And just like that, it’s already June!

US GDP as Expected:

US Preliminary GDP on Friday came in at -0.7%. This showed that their economy contracted during the quarter, but still was a slight beat on the -0.8% expected. I was expecting more of a reaction from this number and thought it would be a real catalyst for some directional trading this coming week, but with the number coming in that close to expectations, the slight miss has already been mostly priced in and this shouldn’t spur any soundbites from the Fed.

Just keep in mind that although the slight miss was still viewed fairly positive by markets due to expectations of a first quarter slowdown being managed, this release marked the 3rd quarterly contraction since the GFC.

Greece Weekend Soap Opera:

Greek Prime Minister Alexis Tsipras:

“The lack of an agreement so far is not due to the supposed intransigent, uncompromising and incomprehensible Greek stance, it is due to the insistence of certain institutional actors on submitting absurd proposals and displaying a total indifference to the recent democratic choice of the Greek people.”

“Plans for collective bargaining by unions adhere to norms in the euro region while reforms for retirees mandated by the country’s bailout agreement aren’t fit for a civilized country.”

Pension reform is still throwing up the biggest hurdle for the reforms needed to keep kicking the can down the road. If you’ve been reading my morning blogs, you’d have noticed that as the market gets more and more desensitised to the sound grabs and printed headlines, I’ve been trying to look at it from the perspective of what is best for the Greek people.

It’s so easy to forget that these headlines we trade and throwaway affect real working people and that last Tsipras quote for me sums it up.

When in a position of relative power and you feel the need to take to Twitter to assure the world that rumours aren’t true, they often are. Where there’s smoke there’s fire and all that good stuff… Sorry Yanis.

But my favourite story from the weekend came from a German Children’s television program called ‘Logo’. A young girl reporting on the EU speaking to German Finance Minister Wolfgang Schaeuble gave a handful of chocolate Euro coins to the politician.

Schaeuble’s reaction was equally as good, thanking the young reporter and giving us this piece of gold:

“I’ll take a few for my Greek colleague, he also needs strong nerves.”

On the Calendar Today:

We kick off June with a bang during Asia with Manufacturing data out of China and Building Approvals from Australia.

There are a few more 2nd and 3rd tier releases on the calendar tonight that you should also keep an eye on with the 2nd tier feature being the Fed’s Fischer’s speech to the American Bankers Association International Monetary Conference, in Toronto.

Friday:

CNY Manufacturing PMI

AUD Building Approvals

CNY HSBC Final Manufacturing PMI

EUR Final Manufacturing PMI’s

GBP Manufacturing PMI

USD ISM Manufacturing PMI

Chart of the Day:

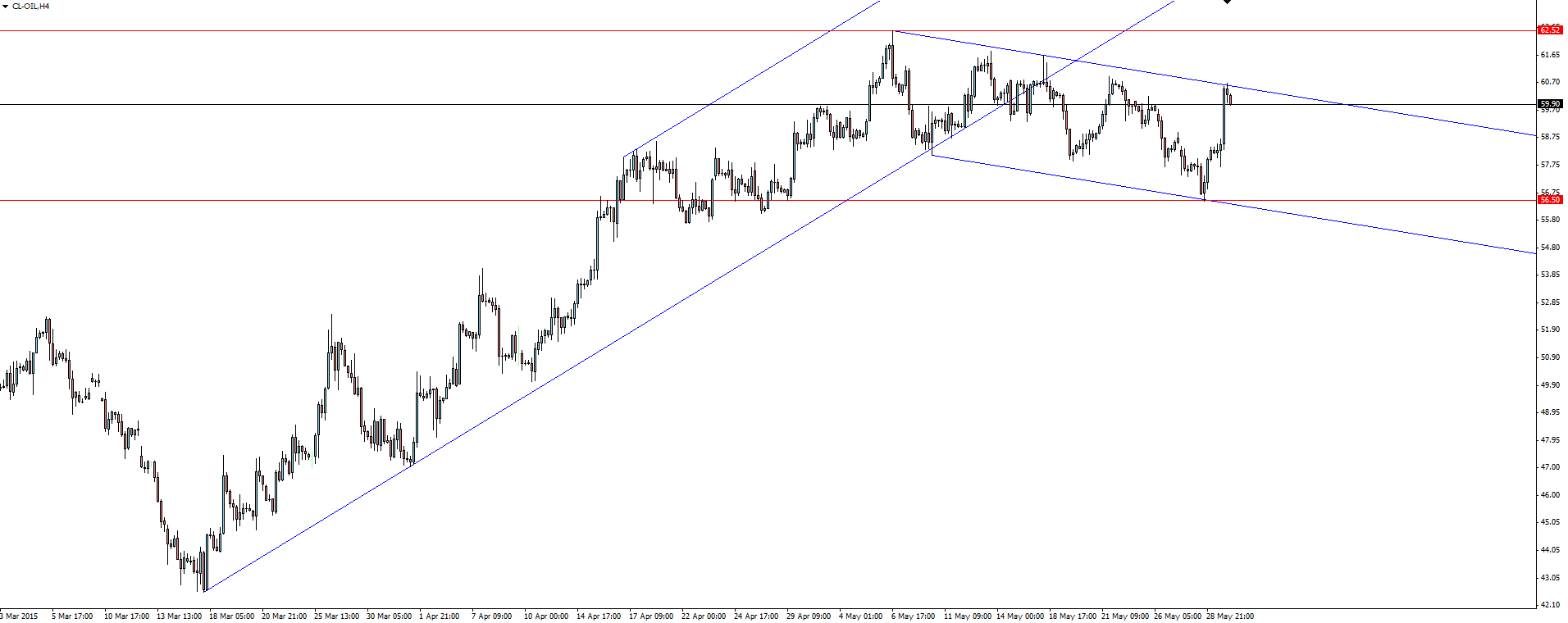

Oil 4 Hourly:

Oil is looking to continue a move higher off it’s higher time frame bottom, after putting in what looks to me like a bullish flag.

However, price at the moment is sitting at channel resistance within the flag and shorts look the play short term. But if we get any strength on dips, I want to position myself for the breakout and rip higher.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.