Looks like the pound’s glory days are over! After its steady climb since the start of the year, the U.K. currency has been having trouble sustaining its gains and here are three reasons why it could be in for more selling.

1. Weakening economic data

As I’ve discussed in my latest economic data roundup on the United Kingdom, consumer spending and housing reports are no longer as rosy as they used to be. For one, slow wage growth appears to be weighing on consumers’ spending habits as the rise in salaries can’t keep up with rising price levels. Meanwhile, the recovery in the housing sector appears to have hit a few road bumps, with falling mortgage approvals and home prices.

Even the manufacturing sector is reflecting signs of a slowdown, as the latest industry PMI fell from 57.2 to 55.4 instead of holding steady as expected. The construction sector isn’t faring so well either, as the PMI dipped from 62.6 to 62.4 in July.

2. Potential shift in BOE stance

With that, the BOE might decide to switch to a more dovish stance in their upcoming interest rate statement. The minutes of their previous monetary policy meeting already indicated that some policymakers are having doubts that the U.K. economy can sustain its strong pace of growth.

Governor Mark Carney himself acknowledged that the outlook for both the global and local economies has been less upbeat. Policymakers zoomed in on the weakness in wage growth as a potential drag to overall economic activity later on.

3. Technicals suggest a reversal

A quick look at the pound charts also suggests that the rallies are about to turn. As Big Pippin pointed out in today’s Daily Chart Art, GBP/USD has broken below an ascending trend line that has been holding since the start of the year.

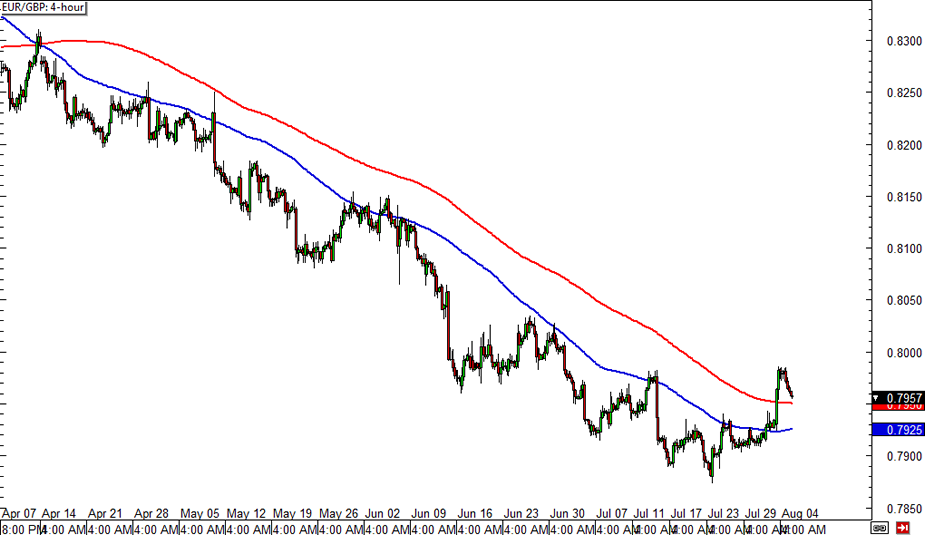

EUR/GBP 4-hour Forex Chart

Even EUR/GBP has made a significant breakout, as price surged past the 100 SMA recently. As you can see from the chart above, this moving average has been holding as a dynamic resistance level for the pair since April.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.