| R3 | 1.0723 |

| R2 | 1.0698 |

| R1 | 1.0669 |

| Pivot | 1.0644 |

| S1 | 1.0616 |

| S2 | 1.0591 |

| S3 | 1.0563 |

EURUSD (1.06): EURUSD closed yesterday's session on a doji candlestick pattern indicating a potential move higher as long as the previous lows at 1.0592 is not breached. For the upside, a break above 1.0697 is needed in order for a test to 1.0825. On the 4-hour chart, with prices finding dynamic support on the minor falling trend line, the bias remains to the upside with 1.07 coming in as the initial support/resistance level in question. A break higher will pave way for a test to 1.0825 support to establish resistance.

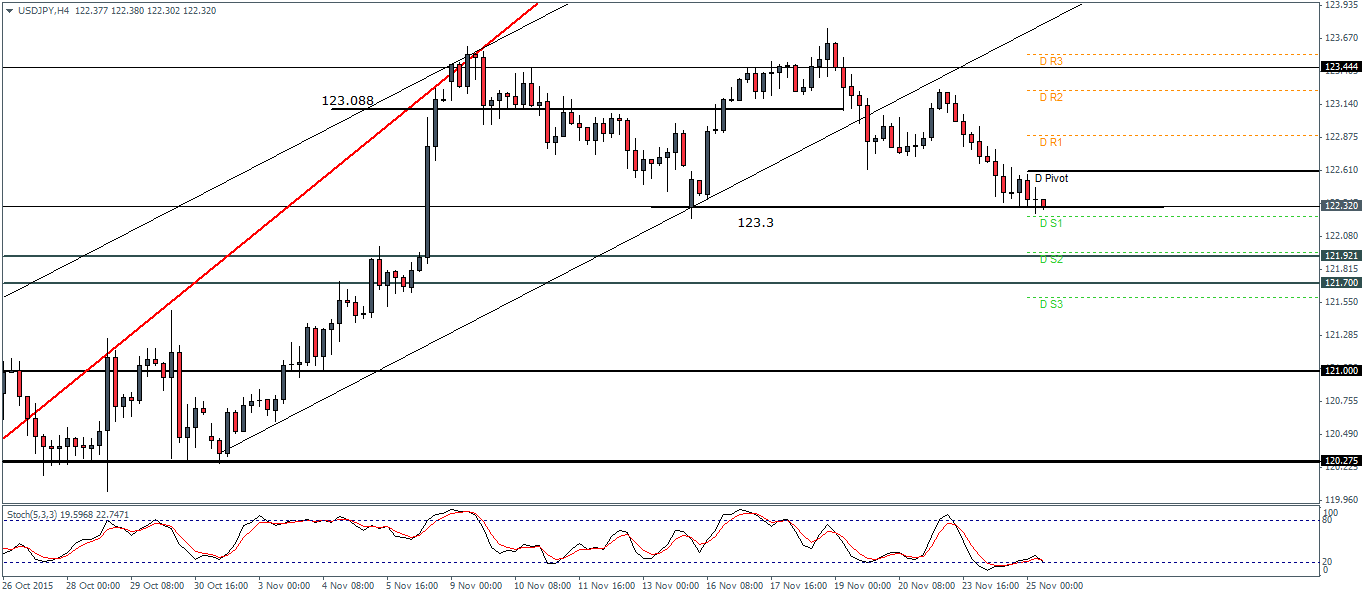

| R3 | 123.540 |

| R2 | 123.251 |

| R1 | 122.889 |

| Pivot | 122.600 |

| S1 | 122.238 |

| S2 | 121.949 |

| S3 | 121.587 |

USDJPY (122.3): USDJPY closed on a bearish note yesterday and the bull flag pattern looks to have been invalidated with prices trading below 122.595. USDJPY is currently testing the minor support at 123.3 on the 4-hour chart. If support fails, a decline to 121.921 looks evident. A modest rebound off 123.3 support could see prices recover back to 122.745, the previous short term pivot low that was formed. The bias in USDJPY remains to the downside, with the focus on 121.921 through 121.7 region of support. A break below could see a sharp decline to 121 support.

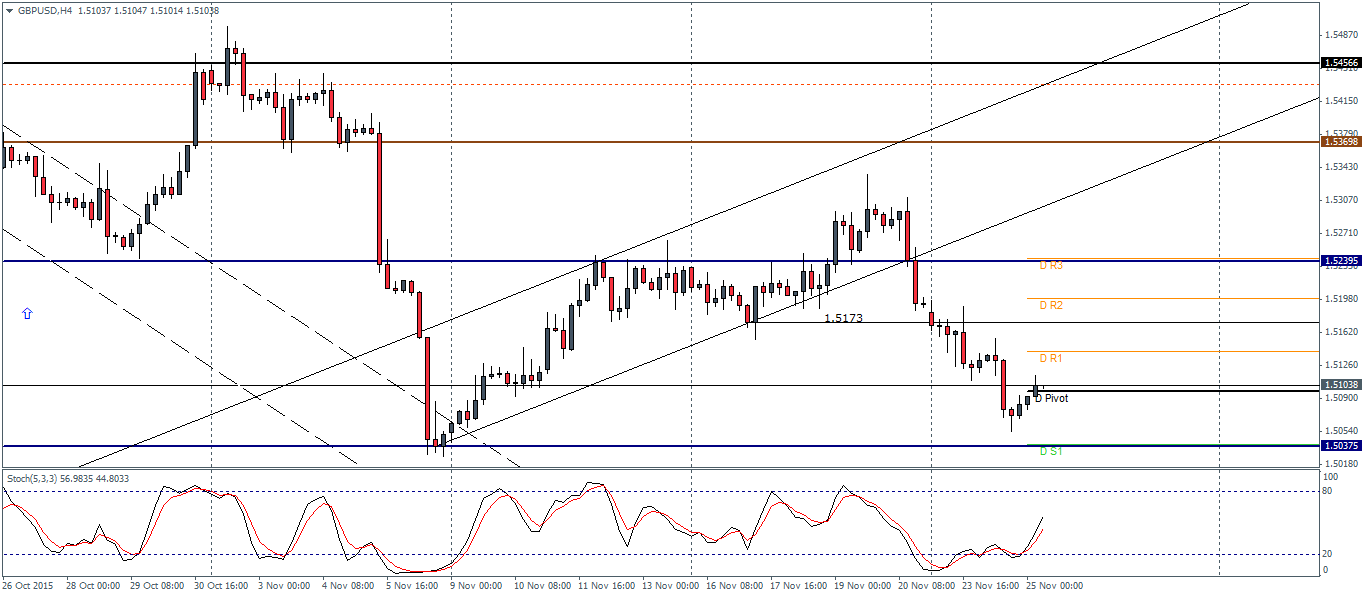

| R3 | 1.5242 |

| R2 | 1.5199 |

| R1 | 1.5140 |

| Pivot | 1.5097 |

| S1 | 1.5031 |

| S2 | 1.4995 |

| S3 | 1.4936 |

GBPUSD (1.51): GBPUSD declined yesterday as expected testing the lows of 1.509 region of support. Prices are currently bouncing off this support on the daily session and a retracement is likely in the near term. The breakout from the rising price channel 1.5239 saw prices dip to 1.505 before prices started to recover some of the losses. The failure to test the lower support at 1.5037 however indicates a retracement that could perhaps test back to 1.5239 break out level. To the downside, below the support at 1.50375, the next main support comes in at 1.50 followed by 1.4961 through 1.4942. The 4-hour Stochastics is printing a bullish divergence, which should see prices correct to 1.5173 at the very least.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.