Daily Forecast - 07 January 2016

WTI Crude February contract

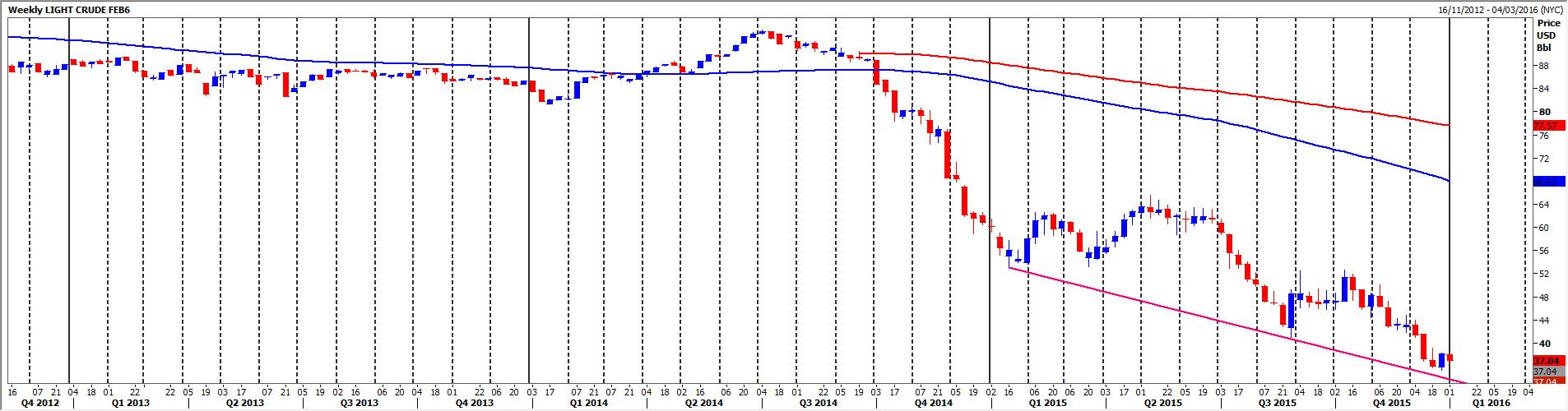

WTI Crude lower as expected & breaking February contract lows was not a surprise. Important trend line support at 3405/00 was tested & although we over ran it was only as far as 3377. For the first time in as long as I can remember I am almost tempted to start thinking about longs in oil. Why? 1. We held December lows. 2. We held important 9 month trend line support. 3. We are fairly close to 2009 lows at 3270/3240. We are watching carefully for a positive signal now. Until then, first resistance at 3450/55 today then stronger resistance at 3490/99. Shorts need stops above 3520. A break higher targets 3540 then resistance at 3560/70. A good chance of a high for the day but shorts need stops above 3595.

The 3400/3380 area is very important support. Longs need wide stops below 3355. Further losses could target the important 2009 lows at 3270/3240. Bulls must go all out to defend this support or we could see prices sub 3000 before long.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.