Market Brief

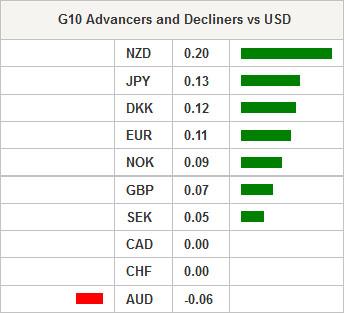

Economic data from the US remain subdued in March as housing starts and building permits came in worse-than-expected at 926K verse 1040K and 2268K verse 2323K, respectively. Initial jobless claims were also due yesterday, it was a disappointment as the number of registered unemployed workers rose 294K last week while market participants were expecting 280K. As a result, the USD paired losses against G10 currencies in New York before consolidating during the Asian session.

In Asia, the Shanghai Composite seems unstoppable as the index rose more than 2% and is about to close in positive ground for the sixth consecutive week; investors are betting the Chinese government will cut rates shortly as the economy decelerates. Hong Kong equities are also green on the screen as the Hang Seng tries to follow the lead, the index is up 0.40%. In Tokyo, the Nikkei is down almost 1% as investors are jumping in Chinese equities. Australian shares paired losses, the ASX 200 retreated by 1.31% to 5,871 after a surge during the previous session. AUD/USD broke the 0.7784 resistance and turned it into a support, the Aussie consolidates above this level and is currently trading around 0.7787.

In Europe, equity futures are clearly red: DAX futures are down almost 2%, CAC 40 lost -0.55%, Euro Stoxx 50 retreated by -1.34% while the Footsie is lower by -0.35%. Investors are worried that Greece may default after rumors spread that Greece asked to delay its next debt payment to the IMF.

In the FX market, bullish EUR/USD trend gains momentum as Fed’s officials went vocal yesterday about the timing of the first rate hike. Committee members have set forth diverging views as they are concerned about increasing rate too early while the US economy had a tough first quarter. A rate hike in June appears more and more unlikely. The single currency broke its second resistance in 2 days (1.0685 and 1.0755 yesterday) and is currently consolidating above the latter. On the upside, a resistance lies at 1.0825 (Fib. 38.2% on March dollar sell-off), while on the downside previous resistance are now supports (1.0685 and 1.0755).

GBP/USD also seems unstoppable as the sterling gained almost 4 figures in four days. However the pair reached a key level last night and will need fresh boost to break the 1.4950/1.50 area (multiple high, psychological level and Fib 50% on Feb-March sell-off). GBP/USD will find support at 1.48 (Fib 23.6%) and resistance around 1.5060 (Fib 50%). The jobs report from the UK is due today and may trigger some sharp moves later this morning at 8:30GMT.

A lot of economic data are due today, traders will watch closely the release of March CPI of Eurozone, the US and Canada; inflation rates are expected positive on a monthly basis for all of them. While consensus sees Retail Sales in Canada at 0.5% for February. Finally the Michigan Sentiment will be released later this afternoon and is expected at 94, above March figure (93).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.