Good Morning Traders,

As of this writing 4:10 AM EST, here’s what we see:

US Dollar: Up at 93.835 the US Dollar is up 479 ticks and trading at 93.835.

Energies: October Crude is up at 39.00.

Financials: The Sept 30 year bond is down 53 ticks and trading at 159.07.

Indices: The Sept S&P 500 emini ES contract is up 223 ticks and trading at 1927.00.

Gold: The October gold contract is trading down at 1148.70. Gold is 44 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and oil is up+ which is not normal but the 30 year bond is trading lower. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading up which is not correlated. Gold is trading down which is correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mixed with about half the exchanges lower and the other half higher. As of this writing all of Europe is trading higher.

Possible Challenges To Traders Today

- HPI is out at 9 AM EST. This is major.

- S&P/CS Composite-20 HPI y/y is out at 9 AM EST. This is major.

- Flash Services PMI is out at 9:45 AM EST. This is major.

- CB Consumer Confidence is out at 10 AM EST. This is major.

- New Home Sales is out at 10 AM EST. This is major.

- Richmond Manufacturing Index is out at 10 AM EST. This is major.

Currencies

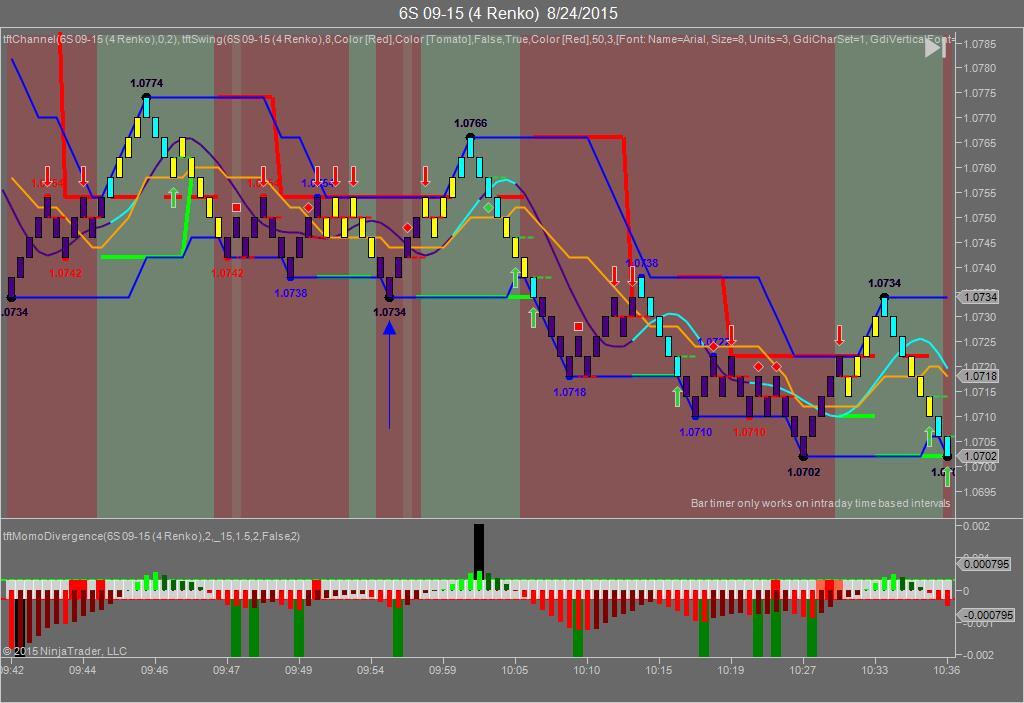

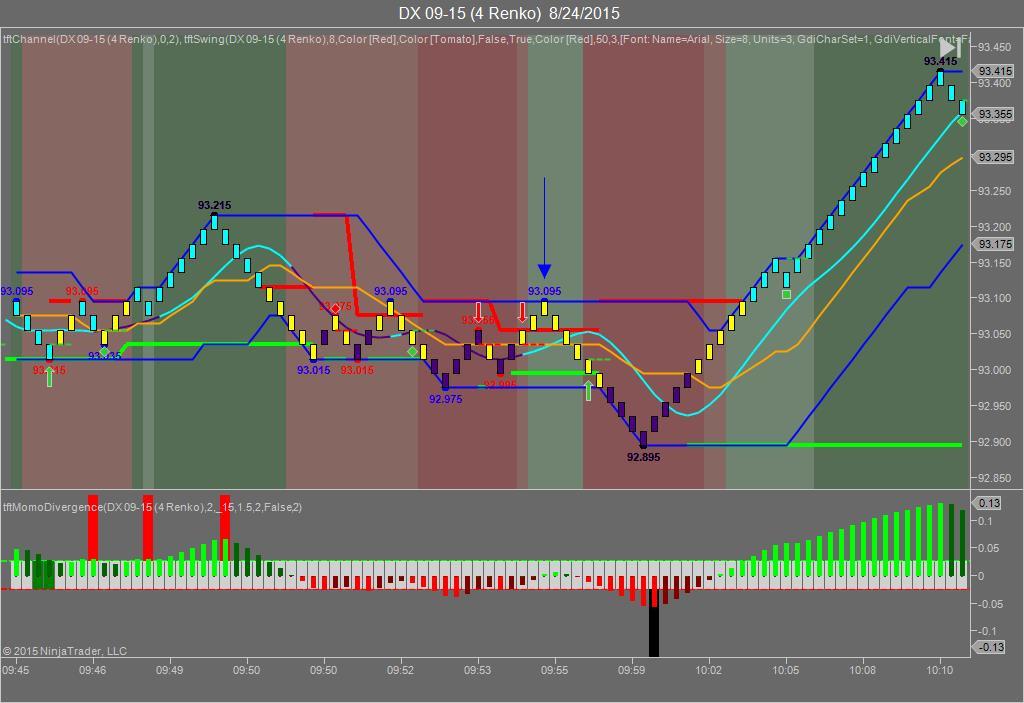

Yesterday the Swiss Franc made it’s move around 9:55 AM EST with no economic news in sight. The USD hit a high at around that time and the Swiss Franc hit a low If you look at the charts below the USD gave a signal at around 9:55 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at around 9:55 AM EST and the Swiss Franc hit a low. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 20 plus ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the downside and unfortunately we were right as the Dow lost 589 points and the other indices fell as well. Today we aren’t dealing with a correlated market however our bias is to the upside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

I grew up with guys whose names were Bruno, Marcello, Fabrizio and no they weren’t Italian-American as they weren’t born in the United States but rather came from the mother country in Europe. I hung out with them because I’m 1st generation in the United States and my father was born in the mother country. Needless to say August 24th is an informal day of remembrance in Italy as that was the day that Mt Vesuvius erupted and destroyed the city of Pompeii. So now we have a market that not erupting to the upside but is being buried in fear and misinformation. Within 6 minutes of its open yesterday the Dow dropped over 1,000 points and of course regained some of it during the session but in two trading days the Dow dropped over 1,000 points. We haven’t witnessed anything like this since 2008 and it’s all being driven by fear. Fear that the Fed may hike prematurely, fear that China is slowing down and therefore the global market must be slowing. Let’s put that to bed right now. China may be slowing. Why? Many manufacturers have come to realize that making goods in China may have been wise in 2008 but Chinese quality has a long way to go to be competitive with Japan or Korea. Many of those firms have brought back their manufacturing. The Fed raising rates prematurely is a real concern but we’re not clear that they will do so as Barclays Capital has stated yesterday that in their estimation the 1st rate hike should be March, 2016. Whether this happens is yet to be seen but we’ll provide the insight as best we can.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.