Market Brief

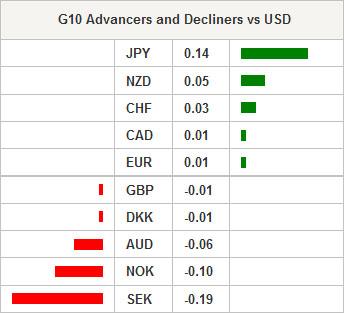

The risk appetite remained limited in Asia as doctor back from South Africa tests positive for Ebola in NYC hospital. The US equity futures traded lower overnight; Dow Jones futures weakened 0.14%, S&P and Nasdaq futures are down 0.32% and 0.37% at the time of writing.

US 10-year yields advanced to 2.30% in New York yesterday, pushing USD/JPY up to 108.35. USD/JPY and JPY crosses were mixed in Tokyo as Ebola story hit wires. We are close to MACD (12, 26) pivot. A week close above 109.00 should signal a short-term bullish reversal. Markets are concerned that low energy prices may further derive the CPI from BoJ’s 2.0% target. Option bids trail above 107.75/108.00, offers dominate below.

New Zealand’s trade deficit overbeat market expectations in September, widened twice more than market estimates. NZ printed 1,350 million NZD deficit in September (vs. -625mn exp. & -489mn last (revised)), exports were little changed 3.61bn (vs. 3.51bn last) but the imports surged to 4.96bn (from 4.00bn last) due to purchase of an aircraft plus parts. The significant September deficit pulled the 12-month trade surplus down from 1,778mn (revised) to 648mn (vs. 1,530mn exp.). NZD/USD spiked down to 0.7791, the bullish momentum fades suggesting a re-test of 0.7709 (Sep 29th low). The RBNZ rate decision is due next week. Given the softer CPI reading and moderate recovery, the RBNZ’s official cash rate is expected to remain unchanged at 3.50%.

In China, soft house price data kept USD/CNY ranged in Hong Kong. New home prices fell in 69 cities over 70 by 1.3% in year to September (vs +0.3% in Aug). The USD/CNY bias should remain on the downside for a week close below 6.13 (MACD pivot).

AUD/USD remains flat (0.8719/0.8774) with trend and momentum indicators marginally bullish. Solid option barriers are placed at 0.8780/0.8800 for today expiry. The key support stands at 0.8643 (Oct 3rd low). AUD/NZD steps in the bullish consolidation zone (MACD turns positive). Key resistance is seen at 1.1298 (Sep high). Option bids are placed at 1.1150, more support is seen at 1.1116/34 (50 & 21-dma) mostly due to heavier offers in NZD-complex.

The GBP-bulls remain timid after the BoE minutes highlighted concerns on the global economic outlook and on the difficult recovery in the Euro-area, which may lead to a delay in first BoE rate hike. Today, traders are focused on 3Q advance GDP release, the consensus is softer 3Q GDP growth of 0.7% q/q (vs. 0.9% in 2Q) and 3.0% y/y (vs. 3.2% printed in Q2). GBP/USD trades ranged within 1.5875/1.6186 (Oct 15th low / Fib 23.6% on Jul-Oct sell-off), corrective bids give some support below 1.60s. Breakout on either side is required to assess fresh direction. The overall bias remains on the downside, the 3-month cross currency basis suggest preference for USD vs. GBP.

USD/BRL advances to fresh 6-year high of 2.5179 as volatilities escalate walking into October 26th runoff. The event risk is high due to hyper-sensitivity to election polls and political headlines.

Today, traders watch Spanish September PPI m/m & y/y, Italian August Retail Sales m/m & y/y, UK 3Q (Advance) GDP q/q & y/y, UK August Index of Services m/m & 3m/3m, Euro-area 2Q Government Deficit, Italian September Hourly Wages m/m & y/y, US September New Home Sales m/m, French September Jobseekers Net Change and Total Jobseekers.

Swissquote Sqore Trade Ideas:

www.swissquote.com/fx(news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.