Good morning from sunny Hamburg and welcome to our Daily FX Report. Yesterday in the World Cup semi final Germany demolished Brazil and won with 7-1. Germany will play either against Argentina or Netherlands, who face each other tomorrow. By the way Klose broke the goals record and becomes the tournament’s all time leading scorer with 16 goals. Former Brazil striker Ronaldo is the second best World Cup scorer with 15 goals.

However, we wish you a great trading day!

Market Review – Fundamental Perspective

Yesterday the Dow Jones Index of shares dropped 0.7 percent and the Standard & Poor’s Index also fell 0.7 percent. In addition global equity markets decreased on Tuesday while media prospects that the European Central Bank will probably not launch an asset-purchase program. On Monday ECB Executive Board member Sabine Lautenschlaeger, who is against a program of asset purchases, said this should be a last resort. Furthermore data showed yesterday that imports and exports in Germany, Europes largest economy, tumbled more than estimated. Exports fell 1.1 percent in May and imports weakened by 3.4 percent in May. The EUR/USD was at 1.3610 and the EUR bought 138.18 JPY. The USD depreciated 0.3 percent to 101.51 JPY. The next major focus for the market will be the release of minutes today from the U.S. Federal Reserve’s June meeting, which will be scoured for sings of when central bank members see an interest rate increase as likely. On Tuesday Minneapolis Fed President said that he welcomed the recent decrease in U.S. unemployment but also warned the labor market has still a long way to go until U.S. central bank has reached its goal on unemployment.

Yesterday a report showed that U.K. factory output dropped 1.3 percent in May from the previous month, the biggest drop since January 2013. The market estimated a rose of 0.4 percent. Nevertheless the GBP was nearly unchanged versus the EUR as investors overlooked this bad data. Furthermore the National Institute of Economic and Social Research said yesterday that the U.K. economy strengthened at a faster speed in the three months through June. The EUR/GBP was at 0.7945, after it had touched yesterday 0.7915 which was the strongest level since September 2012. The GBP/USD traded at 1.7133.

Daily Technical Analysis

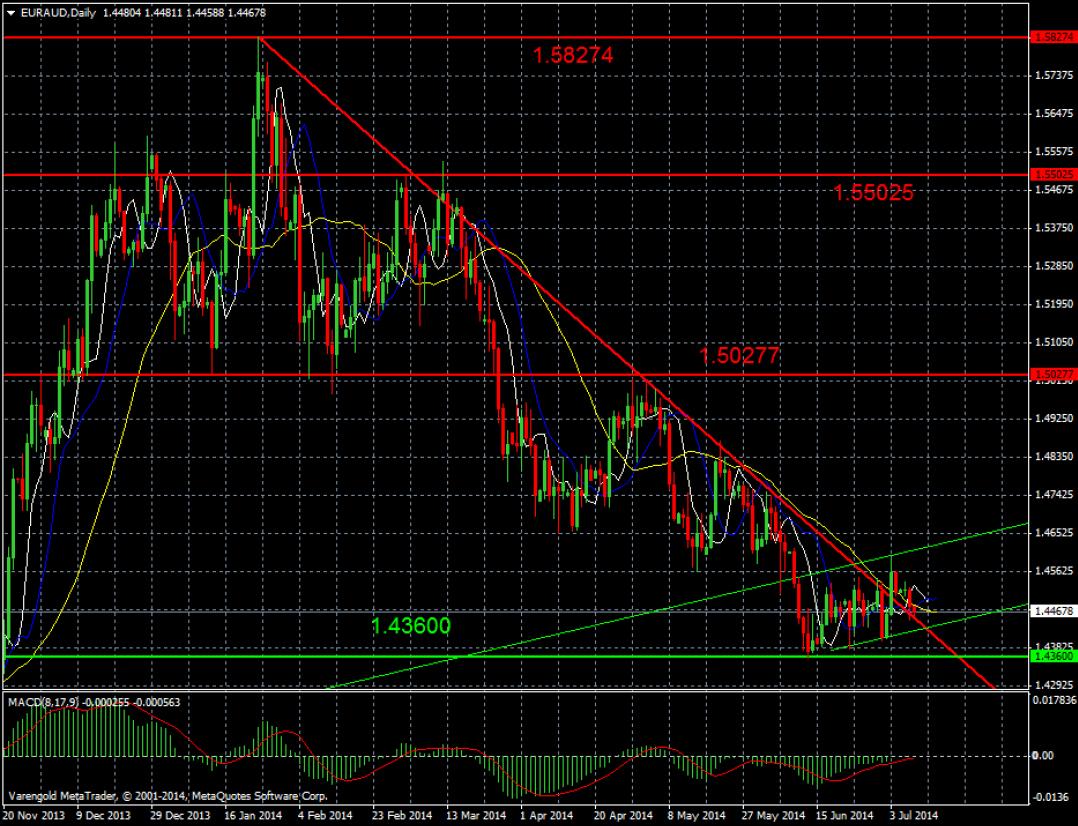

EUR/AUD (Daily)

As you can see the currency pair had formed a head and shoulders pattern and left it by starting a bearish trend at the end of March along a downward trend line. At the support level around 1.4360 it found support and started to trade inside a bullish trend channel. The bullish MACD supports a trend reversal.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.