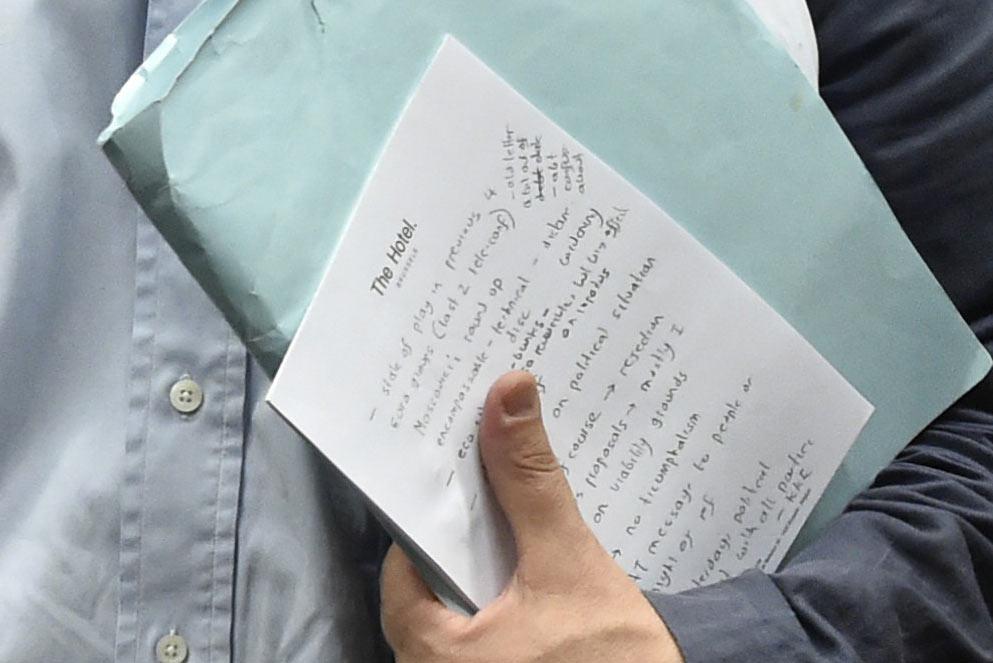

Can you Decipher the Notes?:

It’s now coming into Wednesday after the weekend’s referendum vote and low and behold, Greek banks are still closed, deadlines are still being pushed back and a solution seems as far away as ever before.

But could the answer to Greece’s problems be written on this hotel notepad that new Greek Finance Minister Euclid Tsakalotos was holding while posing for happy snaps alongside Eurogroup President Jeroen Dijsselbloem?

Maybe this is a tactic to use the media to push through negotiations ahead of deadlines? Or maybe it’s just a rookie error that could have been a lot more embarrassing for Greece’s new man.

Anyway, European leaders have now set Sunday as the deadline for Greece and it’s creditors to come to a deal with all of last night’s soundbites sounding like a Grexit is now inevitable.

German Chancellor Angela Merkel:

“We have only a few days left to find a solution. I’m not especially optimistic.”

European Commission President Jean-Claude Juncker:

“We have a Grexit scenario prepared in detail.”

European Union President Donald Tusk:

“The stark reality is that we have only five days left to find the ultimate agreement. Until now, I have avoided talking about deadlines. But tonight I have to say loud and clear that the final deadline ends this week.”

RBA Holds Firm:

The Reserve Bank of Australia’s Interest Rate Statement was a bit of a non-event yesterday, with Governor Stevens taking the wait and see approach and leaving rates on hold.

There wasn’t too much meat for traders to strip off the bone of the accompanying statement either, with it not being as dovish as markets accepted. The key takeaway from the statement seems to be that the RBA believes that further exchange rate depreciation seems likely and that it would be wise to wait and see how things play out in Greece before cutting rates to fresh record lows.

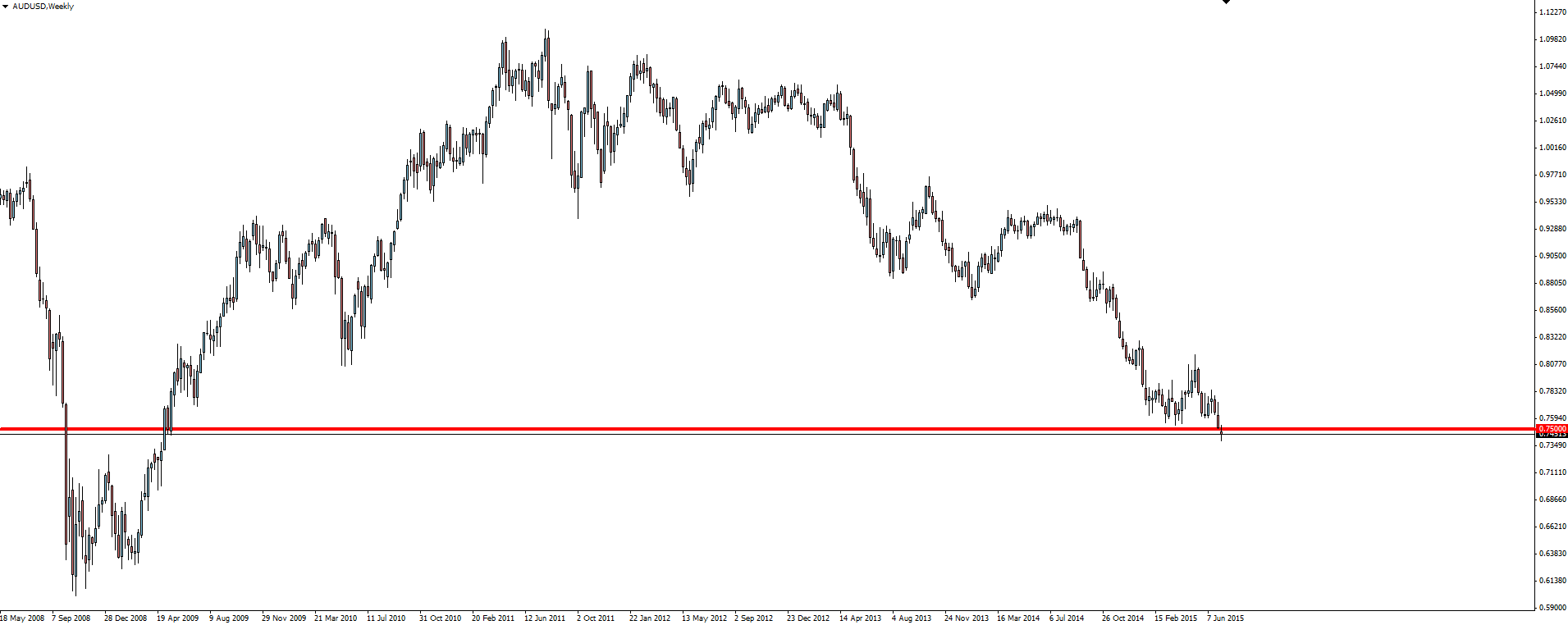

AUD/USD rallied on the statement initially, but the RBA was soon pushed onto the back-burner as European markets took charge and the general risk on sentiment pushed AUD/USD to it’s lowest level in 6 years, holding below the major 75c support level.

AUD/USD Weekly:

Something else to note, was that Stevens made no mention of China in his Monetary Policy Statement. Is that faith in the PBOC’s ability to control, or yet more wait and see?

On the Calendar Today:

Another chance for Greece to come to a compromise with it’s creditors tonight with Eurogroup meetings running all day. FOMC Meeting Minutes are also released but being pre-referendum, they wont contain whether fresh uncertainty has actually altered their thinking on a September rate hike.

Wednesday:

EUR Eurogroup Meetings

GBP Annual Budget Release

CAD Building Permits

USD FOMC Meeting Minutes

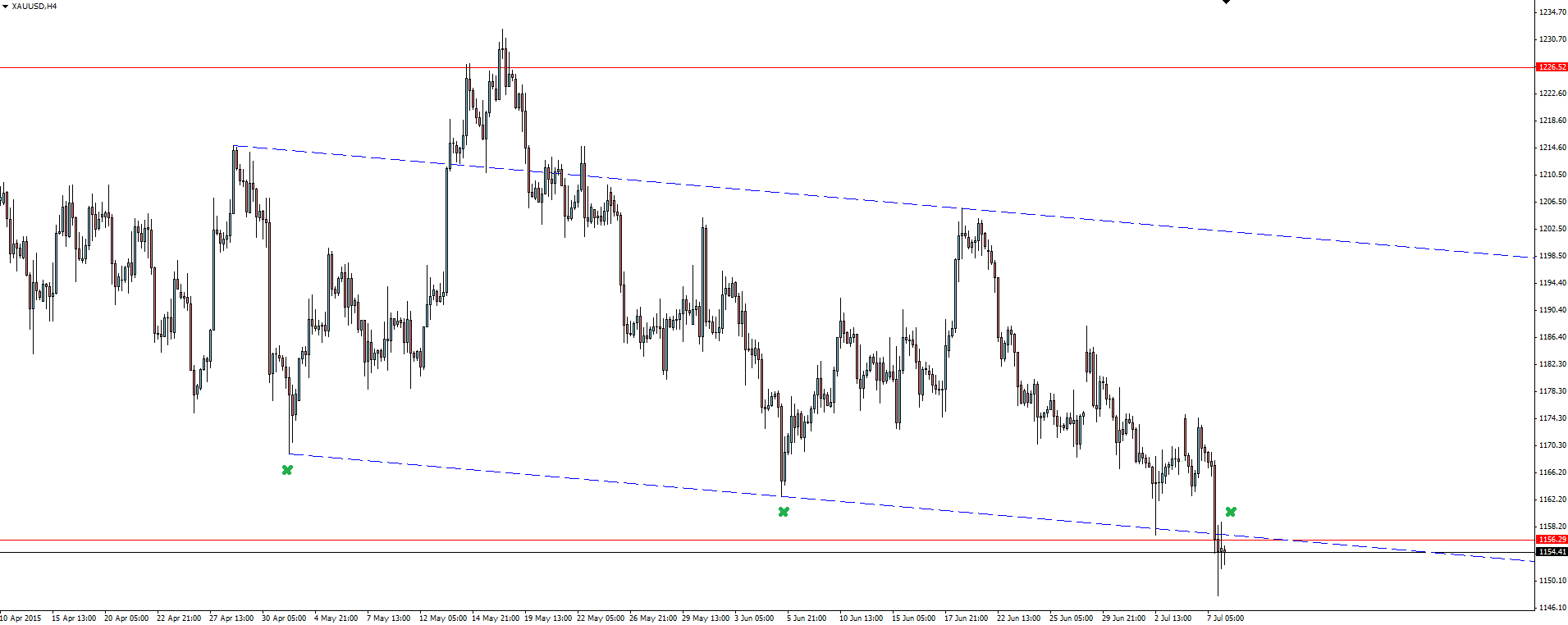

Chart of the Day:

In the Technical Analysis section of the Vantage FX News Centre, we have been looking at building a short position in Gold over the last few weeks in anticipation of a break lower through major support. The level that price is testing the bottom of now.

Gold Weekly:

On the weekly chart, you can see that price is now testing the lower band of the major support zone that we have been looking for a break. Price failed to make a new high and was rejected off the underside of the broken trend line support, now turned resistance.

Gold 4 Hourly:

Zooming into the 4 hourly, we have a short term channel bottom in play with 3 touches as support, followed now by a retest. This could be a perfect chance to add to any short positions you may have taken, or a last chance to find a clear level to manage your risk around to try and get in before any major breakout comes.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.