Market Brief

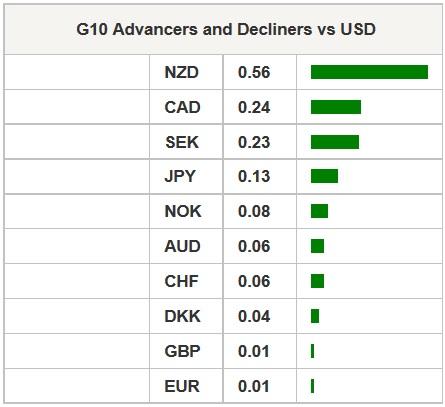

FX markets were basically unchanged with slight USD weakness after Fed Chair Yellen wrapped up her semi-annual testimony. Asia regional equity indices were mixed. The Nikkei rose 1.08%, the Hang Seng index was up 0.38% and the Shanghai composite index climbed 2.15%. ASX and Taiwan were both marginally lower. In the forex markets, the major were range bound, with broadbased liquidation of USD longs. EURUSD edge up on the dovish Yellen comments to 1.1375. However, demand was thin and focus will be on 1.1330 to 1.1390 range. With risk from Greek having subsided we anticipate EURUSD to weaken on divergent monetary policy paths. Australia’s private capital expenditure Q4 2014 collapsed -2.2% against expected -1.6%. The weak CAPEX pushed AUDUSD down to 0.7837 before bargain hunters pushed the pair marginal higher to 0.7855. Expectations for a RBA OCR rate cut at next week meeting spiked from 40% to 52%. AUDUSD focus will be on channel support at 0.7620 as a dovish Fed clear the way for the RBA to cut further. New Zealand’s trade surplus increased to NZ$56mn in January against a market expected deficit of NZ$158mn. New Zealand January’s imports fell to NZ$3.64bn while exports decreased to NZ$3.70bn. Solid trade data help NZDUSD recovery off the session lows at 0.7550 but unable to clear stop heavy 0.7577 barrier.

In BoJ Governor Kurodas testimony to the Diet never shifted from his traditional line. He stated that prices will continued to rise and would adjust policy as necessary. Kuroda went on to say that QQE policy was not to target FX prices but focused on price stability. It seems to suggest that recent comments addressing potentially shifting the inflation target might lack critical board support. In addition, a report in the WSJ suggest that Japanese PM Abe would guide the balance of the BoJ board if necessary. This suggests that when dissenter Morimoto term expires in June another reflationist would be appointed to the BoJ’s Policy Board. For most of the Asian session, JPY was weaker across the board as the USDJPY rallied to 119.10 (aided by closed stressed shorts). We anticipated a sideways range 118.64 to 119.09 for now while markets absorb Yellens comments, the Greek bailout agreement and escalation in Ukraine – Russian tensions.

As expected in what is political theater Fed Chair Janet Yellen scuffled with Republican lawmakers over the need for additional oversight on the Central Bank. Yellen outright rejected accusations that the Fed is unaccountable and closely aligned with the White house and Democrats. Scott Garrett, a New Jersey Republican who has introduced bill to give congress more control of Fed and curb its power, made plenty of headlines grabbing comments. Yet Yellen was able to gracefully spar with the young turk calling it a “complete mis-characterization.”

Today, traders will be watching Spanish Final GDP, EA M3 and Euro area confidence. In the UK, GDP growth is expected to come in at 0.5% q/q in Q4, falling from 0.7% q/q in Q3 and BoE Deputy Governor Shafik is also due to speak. In the US, CPI and Durable Good Order data are expected. Market anticapate CPI should see a monthly drop in headline inflation to -0.6%, while the focus will be on Core CPI (given Fed comments and last month drop) expected to easing to 0.1%, which would hold steady at yearly data at 1.6%. Fed Chair Yellen’s testimony should cap USD upside till next week’s US payroll report.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.