would imply a dip back towards $1.1180, whilst there is an uptrend that has formed over the past two weeks that is being tested. This may just be an unwinding dip back into congestion support around $1.1250. The support band $1.1150/$1.1200 is important near term as a breach would re-open the $1.1050/65 pivot.

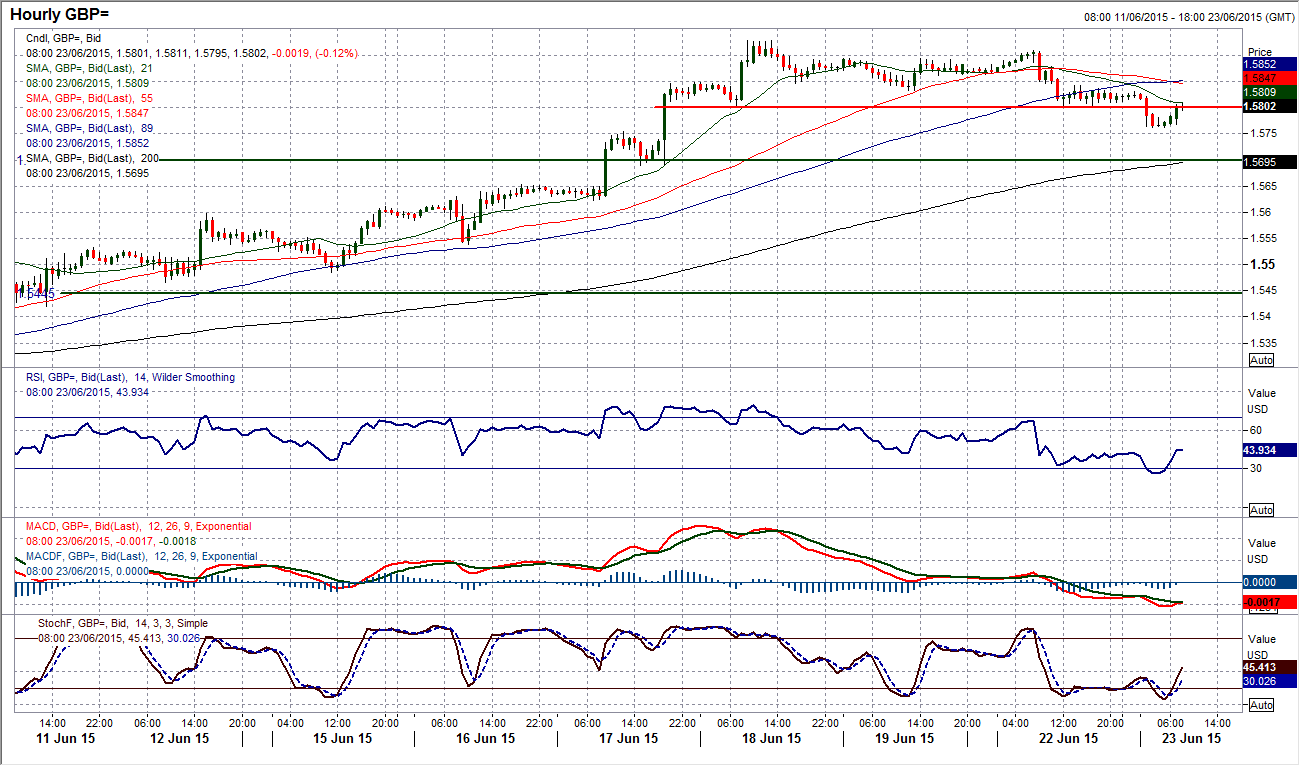

GBP/USD

I spoke yesterday of the uptrend becoming tired and showing signs of a correction and it would appear that these signals are growing. The first bearish candle in over two weeks is being followed up by a second, if the early morning trading is anything to go by. This is putting a corrective slant back on the chart. The Stochastics have turned lower and are threatening a sell signal, whilst the RSI has turned lower from above 70. I have also been focusing on the intraday hourly support around $1.5800 which was the first real higher low support. This has now been broken overnight and the pressure is mounting for a retracement. The break below $1.5800 completed a small top pattern that gives around 100 pips of downside, whilst the next real support does not come in until the next reaction low around $1.5700. It is also interesting how the hourly momentum indicators have also turned corrective. There is now resistance in the near term band between $1.5800/$1.5840.

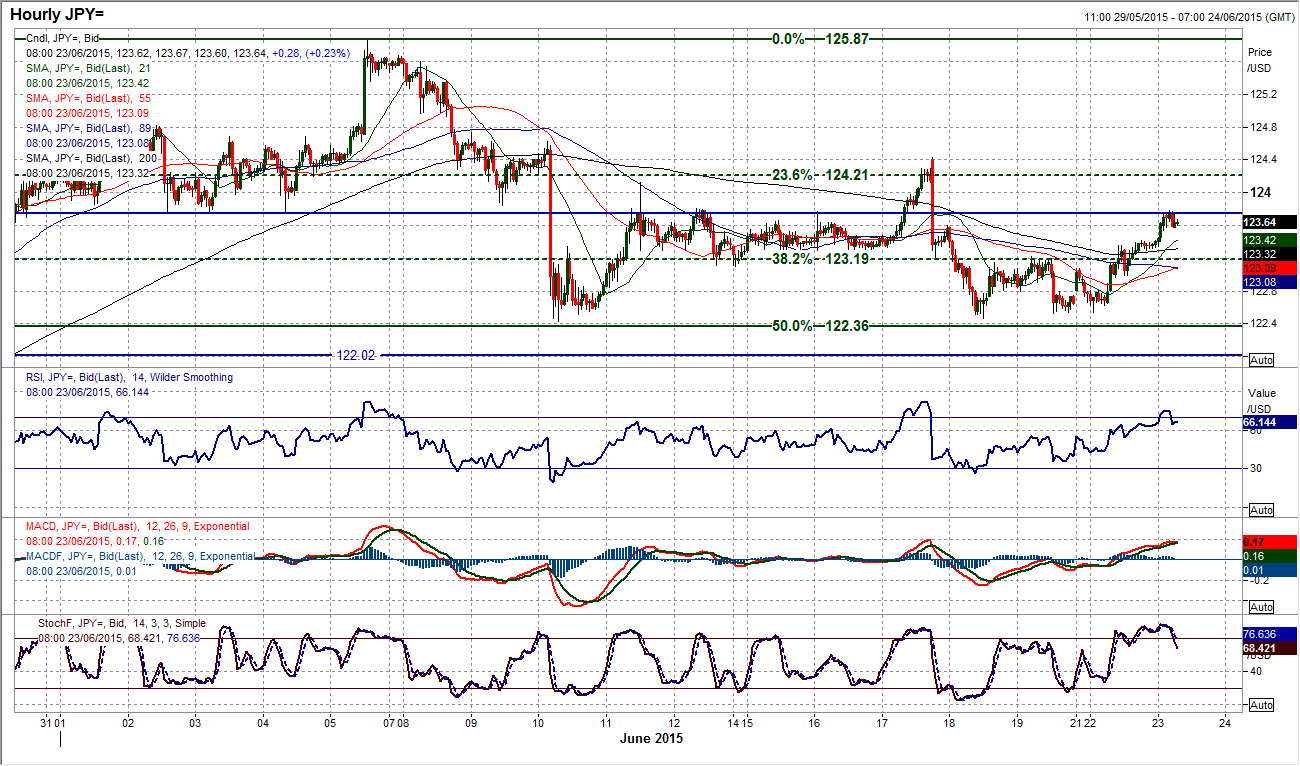

USD/JPY

I have been looking for the pair to leave a higher low around the support of the 122.00 breakout and it is still possible that this higher low has been posted. The 50% Fibonacci retracement of 118.86/125.85 at 122.35 has been used over the past two weeks as the basis of support and now with a positive candle yesterday followed by another positive start to today, the buyers are beginning to gain in confidence. I have previously been concerned that the Stochastics have been in consistent corrective mode, but now there seems to be potential for improvement again as they have started to turn up. Dollar/Yen is now in positive for a test of the first real resistance which is the old floor of support between 123.50/123.70 which has turned into resistance. The key near term support is the spike high at 124.43.

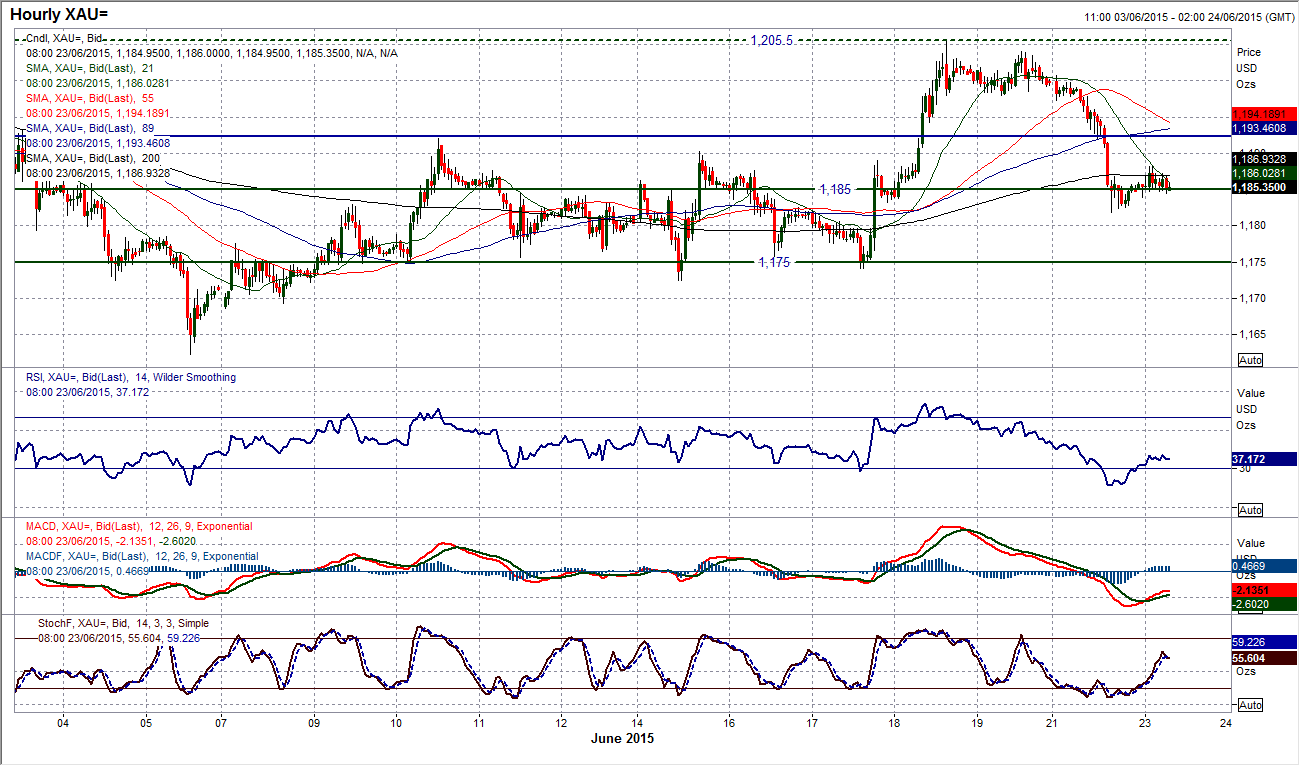

Gold

The outlook may have been neutralised by last week’s sharp rally above $1200, however the selling pressure resumed yesterday to undo much of the work done last week. This move does not entirely put the sellers back in control, but the range support around $1175 is once more back within sight. However, there is a big argument to suggest that this is just part of the trading range phase that is ongoing. There may be a slight bearish bias once more, but the intraday hourly chart shows the support band between $1175/$1185. I think that with a series of conflicting signals that have been seen on gold over the past few weeks, the net impact has tended to be a rangebound outlook, so it is safest to position for this to continue with little real direction. There is resistance once more between $1192/$1196.

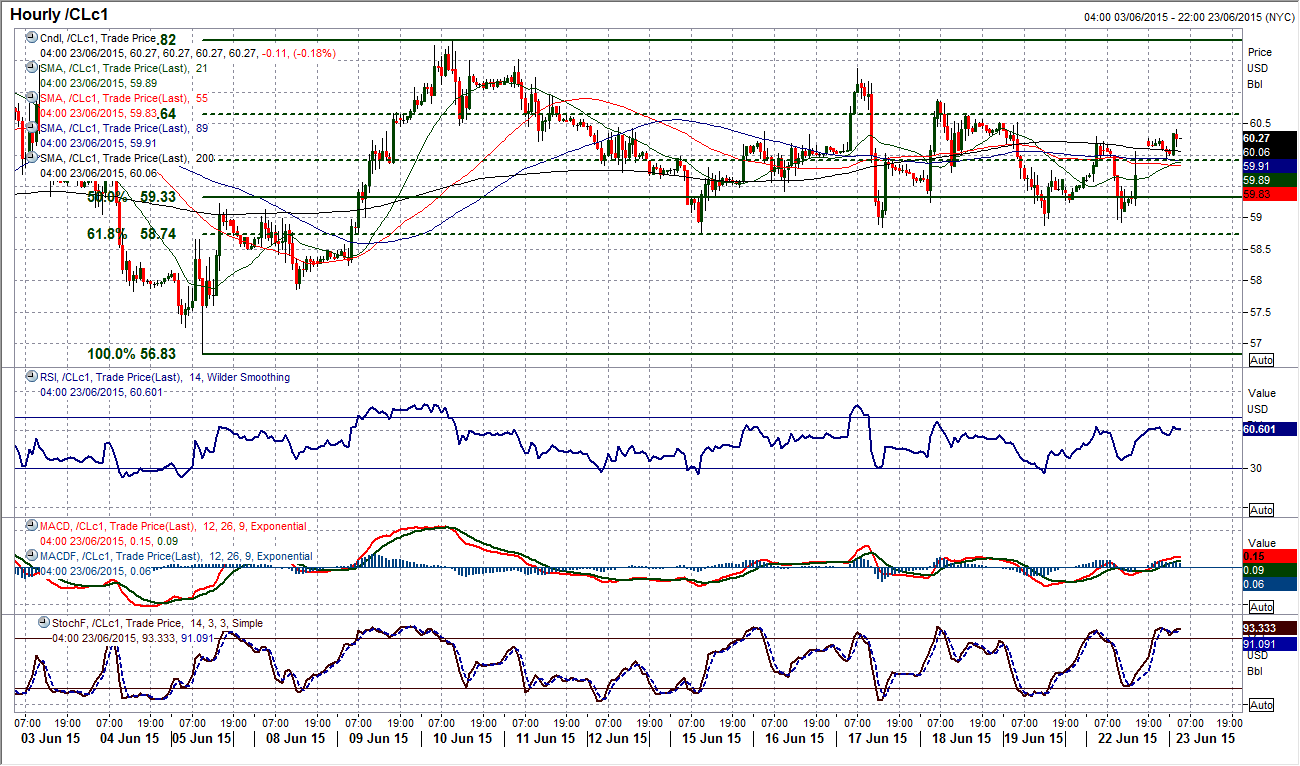

WTI Oil

In the context of the volatility seen on WTI over the past few months, trading over the past week has been remarkably settled on a day to day basis. The daily candles show an almost flat sequence of candles, whilst the momentum indicators have also been almost becalmed by the serenity of the trading. The intraday hourly chart shows much more of a choppy phase, it is just that there continues to be retracements of the retracements with almost zero sum gain. There is a slight sequence of lower highs over the past week, with the pressure just building on the support around the 61.8% Fibonacci retracement of 56.83/$61.82 at $58.74 which has been eyed several times by dips below $59. For now, this support remains intact, but a breach would at least open a test of $57.86 support, with a retest of $56.83 likely. Resistance comes in initially at $60.30 and then $60.90.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.