Technical Bias: Bearish

Key Takeaways

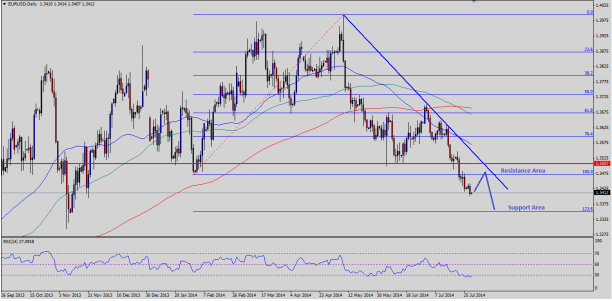

• Euro dives to challenge the 1.3400 support area against the US dollar.

• A small pullback followed by a new low is a likely scenario in the short term.

• EURUSD support seen at 1.3350 and resistance ahead at 1.3460-80.

The Euro continued to struggle against the US dollar, as it fell to a new low yesterday. The market sentiment remains in the favor of Euro bears, which means more losses cannot be denied moving ahead.

Technical Analysis

There is a descending trend line on the 4 hour timeframe for the EURUSD pair, which acted as a hurdle for the Euro buyers on numerous occasions. The pair recently broke the last swing low of 1.3480 level, which was an important support area. The pair is likely heading towards the 1.236 extension of the last move higher from the 1.3472 low to 1.3992 high, which is at 1.3350. However, there is a possibility that the pair might retrace back closer to the mentioned trend line, which now coincides with the swing support of 1.3470. In that situation, the Euro sellers could reappear for a fresh leg lower in the pair. Only a break and close above retracement is possible.

Moreover, if the pair continues to move lower, then as mentioned initial support can be seen around the 1.3350 level. If buyers fail to defend this level, then a test of the 1.3300 pivot area might be on the cards.

Euro Zone Consumer Confidence And Fed Rate Decision

There are a couple of economic releases lined up later during the London session, including the Spanish consumer price index, Spanish GDP, Euro zone consumer confidence and industrial sentiment. These events might cause volatility in the EURUSD pair. More importantly, the Fed interest rate decision is scheduled later during the NY session, which can cause swing moves in the US dollar moving ahead.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.