Market Brief

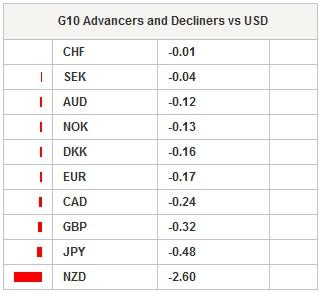

Asian equity markets were broadly higher after two regional central banks cut interest rates. The Reserve Bank of New Zealand (RBNZ) cut its official cash rate by 25bps to 3.25% in reaction to weak inflation expectations while the Bank of Korea cut its benchmark rate, the 7-day repo rate, by 25bps to 1.50% in an attempt to revive weak exports. RBNZ’s Governor Wheeler added that the rate cut was justified to adjust the exchange rate to the downside. The RBNZ remains in easing mode and is ready to debase further the NZD to ensure that inflation converge toward the 2% target rate before 2017. The Governor made clear that further rate cuts will be data dependent. The NZD fell sharply against the dollar, down almost 2 figures to $0.7015, slightly above the 0.70 support level. If broken, the next target is $0.6950. However our favourite currency pair to play the NZD weakness remains AUD/NZD. The Aussie jumped 3 figures to 1.1050 from 1.0750 after the decision. Next target being the highs from the last months of 2014, around 1.13.

In Australia, unemployment rate fell in May to 6% from 6.1% in April (revised downward) versus 6.2% consensus. In our opinion, the big picture is not that bright as the apparent improvement in the job market is mainly due to the unexpected increase in part time employment. The Australian economy created only 14.7k full time job positions compared to 27.3k part time jobs. AUD/USD jumped half a figure to the upside and is currently trading around 0.7760. The next resistance stands around 0.78/0.7820 (Fib 38.2% on May-June debasement and psychological threshold) while the closest support remains at 0.76 (previous low). On the equity front, Australian shares were buoyant, up 1.42% while in New Zealand, equities added 0.94% on the session.

In Japan, the Nikkei gained 1.68% to 20,382.97. The popular index added almost 17% since the beginning of the year. USD/JPY consolidates slightly above the 123.05 level (Fib 38.2% on April-June rally). On the downside, a support can be found around 1.22.18 (Fib 50%) while a resistance stands at 125.86 (previous high).

EUR/USD presents a positive bias as traders are getting impatient with the lack of US data the last couple of days. Their patience will be soon rewarded as US retail sales figures for May are no later than this afternoon, as well as import price index, initial jobless claims and Bloomberg consumer comfort index.

In Europe, equity returns are mixed this morning with the Footsie up 0.11% as investors cheer the surprisingly good industrial production figures from UK (1.2%y/y versus 0.6% expected for May). GBP/USD lost momentum in Tokyo and is heading toward the 1.54 strong support after the UK Parliament voted in favour of a referendum on EU membership, highlighting profound divisions between David Cameron and its party. EUR/GBP is also taking advantage of the current sterling’s weakness and will test soon the resistance standing at 0.7320 (Fib 61.8% on May debasement).

In Brazil, the war against inflation is not over yet as the IPCA rose to 8.47% in May compared to 8.17% previous month and above market’s expectations of 8.30%. This is the highest read since early 2004; we should get further details in the quarterly inflation report due at the end of the month. It definitely increase the odds of a 50bps increase of the Selic rate at the next Copom meeting at the end of July. Minutes of the last meeting are due this afternoon.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.