A few months back, I gave y’all a snapshot of how manufacturing conditions are faring among global economies. It’s about time we take a look at an updated one!

For the newbies just tuning in though, here’s a quick review of what a manufacturing PMI is all about and why it matters. A purchasing managers index(PMI) report is simply a measure of business conditions in an industry taken some time in the middle of the month. In a manufacturing PMI report, a few hundred purchasing managers from the manufacturing industry are asked about their opinions on issues such as employment, inventory levels, new orders, and state of production and supplier deliveries.

An index reading of 50.0 and above hints at optimism among the manufacturers, which could lead to industry expansion. Consequently, a reading of 49.9 and below denotes pessimism and a possible contraction in the manufacturing sector.

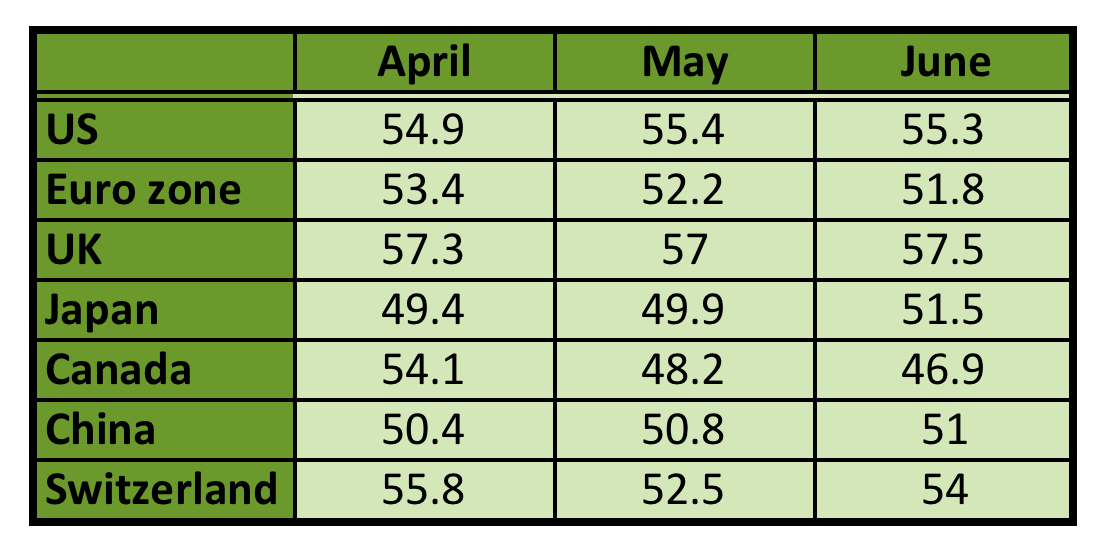

Here’s how manufacturing PMI readings turned out for most major economies in the past few months:

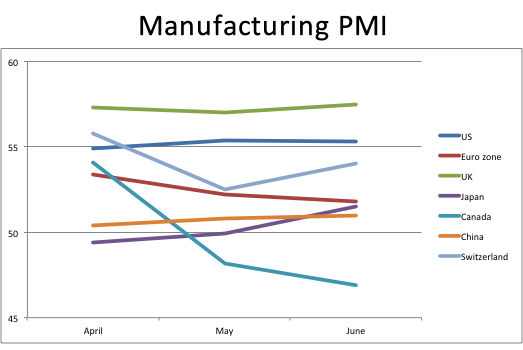

Not a fan of the table format? Here’s a line graph that might help you make better comparisons among the major economies:

As you can see, Canada’s manufacturing sector seems to have fared the worst in the past three months while the euro zone is also seeing a slowdown. Japan has marked a steady improvement in the industry despite the recent sales tax hike while China is also chalking up a recovery.

Meanwhile, the U.K.’s manufacturing sector is a cut above the rest as it has consistently shown strong expansion since April. Manufacturing conditions in the U.S. also appear to be stable.

With developments in the manufacturing sector playing a key role in supporting overall economic activity, it’s no surprise that central bank officials take these PMI into consideration when making policy decisions. Do you think these manufacturing readings are an omen of future price action?

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.