Currencies

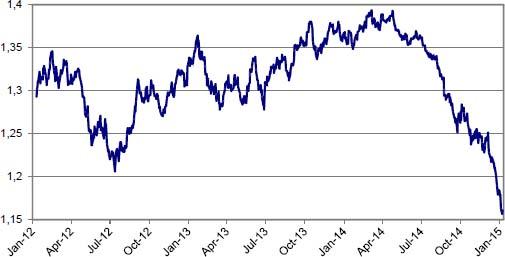

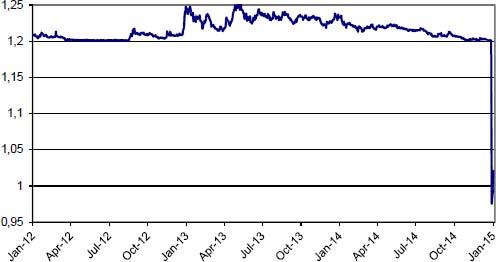

EUR/USD

The EUR/USD decline accelerated as the Fed maintains its intention to raise rates in 2015 while the ECB is very close to QE. The SNB decision to give up the CHF cap flooded the market with excess euro’s.

EUR/GBP

Sterling traded weak in the last quarter of 2014 as markets doubted the BoE’s commitment to raise rates soon. Global euro weakness finally forced the break below 0.7755.

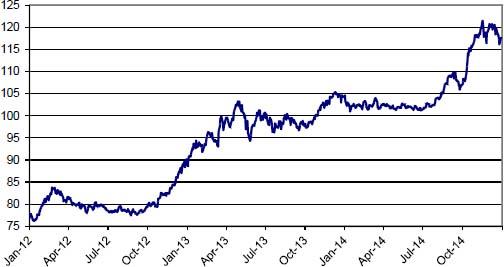

USD/JPY

The USD/JPY rally ran into resistance as low core bond yields and rising volatility restored the balance between the dollar and the yen in favour of the latter. However, the key 115.57 level remains intact.

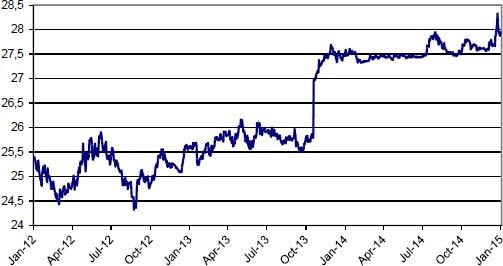

EUR/CZK

Czech koruna weakened in early January as markets speculated that low inflation could inspire the CNB to raise the EUR/CZK floor. Volatility after the SNB decision eased this speculation.

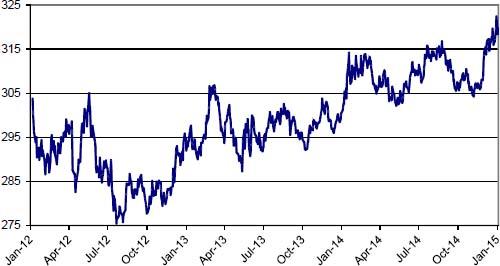

EUR/HUF

Raising global volatility and the CHF decoupling weighted temporary on the forint. The losses were however temporary and limited.

EUR/CHF

The Swiss franc jumped more than 20% higher against the euro as the SNB had to give up the EUR/CHF cap on the franc. The Swiss currency is looking for a new equilibrium.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.