Following a nearly flat price action for the past few days, there were some strong declines across the board as the US dollar strengthened. While gold prices fell sharply towards 1230 levels, EURUSD fell towards 1.1150 support. A reversal off the respective support levels could see the start of a near term pull back in prices.

EURUSD Daily Analysis

EURUSD (1.115): EURUSD declined to 1.1150 minor support yesterday posting a low at 1.1140. Price action is likely to see a short term reversal around the current levels to rally back towards 1.120. The untested resistance level which previously acted as support is like to be tested near 1.138 - 1.140 level if price action manages to hold out at the current support and breakout from the falling price channel. To the downside, below 1.1150, EURUSD could likely continue its declines towards 1.110.

USDJPY Daily Analysis

USDJPY (109.88): USDJPY is still consolidating within the 50 and 20 day EMA's on the daily chart with price action trading flat for the most part. However, multiple attempts to clear above 110.67 resistance is likely to see USDJPY pull back lower to 107.95 - 108.0 support levels. The 4-hour chart shows the USDJPY breaking out from the median line and bounce off the support at 109.73 - 109.35. Forming a lower high here, a break of the lower support could see a test to 108.

GBPUSD Daily Analysis

GBPUSD (1.46): GBPUSD reversed its declines yesterday to close back at 1.4635 resistance. A close above this resistance zone between 1.4743 - 1.4635 is needed for further upside. Support at 1.4425 remains in focus and could likely hold any further declines. On the 4-hour chart, price action has formed a lower high after testing 1.4635. A follow through from this resistance could see GBPUSD test the downside to 1.4312 - 1.430.

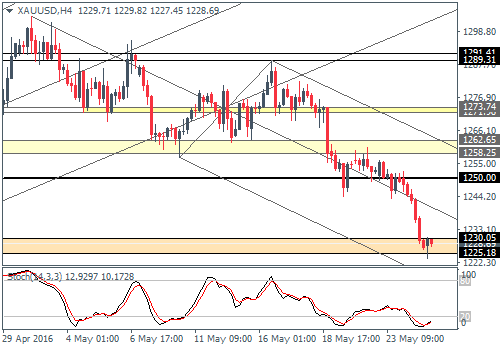

Gold Daily Analysis

XAUUSD (1228): Gold prices broke down strongly yesterday testing the 1230 support level. Further downside is likely to see gold prices test 1190 support. To the upside, any pull backs could see prices stalling near the 1264 - 1270 resistance. On the 4-hour chart, the support zone at 1230 - 1225 has been holding prices so a near term retracement is likely towards 1250.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.