Australian Inflation:

Yesterday saw the release of the official inflation figures out of Australia, with the higher than expected number adding to reasons that the RBA could look to again hold rates in May. For a Governor that to me sounds like he is apprehensive to cut rates again, this might just have tipped his hand.

“You do one interest rate cut and then keep saying that you may cut again – just enough to keep markets on the edge. This way, you keep the currency in check and the markets tame while you actually don’t do anything else.”

Stevens has kept the currency in check by dangling enough of a rate cut carrot to the markets. Along with (most importantly) the external factors such as USD strength, a lot of the currency depreciation work has been done for him.

Keep the idea of a cut on the table and let the market work for you!

BoE Votes.

Last night we also got the latest Bank of England minutes, with all 9 MPC members voting in favour of the current refinancing rate. The amount of QE was also unanimously agreed upon at £375 billion.

GBP/USD rallied strongly on the release, pushing up into the resistance zone that we had spoken about in the Technical Analysis section of the Vantage FX News Centre. I take a look at the chart and some ways to tackle this change in the Chart of the Day section below.

On the Calendar Today:

Chinese Manufacturing data is the big release on the calendar during the Asian session today. With the Aussie recieving a huge boost on the back of yesterday’s inflation number maybe forcing the RBA’s hand on a hold, it will be interesting to see what happens if this number is also a beat.

A whole string of European PMI’s to be released later in the night. Which ones of these actually move the market is a bit of a lottery so stay alert to the release times, especially if you’re trading the Euro.

Thursday:

CNY HSBC Flash Manufacturing PMI

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

GBP Retail Sales

USD Unemployment Claims

Chart of the Day:

A couple of charts again today, keeping with the GBP theme.

GBP/USD Daily:

With the BoE’s hawkish stance, price has pushed up into the zone we were looking for sellers to step in. However, the fact that it rallied hard into the level on momentum is not something that I want to be stepping in front of and fading just yet.

Here is an alternate scenario which is now on the table after the news. I am still however apprehensive to be buying Cable while price is still capped by the descending channel, not to mention the theme of still relentless USD strength.

Turned into a bit of a wait and see.

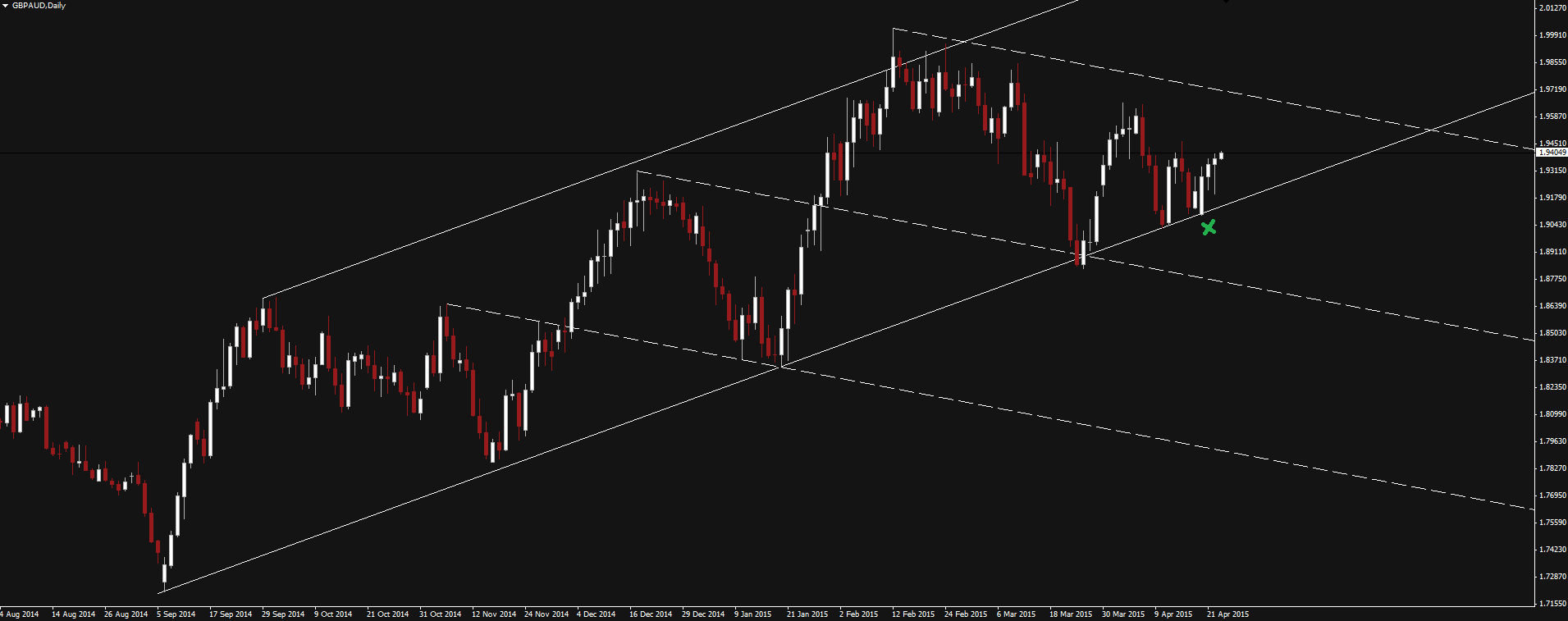

GBP/AUD Daily:

With both the BoE and RBA speaking about moving rates in opposite directions, we better take a look at the GBP/AUD chart. This pair is not as stable as its Cable brother and whips around a lot more. If you are trading this pair, make sure you’re justifying your size and stops accordingly.

Price is moving between levels in it’s bullish channel and last week we got another healthy bounce off support. Now it is looking as though the level has held off the back of the BoE, are new highs are on the cards?

Technically, if that channel snaps to the downside then it’s going to drop hard. But support has held until it hasn’t and right now on the back of both GBP and AUD news earlier in the week, the play is for new highs.

In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the forex trading account of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.sary.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.