Technical Analysis

EUR/USD eyes 1.33

“This is really a blending of several geopolitical themes that are driving that risk-off trade.”

- Clearpool Group (based on CNBC)

Pair’s Outlook

EUR/USD continues to grind lower, and it does not seem we are going to observe a pronounced bullish correction before the pair reaches the 2013 Q4 low at 1.33. Then there will be a high chance of a pull-back up to 1.35, a level that has proven to be fairly important this year (it is also reinforced by the monthly PP and down-trend). Afterwards the sell-off should resume, but this time the Euro will be expected to target the 2013 Sep low at 1.31.

Traders’ Sentiment

The bullish views are getting more popular, as it is becoming cheaper to acquire the single currency. Right now 59% of open positions are long and the remaining 41% are short. But concerning the orders, 67% of them are to sell the Euro against the Buck.

GBP/USD fell through 100-day SMA

“The market has already priced in considerable tightening from the Bank of England over the next 12-24 months whereas the market is only just starting to price in potentially earlier hikes by the Fed, which is supporting the dollar.”

- Citigroup (based on Reuters)

Pair’s Outlook

There is now little hope for the bulls, being that GBP/USD has broken most of its main supports. The monthly technical indicators may still remain positive, but, given the absence of any significant demand areas nearby, the risks are heavily skewed to the downside. One of the few levels that are deemed capable of turning the current bearish tendency around is 1.67, formed by the 200-day SMA and May low.

Traders’ Sentiment

There is still no difference between the amounts of bullish (51%) and bearish (49%) market participants, meaning the overall sentiment is neutral. Speaking of the orders, there is also no gap between the buy (50%) and sell (50%) ones.

USD/JPY—the sky is the limit

“Dollar-yen looks to be on the verge of a breakout.”

- National Australia Bank (based on CNBC)

Pair’s Outlook

It look a little longer than initially expected, but the upward momentum is finally gaining traction. This is evidenced by a majority of the technical indicators on all time-frames giving ‘buy’ signals. Moreover, the scarcity of any notable resistances decreases a possibility of the pair making a sudden U-turn. The only serious obstacle USD/JPY has to face before testing the 2014 Q2 high is the monthly R1 at 103.54.

Traders’ Sentiment

Just as yesterday or five days ago, the sentiment in the SWFX market is strongly bullish with respect to USD/JPY—as many as 74% of open positions are long, leaving the bears in a distinct minority with only 26%.

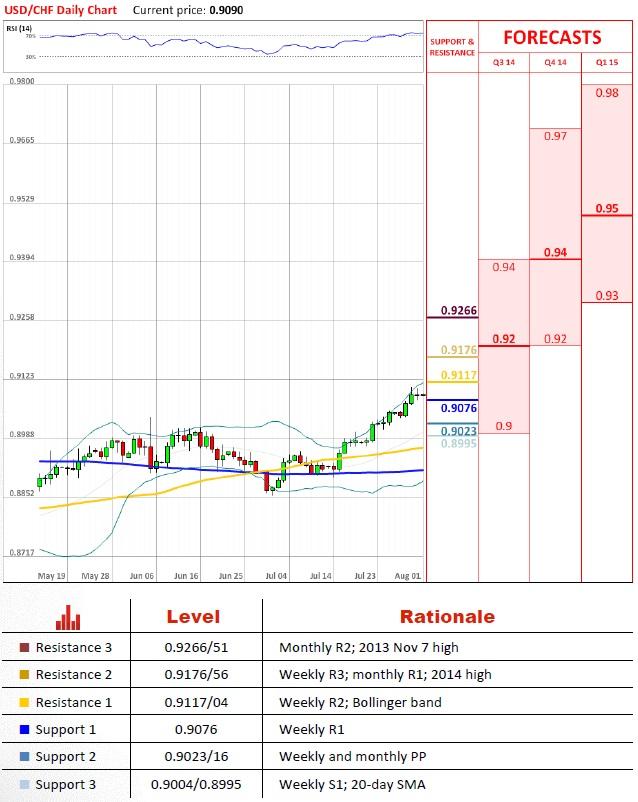

USD/CHF decelerates ahead of weekly R2

“We’ve had data confirming that the U.S. economy is a bit stronger than what everyone previously thought, and the Fed is slowly, slowly moving toward normalizing policy. The trend is for the dollar to move higher.”

- St. George Bank (based on Bloomberg)

Pair’s Outlook

USD/CHF took a break ahead of the weekly R2 and Bollinger band, but there should be no difficulties for the pair to reach the 2014 peak at 0.9156, as suggested by the daily and weekly studies. If we get to see trading taking place above this level, we will consider the 2013 Nov 7 high as the next target, but it must be noted that the monthly indicators are not in favour of a rally, except for the neutral ones most are pointing downwards.

Traders’ Sentiment

While there is a clear advantage in the number of longs (74% of the market), 50 pips from the spot a majority of the commands is to sell the U.S. Dollar against the Swiss Franc. Though 100 pips from the spot already 63% of the orders are to buy the Greenback.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.