Market Brief

As broadly expected the Federal Open Market Committee left short-term interest rates unchanged at between 0.25% and 0.50%. Since there was no press conference, the market had nothing to get its teeth into apart from the statement. The latter was little changed compared to the one from January, indicating that the Fed sticks to its dovish position. The line saying that “the global economic and financial developments continue to pose risks” was removed but on the other hand the Fed agreed that the domestic economic activity appeared to have slowed. All in all, it was roughly in line with the market was expecting and USD crosses remained flat as investors had already priced in that the Fed would most likely hold fire in June. It is now almost a sure thing. EUR/USD fell initially to 1.1272 before bouncing to 1.1362, and finally consolidate at 1.1322.

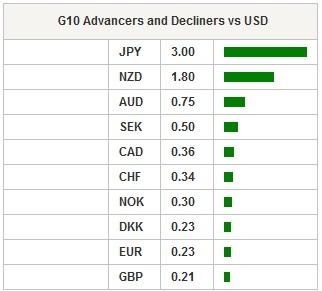

In Japan, the BoJ announced that the bank needs more time to assess the impact of negative interest rates, thus maintaining its monetary stimulus. Nevertheless, the move came as a surprise as the market was expecting the BoJ to take action in response to the recent JPY’s strength that could delay the BoJ’s inflation target. This decision raised some important questions. Is the BoJ worried about the real effects of ultra-accommodative monetary policy on growth and inflation? Or the central bank really need more time to fine tune its negative interest rate tool? However, one thing is clear: the BoJ made clear that the market will not dictate what the central bank should do. USD/JPY collapsed more than three figures or 3.25% and reached 108.20, the lowest level since April 18th. The closest support lies at 107.63 (low from April 11th), further south another support lies at 105.23 (low from October 2014). In our opinion, the first support should not last long given the rapid building in long JPY positioning.

On the commodity market, the West Texas Intermediate was unable to break the strong $45 resistance level and stabilised nearby. Similarly, the international gauge, the Brent crude, tumbled on the $47 level, down 0.53%.

On the equity market, the BoJ decision dampened the mood as Japanese equity fell sharply with the Nikkei 225 down 3.61% and the Topix down 3.16%. In mainland China, the Shanghai and Shenzhen Composites slid 0.26% and 0.13% respectively. In Hong Kong, the Hang Seng edged up 0.45%. in Europe, equity futures are blinking red across the board, pointing to a lower open as the negative mood is spreading from Asia.

Today traders will be watching CPI from Spain and Germany; retail sales from Sweden; unemployment from Germany; consumer confidence from the Eurozone; initial jobless claims, GDP, personal consumption and core PCE from the US.

| Global Indexes | Current Level | % Change |

| Nikkei 225 Index | 16666.05 | -3.61 |

| Hang Seng Index | 21456.68 | 0.45 |

| Shanghai Index | 2945.668 | -0.27 |

| FTSE futures | 6241 | -0.43 |

| DAX futures | 10280 | -0.47 |

| SMI Futures | 8002 | -0.35 |

| S&P future | 2079.1 | -0.55 |

| Global Indexes | Current Level | % Change |

| Gold | 1255.47 | 0.77 |

| Silver | 17.36 | 0.71 |

| VIX | 13.77 | -1.36 |

| Crude wti | 45.13 | -0.44 |

| USD Index | 93.74 | -0.69 |

| Today's Calendar | Estimates | Previous | Country/GMT |

| SP 1Q Unemployment Rate | 20,90% | 20,90% | EUR/07:00 |

| SP Apr P CPI EU Harmonised MoM | 0,80% | 2,00% | EUR/07:00 |

| SP Apr P CPI EU Harmonised YoY | -0,90% | -1,00% | EUR/07:00 |

| SP Apr P CPI MoM | 1,10% | 0,60% | EUR/07:00 |

| SP Apr P CPI YoY | -0,70% | -0,80% | EUR/07:00 |

| IT Bank of Italy Annual Meeting of Shareholders | - | - | EUR/07:30 |

| SW Mar Retail Sales MoM | 0,40% | -0,20% | SEK/07:30 |

| SW Mar Retail Sales NSA YoY | 3,50% | 3,90% | SEK/07:30 |

| RU Bloomberg April Russia Economic Survey | - | - | RUB/07:30 |

| TU Bloomberg April Turkey Economic Survey | - | - | TRY/07:50 |

| GE Apr Unemployment Change (000's) | 0k | 0k | EUR/07:55 |

| GE Apr Unemployment Claims Rate SA | 6,20% | 6,20% | EUR/07:55 |

| NO Feb Unemployment Rate AKU | 4,80% | 4,80% | NOK/08:00 |

| NO Mar Retail Sales W/Auto Fuel MoM | 0,40% | -0,50% | NOK/08:00 |

| TU Mar Foreign Tourist Arrivals YoY | - | -10,30% | TRY/08:00 |

| NO 1Q Industrial Confidence | -6 | -8 | NOK/08:00 |

| IT Mar Hourly Wages MoM | - | 0,10% | EUR/08:00 |

| IT Mar Hourly Wages YoY | - | 0,80% | EUR/08:00 |

| FI Bank of Finland Governor Liikanen Speaks in Helsinki Seminar | - | - | EUR/08:40 |

| EC Apr Economic Confidence | 103,4 | 103 | EUR/09:00 |

| EC Apr Business Climate Indicator | 0,14 | 0,11 | EUR/09:00 |

| EC Apr Industrial Confidence | -4 | -4,2 | EUR/09:00 |

| EC Apr Services Confidence | 10 | 9,6 | EUR/09:00 |

| EC Apr F Consumer Confidence | -9,3 | -9,3 | EUR/09:00 |

| AS Austrian Central Banker Nowotny Presents Annual Report | - | - | EUR/09:15 |

| SA Mar PPI MoM | 1,10% | 0,80% | ZAR/09:30 |

| SA Mar PPI YoY | 7,40% | 8,10% | ZAR/09:30 |

| NO Norway Wealth Fund Issues 1Q, Real Estate Reports | - | - | NOK/10:00 |

| BZ Apr FGV Inflation IGPM MoM | 0,35% | 0,51% | BRL/11:00 |

| BZ Apr FGV Inflation IGPM YoY | 10,65% | 11,56% | BRL/11:00 |

| PO Bank of Portugal's Costa Speaks at Conference in Lisbon | - | - | EUR/11:30 |

| GE Apr P CPI MoM | -0,20% | 0,80% | EUR/12:00 |

| GE Apr P CPI YoY | 0,10% | 0,30% | EUR/12:00 |

| GE Apr P CPI EU Harmonized MoM | -0,20% | 0,80% | EUR/12:00 |

| GE Apr P CPI EU Harmonized YoY | 0,00% | 0,10% | EUR/12:00 |

| US Apr 23 Initial Jobless Claims | 259k | 247k | USD/12:30 |

| US Apr 16 Continuing Claims | 2136k | 2137k | USD/12:30 |

| US 1Q A GDP Annualized QoQ | 0,60% | 1,40% | USD/12:30 |

| US 1Q A Personal Consumption | 1,70% | 2,40% | USD/12:30 |

| US 1Q A GDP Price Index | 0,50% | 0,90% | USD/12:30 |

| US 1Q A Core PCE QoQ | 1,90% | 1,30% | USD/12:30 |

| RU Apr 22 Gold and Forex Reserve | - | 386.2b | RUB/13:00 |

| BZ Mar Outstanding Loans MoM | - | -0,50% | BRL/13:30 |

| BZ Mar Total Outstanding Loans | - | 3184b | BRL/13:30 |

| BZ Mar Personal Loan Default Rate | - | 6,20% | BRL/13:30 |

| US Apr 24 Bloomberg Consumer Comfort | - | 42,9 | USD/13:45 |

| US Apr Kansas City Fed Manf. Activity | - | -6 | USD/15:00 |

| BZ Mar Central Govt Budget Balance | -9.9b | -25.1b | BRL/17:00 |

| SK May Business Survey Non-Manufacturing | - | 71 | KRW/21:00 |

| SK May Business Survey Manufacturing | - | 70 | KRW/21:00 |

| IN Mar Eight Infrastructure Industries | - | 5,70% | INR/22:00 |

Currency Tech

EURUSD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1353

S 1: 1.1144

S 2: 1.1058

GBPUSD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4588

S 1: 1.4284

S 2: 1.4132

USDJPY

R 2: 112.68

R 1: 111.91

CURRENT: 108.29

S 1: 107.63

S 2: 105.23

USDCHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9672

S 1: 0.9476

S 2: 0.9259

- S: Strong, M: Minor, T: Trendline, K: Keylevel, P: Pivot

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.