Market Brief

Sell-off in risky assets ahead of data

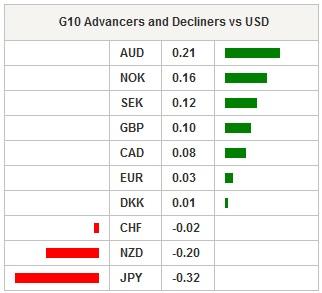

Risk appetite was reduced in the Asian session despite no clear catalyst suggesting short-term mean reverting behavior. Potentially, the sell-off in risky assets could have been triggered by news that Donald Trump is the presumptive Republican presidential nominee following a conclusive victory in the Indiana primary and Ted Cruz’s confirmation of the end of his campaign. The prospect of a USA President Trump makes everyone, including battled hardened financial professionals, very concerned. Asian regional equity indices were broadly in the red and the Hang Seng fell -0.79%, Shanghai composite -0.03% and ASX down -1.47% reversing yesterday's RBA driven gains. Oil was weak, below $44brl as US inventories indicated expanded stockpiles. Stockpile news added to concerns caused by weakness in China PMI and manufacturing confidence forcing commodity traders to rethink the Asia based recovery story. USD was broadly stronger following recent heavy selling, yet demand volume remains light. EURUSD pulled back from yesterday’s 1.1616 highs to 1.1494. A similar pattern was seen in USDJPY as the pair further corrected off the lows at 105.55, rising to 107.46.

US Fed Lockhart provided some headlines but little real insight. Overall, Lockhart was ambivalent on whether to increase interest rates in June as he indicated concerns that Q1 growth softness could linger. Lockhart stated that the consumer was healthy and that the economy is expanding at a moderate pace, while also indicating his disappointment in domestic demand. Finally, he also made reference to Brexit as a source of increased global anxiety. We retain our expectations of one 25bp hike in 2016, most likely in December as the cyclical aspect of US data is likely to shift downwards and volatility generating events will make the hike timing difficult. Without the monetary policy divergent story and rising yield support we do not see a fundamental rationale to buy USD.

Data overnight was light with the New Zealand commodity price index printing -0.8% in April and the Q1 unemployment rate jumping to 5.7% from 5.3% versus an expected 5.5%. NZDUSD fell sharply from 0.6937 to 0.6880 on the disappointing results.

On the docket today the final release of the April Euro area composite & services PMI is due with consensus suggesting a flat 53 & 53.2 read. This will follow a string of PMI reads across Europe and Euro area retail sales giving investors some insight into the economic state of Europe. Yet, following the upward revision to the Euro area April manufacturing PMI there is some upside to today’s reads. In the UK construction PMI is expected at 54.0 from 54.2 prior read. This follows a significantly disappointing UK manufacturing PMI read where weak external demand and uncertainty around the Brexit question has dragged down manufacturing activity in the near term. Deterioration in UK fundamentals and uncertainty over the EU referendum outcome will erase the recent shine on the GBP providing short term selling opportunities. However, the focus of GBP traders will be Prime Minister David Cameron’s questions from the House of Commons Liaison Committee over the June EU referendum. The US will provide plenty of volatility driven data including ADP, trade balance, ISM non-manufacturing, services & composite PMI, factory orders, and durable goods orders. We anticipate further evidence that weaker USD has not helped the US considering the soft international activity. We remain bearish on the USD and view recovery bounced as an opportunity to sell.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16147.39 | 0 |

| Hang Seng Index | 20491.92 | -0.89 |

| Shanghai Index | 2988.4 | -0.14 |

| FTSE futures | 6135.5 | -0.2 |

| DAX futures | 9956 | -0.03 |

| SMI Futures | 7803 | -0.02 |

| S&P future | 2052.9 | -0.19 |

| Global Indexes | Current Level | % Change |

| Gold | 12871.07 | -0.42 |

| Silver | 17.29 | -0.71 |

| VIX | 15.6 | 6.2 |

| Crude wti | 43.62 | -0.06 |

| USD Index | 93.07 | 0.13 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SZ 1Q UBS Real Estate Bubble Index | - | 1,41 | CHF/06:00 |

| SW Apr Swedbank/Silf PMI Services | 56 | 54,9 | SEK/06:30 |

| EC Apr F Markit Eurozone Services PMI | 53,2 | 53,2 | EUR/08:00 |

| EC Apr F Markit Eurozone Composite PMI | 53 | 53 | EUR/08:00 |

| UK Apr Markit/CIPS UK Construction PMI | 54 | 54,2 | GBP/08:30 |

| EC Mar Retail Sales MoM | -0,10% | 0,20% | EUR/09:00 |

| EC Mar Retail Sales YoY | 2,60% | 2,40% | EUR/09:00 |

| US 29.avr. MBA Mortgage Applications | - | -4,10% | USD/11:00 |

| US Apr ADP Employment Change | 195000 | 200000 | USD/12:15 |

| US Mar Trade Balance | -4,12E+10 | -4,71E+10 | USD/12:30 |

| CA Mar Int'l Merchandise Trade | -1,40E+09 | -1,91E+09 | CAD/12:30 |

| US 1Q P Nonfarm Productivity | -1,30% | -2,20% | USD/12:30 |

| US 1Q P Unit Labor Costs | 3,30% | 3,30% | USD/12:30 |

| US Apr F Markit US Services PMI | 52,1 | 52,1 | USD/13:45 |

| US Apr F Markit US Composite PMI | - | 51,7 | USD/13:45 |

| US Apr ISM Non-Manf. Composite | 54,8 | 54,5 | USD/14:00 |

| US Mar Factory Orders | 0,60% | -1,70% | USD/14:00 |

| US Mar Factory Orders Ex Trans | - | -0,80% | USD/14:00 |

| US Mar F Durable Goods Orders | 0,80% | 0,80% | USD/14:00 |

| US Mar F Durables Ex Transportation | -0,10% | -0,20% | USD/14:00 |

| US Mar F Cap Goods Orders Nondef Ex Air | - | 0,00% | USD/14:00 |

| US Mar F Cap Goods Ship Nondef Ex Air | - | 0,30% | USD/14:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.