If you’re a comdoll trader like Happy Pip, then you’d be interested to check out this rundown of events that pushed Aussie and Kiwi pairs around for the past 12 months:

1. Rate hike expectations

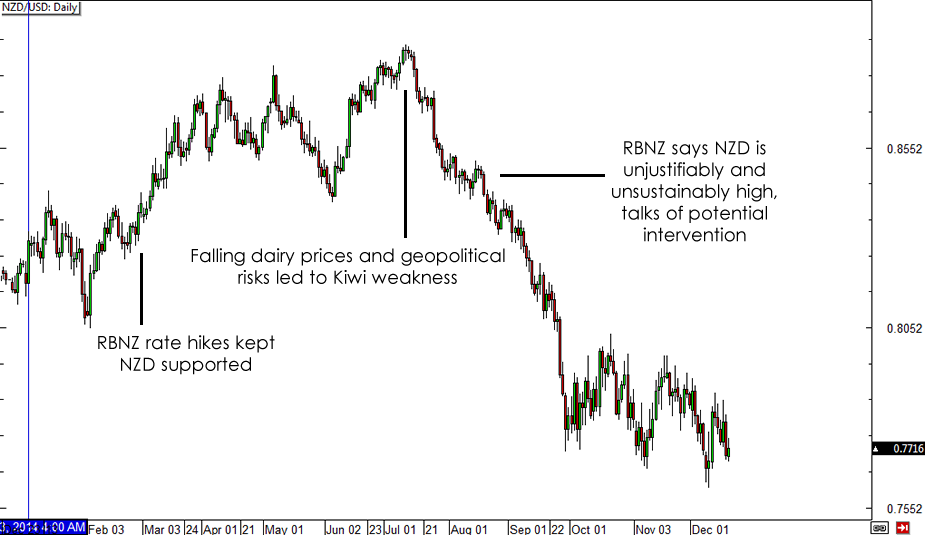

The Kiwi started the year on an upbeat note, as the RBNZ had a rate hike spree for four consecutive monetary policy decisions starting in March. At that time, the New Zealand economy was performing amazingly well, allowing the central bank to bring interest rates up from 2.50% all the way up to 3.50%.

As for the RBA, the announcement that policymakers weren’t looking to cut interest rates anytime soon was also enough to keep the Aussie supported early in the year. However, this language shifted to a more cautious tone later on, as Stevens and his men clarified that they’re not looking to hike rates soon either, emphasizing that a period of stability in interest rates is warranted.

2. Falling commodity prices

As they year dragged along, forex market watchers became increasingly concerned about the potential impact of falling dairy prices on the New Zealand economy. In fact, the downturn started in February and carried on for months, prompting Fonterra to cut its milk payout forecasts for farmers and suppliers.

Gold and other commodities also sank, as price pressures weakened across most economies. Towards the end of the year, gold prices suffered a sharper selloff, as the referendum on the Swiss gold initiative indicated that the SNB no longer needs to purchase huge amounts of gold bars to meet the proposed 20% holdings requirement. These contributed to AUD/USD’s slow grind lower during the latter half of the year.

3. Central bank jawboning

Deflation became a global concern sometime in Q3, prompting central bank officials to engage in currency wars. While some major central banks resorted to monetary policy easing partly to keep their respective currencies weak, the RBA and the RBNZ stuck mostly to jawboning.

In most of the RBA statements, Stevens repeated that the Australian dollar is trading at historically high levels that do not reflect fundamentals. This kept the Aussie’s gains in check, as forex traders were wary of central bank intervention. In fact, the RBNZ did stage another secret intervention in August to prevent the New Zealand from rallying too much.

4. China’s economic performance

Apart from affecting overall market sentiment, China’s economic performance played a key role in dictating Aussie and Kiwi trends. After all, Australia and New Zealand are export-driven economies relying mostly on commodity shipments to China, the world’s second largest economy.

Speculations of an ongoing slowdown in China, spurred by weakening manufacturing PMI readings, led to downgraded trade estimates for Australia. While Chinese officials claimed that this was the “new normal” in the Chinese economy, the PBoC’s surprise easing announcement in November confirmed that policymakers are getting worried about the fate of their economy.

Now here are the charts to show how these events sparked strong trends for AUD/USD and NZD/USD. Did you catch any of these big moves?

Moving forward, these market factors might continue to impact Aussie and Kiwi movements early next year, as the economic landscape hasn’t changed that much. Monetary policy biases, commodity prices, and Chinese economic performance could spur extended trends in the next few months so make sure you keep tabs on these!

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.