ADP Consideration

According to figures by payroll processor ADP, employment grew again in the month of January, to the tune of 192,000. The headline figure was slightly above estimates of a 175,000 monthly addition by market analysts. Report details show major and optimistic gains as small and medium size businesses continued to hire in the first month of the year. Small businesses added 115,000 jobs to the economy while medium sized firms took on 79,000. Larger firms, by comparison, actually cut jobs – releasing 2,000 positions.

Once again the services sector bolstered a majority of the gains, with additions to construction and production crews supporting a positive tidbit on the month. Unfortunately, manufacturing continued to shed positions – losing 3,000 jobs.

All in all, a good report, the ADP survey lends to speculation that jobless claims should be lower than the anticipated 362,000, and also allude to a better than expected non-farm payrolls figure. Currently, estimates for the BLS report are for a 161,000 print.

Seasonal Calculation

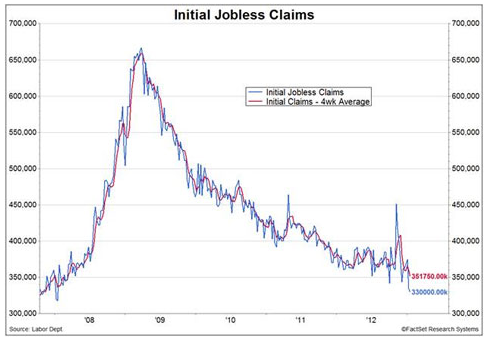

An additional consideration, heading into the jobless claims release, is the fact that many economists remain fixated on the report’s calculation as last week’s jobless claims fell to a five year low – a weekly 330,000. The steep decline in jobless claims, which fell from an earlier 371,000 two weeks prior, seems likely attributed to calculations that simply don’t take into account the holiday season and cyclical fluctuations.

As a result, a rise in the amount of claims may not spark any type of meaningful bearish sentiment surrounding the US economy.

What to Expect

At or Below 362,000. A bullish scenario, a below 362,000 figure would spark notions of stability in the US labor market, which in turn would spur consumer spending down the road – or higher US growth. This essentially would negate any notion of a calculative difference in the report and remain US Dollar bullish.

Above 362,000. Although alternatively bearish, an above 362,000 print may not be so bad. For the most part, the figure would be a normalization of the jobless claims figure – only confirming that last week’s release would have been an unadjusted slip up. Nonetheless, any bearish notions shouldn’t kick in until well above 380,000 – against an adjusted average of 370,000 for weekly claims.

Source: US Labor Department, FactSet

Source: US Labor Department, FactSet

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.