USD Timeout:

Good Morning Traders. Both end of the week and end of the month so stay alert for any end of month flows as we head into the weekend.

We saw a little bit of that yesterday with some USD long squaring as traders took some profit ahead of tonight’s major US GDP release. USD/JPY hasn’t looked back since it’s Tuesday breakout so for me has some more to give back before the release. If the GDP number is good however, /USD pairs watch out. This one is going to be a serious market mover!

On the JPY side of the equation, Japanese Finance Minister Taro Aso was on the wires saying that recent currency moves were “rough” and that he will monitor forex moves carefully which helped the small pullback we got. Japan are enjoying the fruit that a weak Yen brings with it, but the government is worried about the almost straight line fall the currency is continuing to experience. With 125.00 not too far away, the risk of jawboning and some wild corrective spikes is definitely on the cards.

Euro Weekend Risk:

Turning back to the ever present Greece, time is running out for a deal with the IMF to be done.

With the G7 meetings this week, we got some juicy comments from Christine Lagarde talking to a German Newspaper, seeming almost reserved to the fact that the end for Greece is nigh.

“No one wishes the Europeans a Grexit.”

“It’s very unlikely that we will reach a comprehensive solution in the next few days.”

With public sector wages and pensions to pay out the domestic priority (and can you really blame them?), Greece wants to do things on it’s own terms. But with €448m of repayments due next week, it’s interesting to hear Lagarde reveal the mounting frustration among Greece’s paymasters.

One again just to re-iterate, Greece may be small and insignificant when looking at the issue from a purely numbers point of view, but the impact of a Grexit would set a dangerous precident for some of the other bigger nations in the Euro. The union is only as strong as it’s weakest link.

Aussie Capex Miss

Finally, yesterday saw the Aussie smacked down hard by a horrible Capital Expenditure (Capex) print. Like it’s /USD brethren, the AUD/USD clawed back some of the pounding it took during the Asian session but for me, this is definitely the weak one heading into the weekend. I see new lows on the cards and at least a re-test of the broken channel resistance from February coming into play and acting as support.

Throughout the week, we’ve been talking about the important AUD/NZD level on the @VantageFX Twitter feed which we will be keeping an eye on. Give us a follow and share your thoughts with the trading community.

On the Calendar Today:

An absolute tonne of 2nd and 3rd tier data on the calendar today all the way through to the weekend. The major release during Asia being the Kiwi Business Confidence data while the US Preliminary GDP number is obviously the big one.

With the Fed sticking hard to it’s data dependent tagline, this number will be a major factor in whether the 1st quarter slowdown was indeed just the anomaly that they need it to be to justify raising rates as early as possible.

Friday:

JPY Household Spending

JPY Tokyo Core CPI

AUD HIA New Home Sales m/m

NZD ANZ Business Confidence

USD G7 Meetings

CAD GDP

USD Prelim GDP

Chart of the Day:

With the Greece driven headlines featuring the decision on economic reforms needed to reach the nation’s debt repayment requirements, we take a look at where the single currency sits from a technical point of view.

EUR/USD Daily:

Price is technically still in a bit of no-mans-land for me, right in the middle of the daily range that the pair has started to put in following it’s huge decline over the last 12 months or so. This middle zone is definitely a point of interest, but there isn’t really a clear indication of which direction it wants to go at the moment, so at this point on the daily, I’m not really interested in having a punt either way.

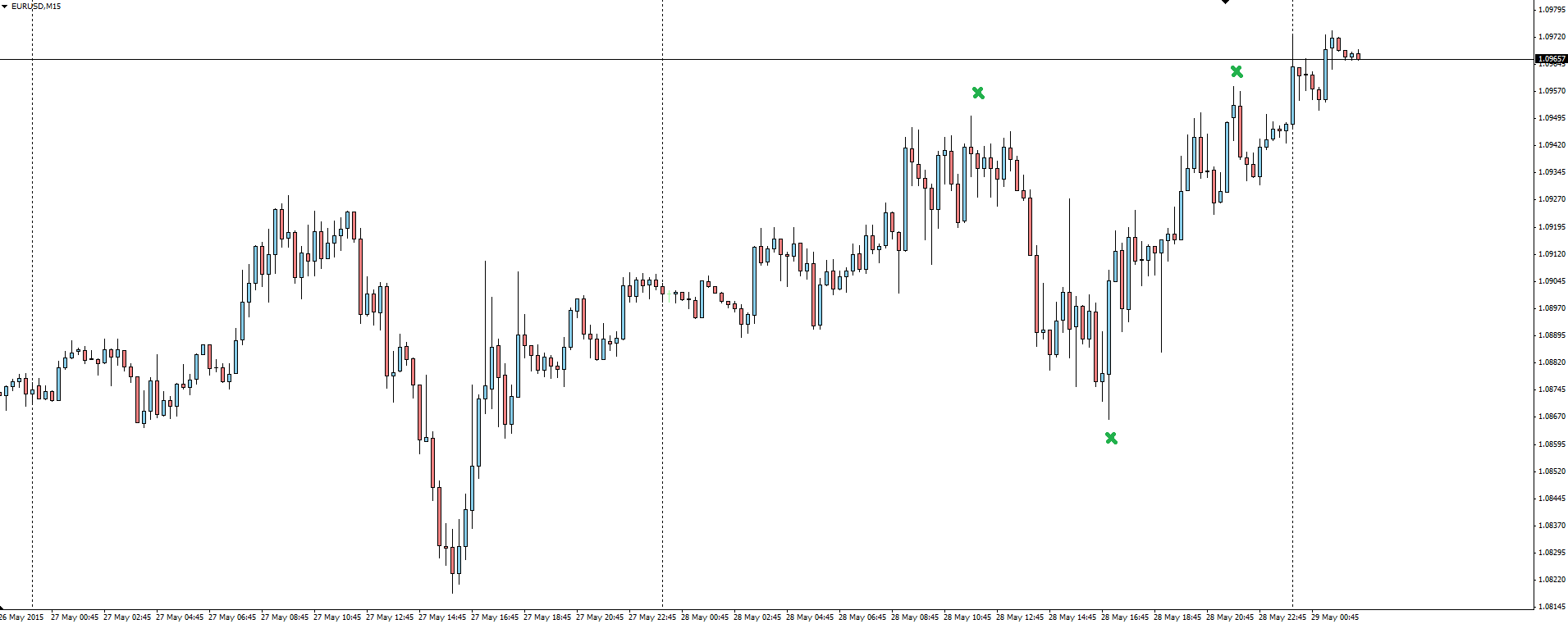

EUR/USD 15 Minute:

Zooming right down into the 15 minute chart really highlights yesterday’s headline driven price action in the pair. Whenever we get close to a deal on Greece, it’s always the same thing where price gets chopped about on an intra-session basis. Of course trading breakouts on the back of these headlines which are often just rumours misrepresented by journalists who crave a fact for the day is never a good idea.

Looking at the Euro on days like this (and lets face it, there are going to be plenty more as the can gets kicked just that little bit further down the road), I still like the strategy of fading the edges with the mentality of when I’m wrong, I’ll know I’m wrong without taking too much risk.

The alternative is sticking to the less headline driven pairs sitting at major decision levels such as the NZD/USD setup we have been talking about in the Technical Analysis section of the Vantage FX News Centre.

Let us know what you’re watching or trading? Leave a comment below or mention @VantageFX on Twitter.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.