Market Brief

The risk sentiment soured since yesterday on weak US and Chinese data. The Chicago Fed National Activity index turned -0.23 in March from 0.44 last month, while the existing home sales fell -0.6% vs. +0.8% in February. This is clearly in opposition with the new home starts in US, which increased by 7% in March while the existing homes seem to have hard time to be sold.

In China, the HSBC Manufacturing PMI fell short of the market expectations. Chinese manufacturing expansion slowed down to 50.5 from 51.6 last month. In reaction, Asian stock markets lost overnight. Hang Seng fell 1.2%, Shanghai’s Composite slumped 2.2%; Nikkei (-0.35%), Taiex (-0.40%) and Kospi index (-0.35%) followed the bear market.

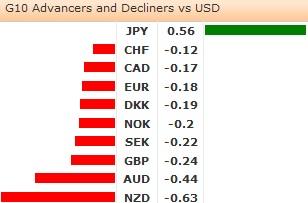

JPY was bid overnight on the deteriorating risk appetite. USDJPY traded down to 98.98 in US and extended losses to 98.59 in Tokyo. AUDJPY and EURJPY have been among the most hit pairs on the disappointing Chinese PMI. Nikkei reported that the Japanese insurers pivot towards foreign bonds, yet 100-wall appears to be thicker than thought. S&P sees still more then 1/3 chance of Japan downgrade while the Japan ageing industrial trail is shown as significant roadblock to “Abenomics”.

The high volatility registered on Italian Napolitano’s re-election left its place to a quiet trading in Euro ahead of PMI figures scheduled this morning. As the discussions on a possibility of an ECB rate cut gains pace, ECB Coeure’s comments weighed further on Euro-sentiment. Coeure said he didn’t see any improvement since last ECB meeting (nothing more exciting than the obvious reality) and the jittering around an upcoming rate cut sent EURUSD down to 1.3015. However in the European opening, EURUSD registered a decent rally on better-than-expected French PMI.

The bull attempt in Aussie remained capped at yesterday’s 1.0310. AUDUSD sold-off to 1.0221 on global growth concerns, as Chinese and US data were not gratifying news for commodity currencies. The fall was tempered by local importers above 1.0200, yet stops are reported below this level. In New Zealand, NZD was sold ahead of RBNZ policy announcement tonight. The OCR is expected to remain unchanged at 2.5%.

Today the economic calendar consists of Swiss March Trade Balance, Imports & Exports, French March Business Confidence, Italian April Consumer Confidence, French, German and Euro-Zone April (Preliminary) PMI Manufacturing & Services, UK March Public Finances, Canadian February Retail Sales, US February House Price Index, US March New Home Sales and April Richmond Fed Manufacturing Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.