Good Morning Traders,

As of this writing 4:20 AM EST, here’s what we see:

US Dollar: Down at 97.330 the US Dollar is down 109 ticks and trading at 97.330.

Energies: September Crude is down at 46.59.

Financials: The Sept 30 year bond is up 12 ticks and trading at 156.10.

Indices: The Sept S&P 500 emini ES contract is up 4 ticks and trading at 2099.50.

Gold: The August gold contract is trading down at 1092.90 Gold is 20 ticks lower than its close.

Initial Conclusion

This is not a correlated market. The dollar is down- and oil is down- which is not normal but the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are up and Crude is trading down which is correlated. Gold is trading down which is not correlated with the US dollar trading down. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly lower with the exception of the Indian Sensex exchange which traded higher. As of this writing Europe is trading mixed with half the exchanges higher and the other half lower.

Possible Challenges To Traders Today

- Core PCE Price Index m/m is out at 8:30 AM EST. This is not major.

- Personal Spending m/m is out at 8:30 AM EST. This is not major.

- Personal Income m/m is out at 8:30 AM EST. This is not major.

- Final Manufacturing PMI is out at 9:45 AM EST. This is not major.

- ISM Manufacturing PMI is out at 10 AM EST. This is major.

- Construction Spending m/m is out at 10 AM EST. This is major.

- ISM Manufacturing Prices is out at 10 AM EST. This is major.

- FOMC Member Powell Speaks at 10:50 AM EST. This is major.

- Total Vehicle Sales – All Day, this is major.

Currencies

On Friday the Swiss Franc made it’s move around 10 AM EST after the economic news was reported. The USD hit a low at around that time and the Swiss Franc hit a high If you look at the charts below the USD gave a signal at around 10 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at around 10 AM EST and the Swiss Franc hit a high. These charts represent the latest version of Trend Following Trades and I’ve changed the timeframe to a Renko chart to display better. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted about 20 ticks on this trade. We added a Donchian Channel to the charts to show the signals more clearly. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

On Friday we said our bias was neutral as we didn’t see follow thru on the indices Friday morning. The Dow dropped 56 points and the other indices lost ground as well although not by much. (note: Subscribers kindly check our Market Bias video for an explanation). Today we aren’t dealing with a correlated market and will maintain our neutral bias.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Well another month in the summer goes by and quite frankly we didn’t see much out of this market, this month. Alot of it has to do with the Fed fear in terms of hiking rates but some of it has to do with the time of year that it is and let’s not forget the Greek crisis that threw the market into a tailspin.

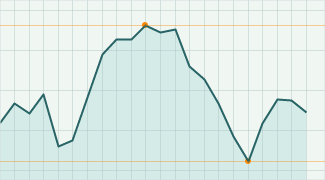

The above chart shows the DJIA for the month of July, 2015. The Dow hit a high of 18,100 on July 16th but then immediately dropped about 700 points and then meander slowly upward. The Dow did post a slight gain for the month but it wasn’t by much and certainly didn’t jolt the markets upwards. Will we see a better August? Only time will tell….

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.