Fundamental Bias: Bearish

Key Factors

- Softer than expected Australian inflation data to boost dovish outlook of the RBA.

- Dismal Chinese manufacturing and factory activity to add further pressure on the Aussie buyers.

- Failure to hold a major trend line suggest risk of a much larger Australian dollar breakout.

The Australian dollar traded below an important bullish trend line yesterday after the US durable goods orders data was released. Furthermore, signs of increasing tensions between Russia and Ukraine also dented the Australian dollar recovery.

The Australian dollar dropped to three-week lows against the U.S. dollar on Thursday, after the release of US durable goods orders by the US Census Bureau. The report suggested that the US durable goods orders rose 2.6% m/m in March vs. 2% expected and 2.1% prior. Moreover, excluding transportation, new orders increased 2.0 percent. Excluding defense, new orders jumped 1.8 percent.

Fundamentals

The Aussie buyers will definitely struggle to take the currency higher, as the recent incoming data warned against chasing the Australian dollar higher. The most significant release this week was the inflation report. The CPI rose 0.6% in the March quarter 2014, compared with a rise of 0.8% in the December quarter 2013. Moreover, China’s HSBC manufacturing purchasing managers’ index was also released, which registered a minor rise from 48.0 to 48.3, but still below the all-important 50 level. All these factors might weigh on the Aussie in the short term.

Technicals

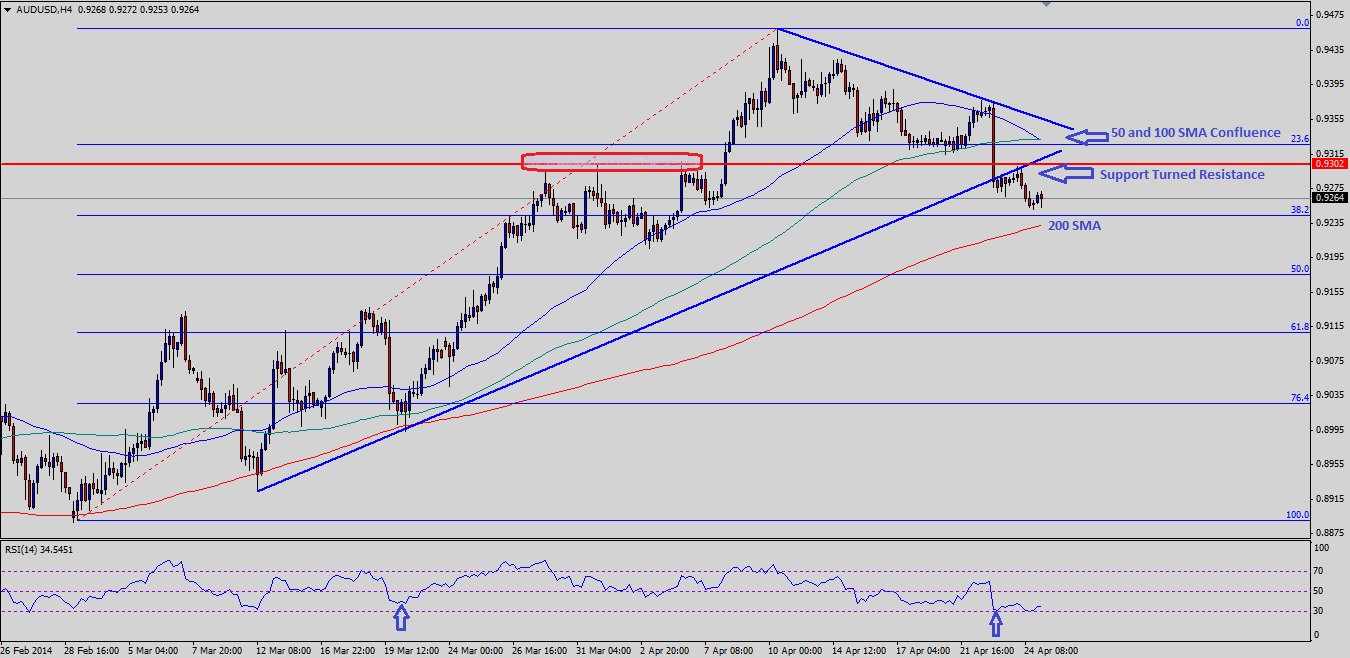

AUDUSD sellers managed to break an important trend line connecting all previous lows starting from 0.8923 during New York’ session. The buyers fought hard to take the pair higher again, but the broken trend line acted as a short term barrier. The AUDUSD intraday technicals are slightly bearish while trading below 0.9300 looking to test support in the 0.9220-0.9200 area. The mentioned support area holds a lot of significance as 200 simple moving average on the 4 hour timeframe sits around the same area. A break either side of 200 SMA is likely to exposure 50% Fibonacci retracement level of the last major leg higher from 0.8888 low to 0.9460 high.

Looking Ahead

If there is a big move in the US dollar, then AUDUSD might dive towards 0.9220 support level. Alternatively, we might witness a move back towards the confluence area of 100 and 50 (4h) SMA’s.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.