#This Is A Coup:

It’s worth taking a look at the latest trending hashtag on Twitter. I’ll leave you to explore the #ThisIsACoup theme yourself, but it is a prime example of the idealistic risks that arise from oppressing a nation or group the way that capital controls and austerity does.

Nobody wants another North Korea in the middle of Europe.

Syriza Government Buckling:

It’s not only a growing budget deficit that Greece is facing, but now also an ever increasing deficit of a much more important currency; Trust. As German Chancellor Angela Merkel goes on to say:

“The most important currency has been lost and that is trust.”

“That means that we will have tough discussions and there will be no agreement at any price.”

By refusing the first bailout package from creditors and calling a referendum, Tsipras and his Syriza Government last week basically made an all or nothing bet in hope of trying to bluff Europe into buckling. It now would seem that the Greek hand wasn’t as strong as Tsipras had hoped and with Europe not moving, looks as though they will be forced to accept the original package no matter what.

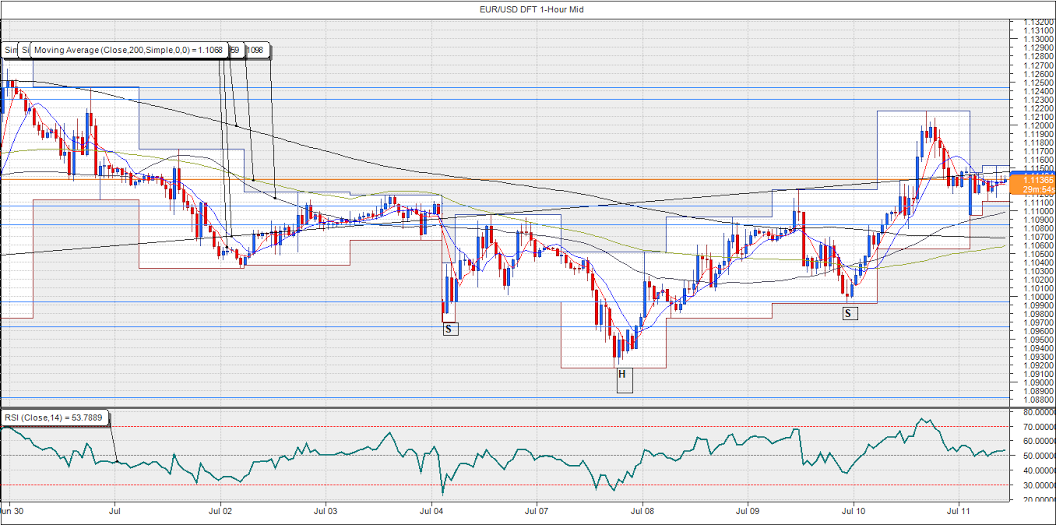

EUR/USD Daily:

I actually can’t believe that history repeated on the Monday morning open 3 weeks in a row! Price once again gapped down on the open after a weekend of rumours, but was immediately bought by optimistic Monday morning traders who are still speculating on either a deal being done or a Grexit having a limited fallout. Whatever the reason, traders that chase the closing of gaps across the board are loving life right now.

The latest draft proposal has stated that to avoid default, Greece will need €7 billion by the first deadline of July 20 which is the deadline for a bond repayment to the ECB. Just the first major deadline looming.

With a complete lack of trust on the side of the Europeans, they are asking Greece to legislate the latest measures before releasing the funds that they need just to continue funding the banking system. With no plan, direction or will of the people, how this can be done before July 15 seems almost impossible.

Happy Monday!

On the Calendar Today:

The Chinese Trade Balance is the big one during Asia, while 3rd tier Japanese data is also there. There were some headlines doing the rounds earlier that the BoJ was to meet today to ‘discuss the Greek situation’. I’m not too sure what could come from that, but again it’s a headline risk.

Vantage FX is offering clients free access to a News Terminal where retail traders can easily keep up to date with real time market moving headlines such as this from the BoJ. Take a look here.

Friday:

CNY Trade Balance

JPY Revised Industrial Production

JPY Tertiary Industry Activity

EUR Eurogroup Meetings

GBP BOE Credit Conditions Survey

Chart of the Day:

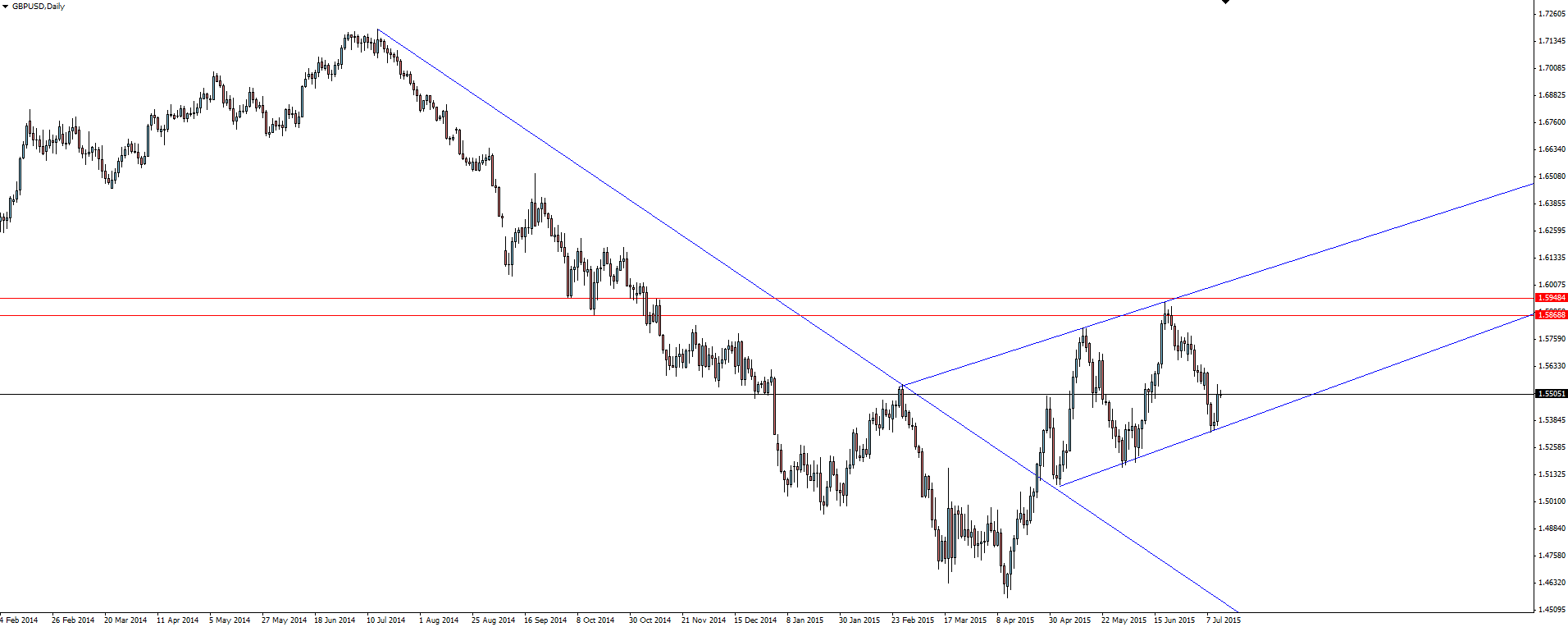

A follow up to the GBP/USD daily setup that we have been watching over the last few weeks.

GBP/USD Daily:

We had been watching the newly formed bullish channel on the daily chart and with price pulling back to the middle, we were watching for any sort of re-activation of support in this zone. The line didn’t hold or react as a support level at all and we fell straight down to the bottom of the channel where price now sits.

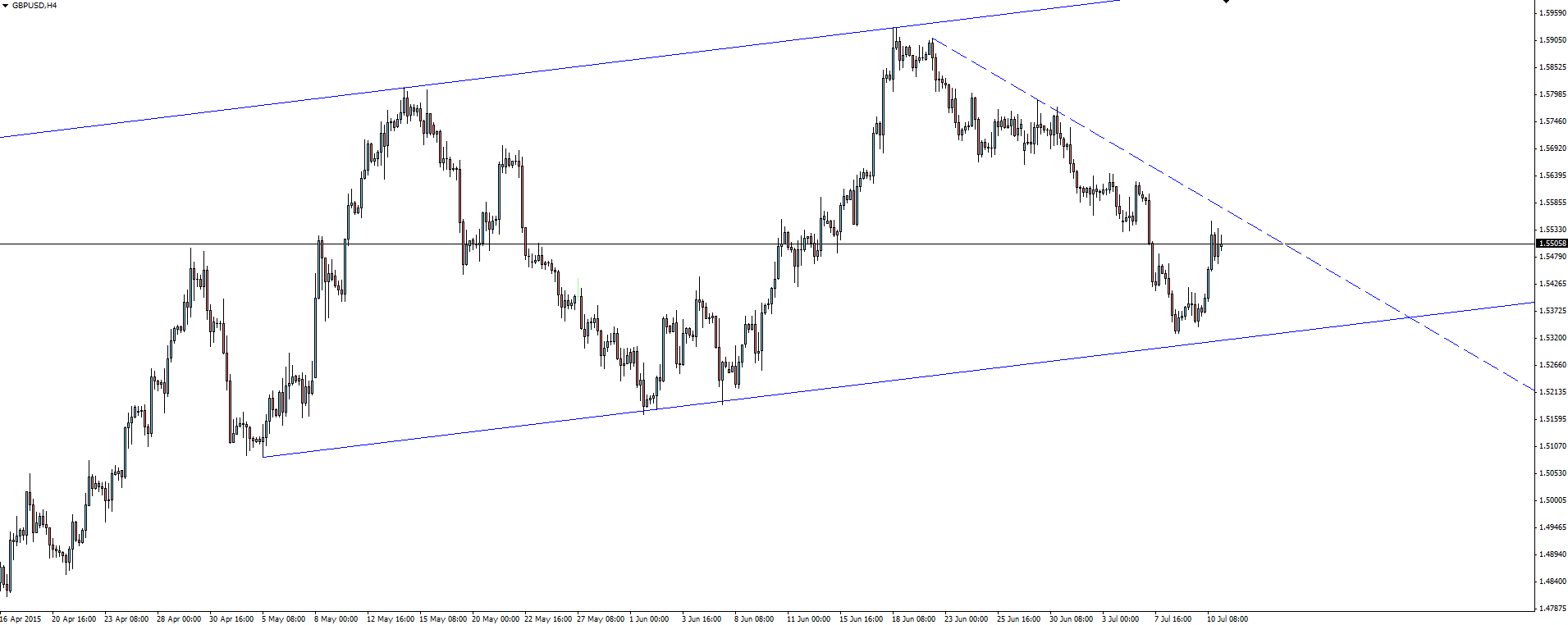

GBP/USD 4 Hourly:

The 4 hour shows the new level in question and as the channel is bullish, I see the safer option to be playing from the long side. I am now watching for a possible break and re-test of the dashed resistance line as an opportunity to get long.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.