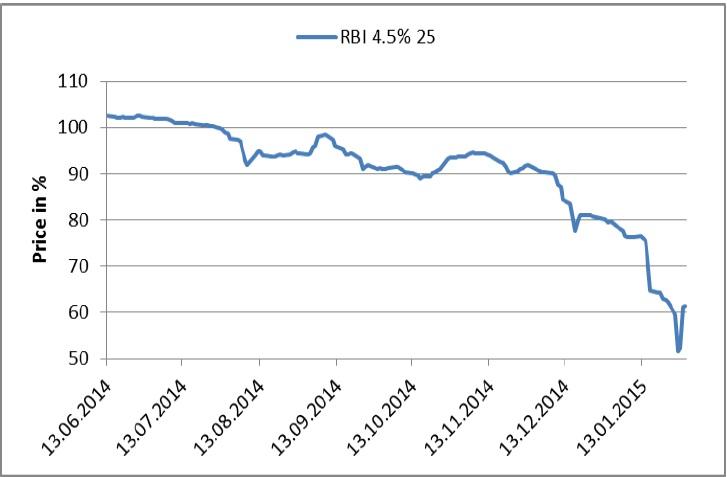

Chart of the Day:

Raiffeisen Bank International Subordinated Debt: Finally, some respite for RBI. The price of sub debt was in freefall as speculation rose that coupon payments would be blocked by regulators. Yesterday’s ad hoc statement gave investors some hope that would not be the case. The board also announced that a divestment programme would supplant any need to raise additional capital.

Analysts’ View:

HR Macro: December industrial production brought a positive surprise, with robust 5.3% y/y growth above both our and market expectations (2.5% and 3%, respectively). While the monthly data revealed a marginal decline of 0.2% (s.a.), strong production in the intermediate goods sector pushed the headline figure into the black y/y. The December output data also displayed the strongest YTD performance in 2014, which concluded a cumulative 2014 industrial rebound of 1.3% y/y. As for the prospective 2015 performance potential, we see a low base effect and external impulses supporting production , balancing out weak domestic demand which is clearly putting downside pressure on the recovery profile. As for our capital market forecasts, we expect them to remain unaffected by this release.

Traders’ Comments:

CEE Fixed income: A meeting between Greek Prime Minister, Alexis Tsipras, and EU Parliament President, Martin Schulz, was conciliatory rather than antagonizing and markets preferred to focus on the positives amid very mixed signals from the Greek government. The jury is out about how things on the debt restructuring front will develop in Greece but in our region debt restructuring is already very real in Ukraine and Belarus. In spite of this, CEE fixed income had a calm day with a bit more two-way flow and both the HUF and PLN gained as tensions eased a little. For the moment, price movements in secondary bond markets can broadly be summed up as directionless but primary markets are still heading in one direction only. Erste Group Bank priced EUR 500 m in 10Y covered bonds at MS +6 bps, down from IPT of +10 bps.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.