Countdown to Liftoff:

Although the Federal Reserve didn’t give a clear signal on the timing of liftoff, the rhetoric of improving housing and labour markets shows that the countdown has at least begun.

Fed officials have indicated that a September rate hike is now a real possibility after citing that the economy has overcome its first quarter slowdown and despite external factors and energy market worries, that the economy has actually expanded moderately.

Here are a couple of key quotes indicating that confidence in the labour market is improving:

“On balance, a range of labor market indicators suggest that underutilization of labor resources has diminished since early this year.”

“The labour market continued to improve, with solid job gains and declining unemployment.”

This definitely indicates an improved outlook on the economy from the Fed, with last month’s statement saying that ‘some slack still remained’ in the labour market.

“Need to see “some” more improvement in the labor market.”

As always, it’s the little things that have a huge impact on traders mindsets. In today’s statement, by adding the word ‘some’, markets are interpreting the hurdle to a September rate hike as being lowered.

10… 9…. 8….

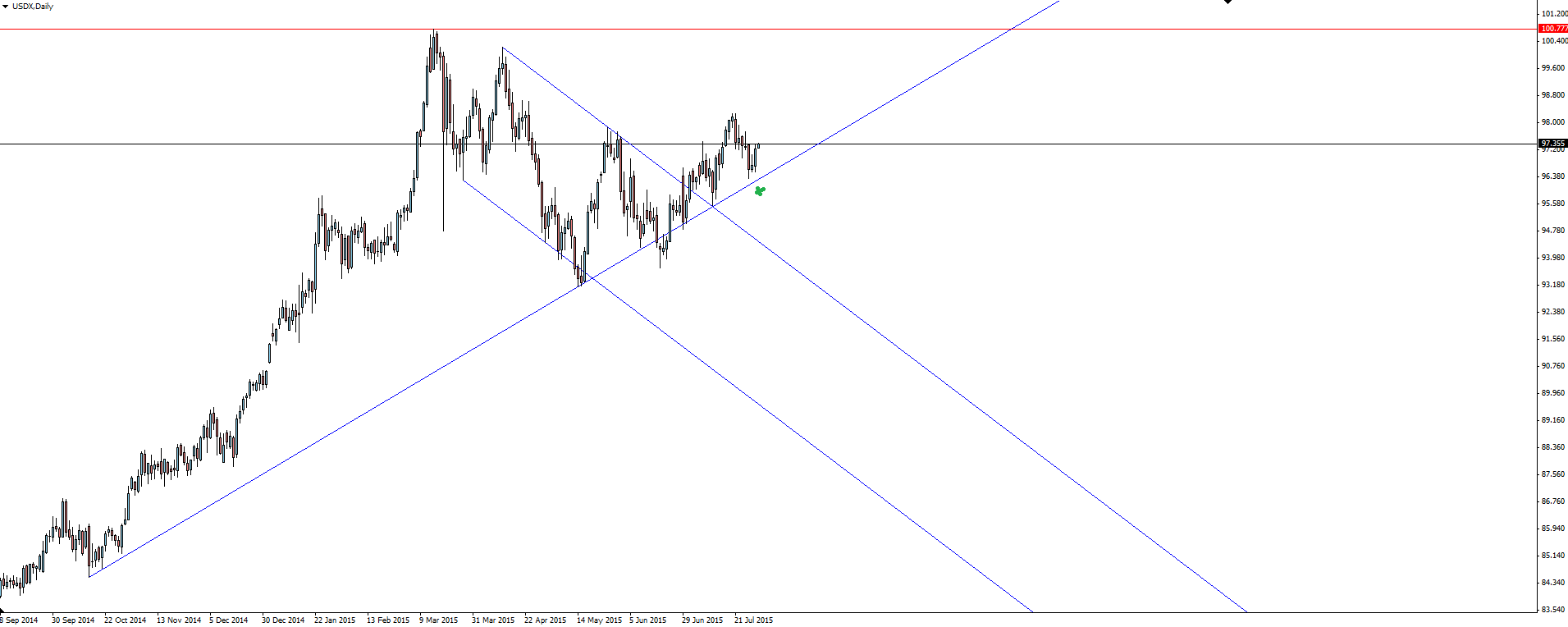

USDX Daily:

The US Dollar Index rallied on the release, pushing out of trend line support and targeting new highs.

On the Calendar Thursday:

AUD RBA Gov Stevens Speaks

AUD Building Approvals

USD Advance GDP

USD Goods Trade Balance

USD Unemployment Claims

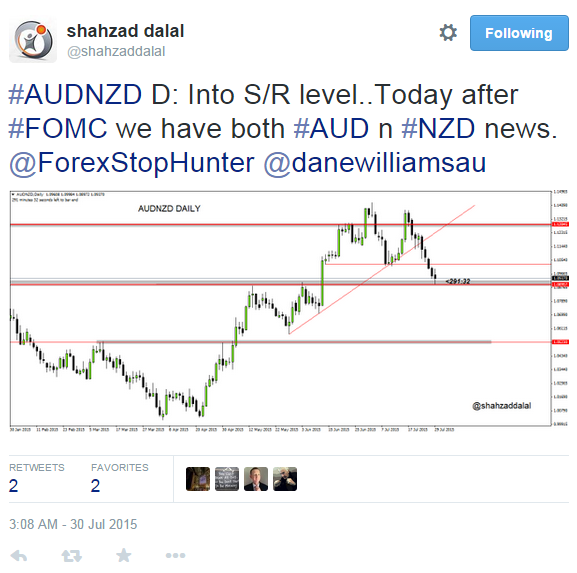

Chart of the Day:

With FOMC now in the rear view mirror, we this morning turn our attention to AUD/NZD and this chart from @shahzaddalal on Twitter shows the zone of interest perfectly.

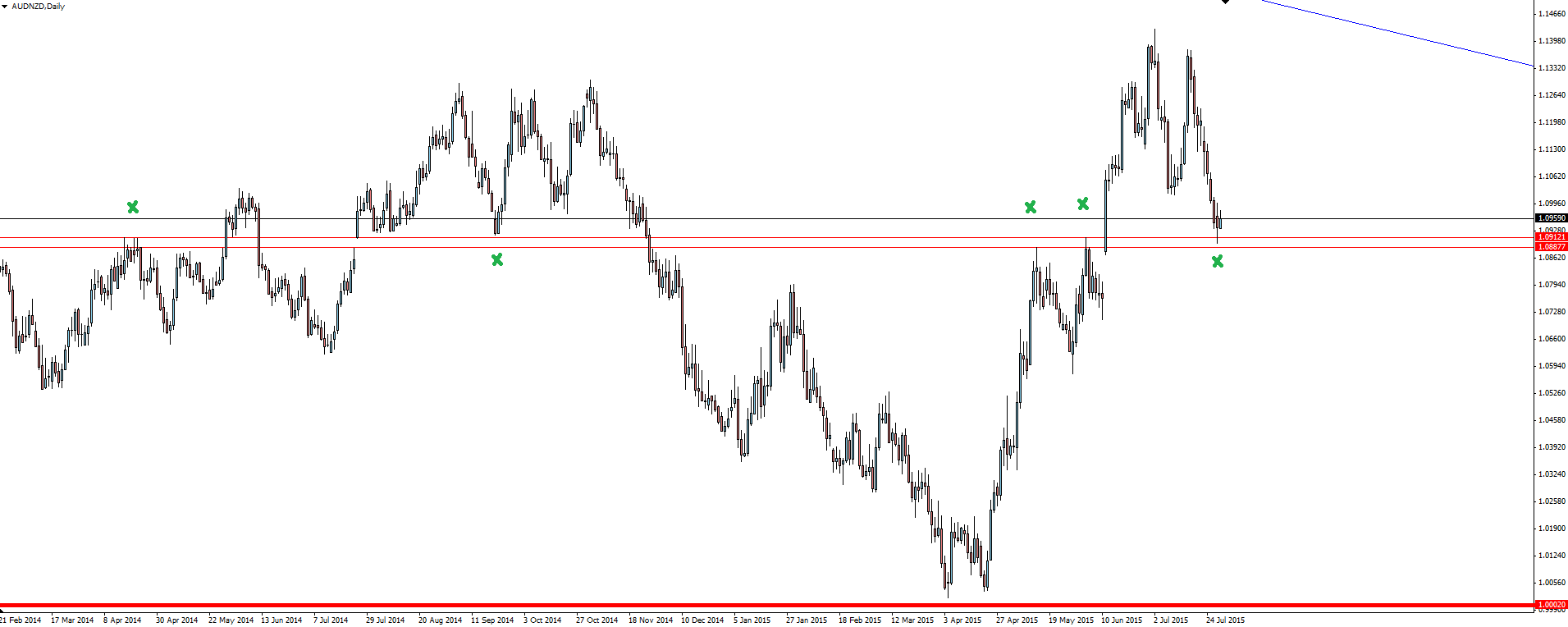

With the overall trend strongly bearish, the level I’ve highlight on the weekly chart shows price retesting broken support now as resistance. This is normal trend resumption price behaviour. The long term trend line resistance also gives extra insurance to a bearish trend trade.

AUD/NZD Weekly:

However, the daily chart that Shahzad posted above, shows price hitting an important short term support/resistance level that has been tested and retested on multiple occasions over the last couple of years.

AUD/NZD Daily:

Trading from the bottom side of this level is obviously the safer trade but with yesterday’s daily candle providing a long wick into the zone and then bouncing today, an argument could easily be made to trade the opposite direction.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.