Market Brief

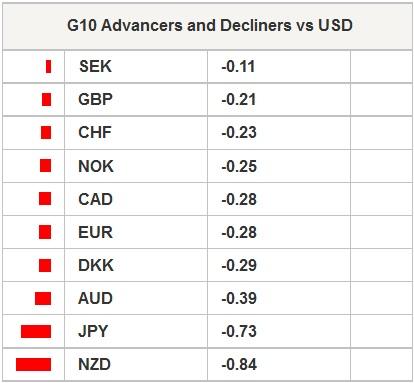

The USD was better bid against its G10 and EM peers in Asia, the risk appetite remains moderate. The Chinese GDP grew at the pace of 1.5% in 4Q, missed already weak market estimates (1.7% q/q exp. & 1.9% last). The GDP growth on year remained stable at 7.3% (vs. 7.2% exp.). An IMF economist said that the slower China growth will have adverse effect on trading partners as the IMF revised down its 2015 growth forecasts from 3.8% to 3.5%.

Gloomy macro news from China weighed on AUD overnight. AUD/USD legged down to 0.8160 (slightly above its 21-dma, 0.8148), the positive trend loses pace. Trend and momentum indicators remain marginally positive, yet offers at 0.8250/70 area need to be cleared for fresh upside attempt. Important resistance remains at 0.8316/20 (50-dma/October – January downtrend base).

JPY crosses were better bid in Tokyo, alongside with Nikkei stocks (+2.07%). USD/JPY advanced to 118.53, yet found sellers above the Ichimoku cloud top (118.48). The base and conversion line flattens before the BoJ decision. As we expect the BoJ to maintain the status quo, the accompanying statement, especially comments on the inflation target, should give fresh direction to JPY-complex from Wednesday. We are looking for a break above the Ichi cloud for fresh bull trend, while a step below 115.50/57 (Fibonacci 50% on Oct-Dec rally/December low) should trigger further slide to 112.45/113.50 area (Nov 3rd low/Ichi base). EUR/JPY recovers to 137.26. Given the broad EUR-negative sentiment, resistance is presumed at 138.00/138.27 (optionality/Fib 23.6% on December-January sell-off).

EUR/USD consolidates weakness with traders looking to sell the rallies before the ECB decision. As the ECB is expected to pull the trigger on QE by Thursday, the expectations of a sizeable action should keep the downside pressures tight on the EUR/USD despite oversold conditions (RSI at 22%). Decent option barriers trail below 1.17 for today, more vanilla puts abound below 1.16 from tomorrow. EUR/GBP holds ground above 0.76 with MACD comfortably negative, signaling the bias remains on the downside. Danish Central bank cut its CD rate by 15 basis points and stated that it has tools to defend the peg verse EUR.

Else, Turkey Central Bank gives policy verdict today. The lower oil and commodity prices, the expectations for further cool-off in inflation, the negative rates in Switzerland, the anticipations for further expansion in the Euro-zone, the surprise action in India (based on similar motives), combined to political pressures should lead to lower CBT to take advantage of the situation on rates. We expect 25 basis points cut in benchmark repo rate at today’s meeting. USD/TRY moves higher, a daily close above 2.3370 (MACD pivot) should signal a challenge of 2.3540 (January 5th high).

Today’s economic calendar : German December PPI m/m & y/y, Italian November Trade Balance, Euro Are 3Q Government Deficit, ZEW Survey on Current Situation and Expectations in Germany in January, ZEW Survey for Expectations in the Euro-zone in January, Canadian November Manufacturing Sales m/m and US January NAHB Housing Market Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.