Market Brief

Asian markets opened the week with good risk appetite. Nikkei 225 surged 3.98% on news that the GPIF will increase allocation on domestic stocks from 12% to 20-30% (RTRS); Hang Seng and Shanghai’s Composite gained 0.50% and 0.58% respectively, the emerging Asia followed: TWSE (+1.77%), Kospi (+1.55%), Sensex (+1.46%), JCI +(1.15%). USD/CNY traded in the tight range 6.1224/75 in Hong Kong. China is heading into a data-full week: 3Q GDP, September retail sales, industrial production and fixed assets (ex-rural) are due tomorrow and should give fresh direction to Yuan. The consensus is a slower GDP growth of 7.2% (vs. 7.5% in 2Q). Soft print will likely cap the recent Yuan strength around the Fibonacci 38.2% (6.1264) that currently acts as good support and lead to some upside correction. Decent option related offers for USD/CNY trail down 6.18 for this week expiry.

USD/JPY and JPY crosses were better bid in Tokyo on GPIF news. USD/JPY advanced to 107.39. Offers are seen at 107.50/108.20 (optionality / 21-dma). Trend and momentum indicators are still comfortably bearish, suggesting limited upside potential in the short-run. Especially now that the JPY weakness worries. Japanese PM Abe hints at possibility of delay in next sales tax hike, there are talks of split at the heart of LDP, the ruling party. EUR/JPY advanced to 137.01, resistance is eyed at 137.48/50 (daily Ichimoku cloud cover).

EUR/USD made a quiet start to the week. We see recovery in peripheral yields amid last week’s heavy sell-off, yet the sentiment remains fragile. Traders chase opportunities to sell the rallies. Offers are seen pre-1.2800; more resistance should come into play at 1.2853/1.2886 (Fib 23.6% on May-Oct sell-off / Oct 15th high). EUR/GBP opened slightly below its 50-dma (0.79252), resistance is eyed at 0.79701/815 (daily cloud cover).

The Cable extends recovery to 1.6135 this Monday, yet the bull-trend is fragile given the event-full week. The BoE minutes are due on Wednesday and may reveal dovish surprise now that we suspect a delay in first BoE rate hike. The 3Q advance GDP data is due on Friday and traders expect softening 3Q growth (from 3.2% to 3.0% y/y). Therefore, the upside attempts in GBP should find sellers. We see resistance at 1.6155 (21-dma), 1.6239 (Fib 23.6% on Jul-Oct sell-off), then 1.6525 (post-Scott referendum rally).

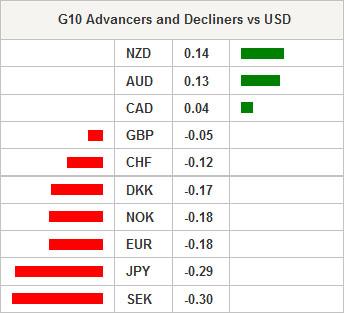

AUD, NZD, CAD did little at week open. USD/CAD consolidates above 1.1200 given the slight cool-off in CPI in September, the recovery in oil prices help limiting weakness in CAD this Monday.

Today, traders watch German September PPI m/m & y/y, Italian August Industrial Sales and Orders m/m & y/y, ECB August Current Account and Canadian Wholesale Trade Sales m/m.

Swissquote Sqore Trade Ideas:

G10 Curreny Trend Model: Short EURUSD at 1.2805

For more great trade ideas go to: www.swissquote.com/fx/news/sqore

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.