I remain in “awe” of China-loving proponents who believe the Yuan will soon supplant the US dollar as the world’s reserve currency on the way to becoming the world’s top economic power.

By soon I mean a “decade” or less. It’s not going to happen.

Centrally planned bogus economies, with tiny illiquid bond markets, huge capital controls, pegged currencies, and no freedom of speech are no way suitable for such lofty expectations.

One can make such comments here, in China, you are in trouble.

Please consider China Presses Economists to Brighten Their Outlooks.

Securities regulators, media censors and other government officials have issued verbal warnings to commentators whose public remarks on the economy are out of step with the government’s upbeat statements, according to government officials and economic commentators with knowledge of the matter.

Lin Caiyi, chief economist at Guotai Junan Securities Co. who has been outspoken about rising corporate debt, a glut of housing and the weakening Chinese currency, received a warning in recent weeks, these people said. It was her second. The first came from the securities regulator, and the later one, these people said, from her state-owned firm’s compliance department, which instructed her to avoid making “overly bearish” remarks about the economy, particularly the currency.

At least one Chinese think tank, meanwhile, was told by propaganda officials not to cast doubt on a planned government program to help state companies reduce debt.

Gao Shanwen, chief economist at brokerage Essence Securities Co., told investors that “a lot of the official data aren’t reliable” and the economy still faces “big problems,” according to people who attended the closed-door event.

Words of those remarks crackled across social media. Two days later, Mr. Gao issued a clarification on his public account in the popular Chinese messaging app, WeChat, saying those remarks were “made up.” He then released a report on the economy shorn of critical commentary. Mr. Gao and representatives at his firm didn’t return requests for comment.

While restrictions on foreign media have always been tight, they are becoming tighter, with a growing list of foreign publications having their websites blocked from view within China, including The Wall Street Journal.

Blocked Sites

I am proud to be in the list of blocked sites (Global Economic Analysis was – not sure if MishTalk is yet).

If I am not blocked yet, but this post is sure to do it.

China vs. US

-

Despite all the anti-US rhetoric, the US has the only bond market in the world large enough to be the world’s reserve currency.

-

Unlike China the US floats its currency. China has a peg. It’s ridiculous to believe a pegged currency will rein supreme.

-

The US has freedom of speech, China doesn’t.

-

The US does not have capital controls, China does.

-

The US is the global leader in innovation, China isn’t.

-

The US is not led by a group of central planners that determine output, although the Fed and the Bank of China (central banks in general) are central planners when it comes to currencies, interest rates, and indirect attempts to influence output.

The only point that may change anytime soon is point number 2. Point number 1 in isolation kills the entire idea.

Economically and politically China is a joke compared to the US.

Headed for Serious Trouble

I am not sure how many warnings you get ion China but I strongly suspect two is max.

Can you spot the two in serious trouble?

Gao gets a reprieve. He denies saying what he said.

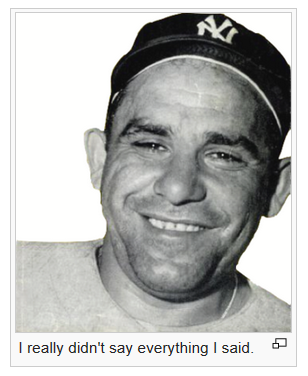

It worked for baseball legend Yogi Berra who said “I really didn’t say everything I said”.

Somehow, I doubt that defense works in China more than once.

Impossible to Suppress the News

It is beyond stupid to think one can suppress the news and achieve positive results doing so.

The news either gets out anyway, or people become so fearful of the lies and distortions they believe things are even worse than they really are.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.