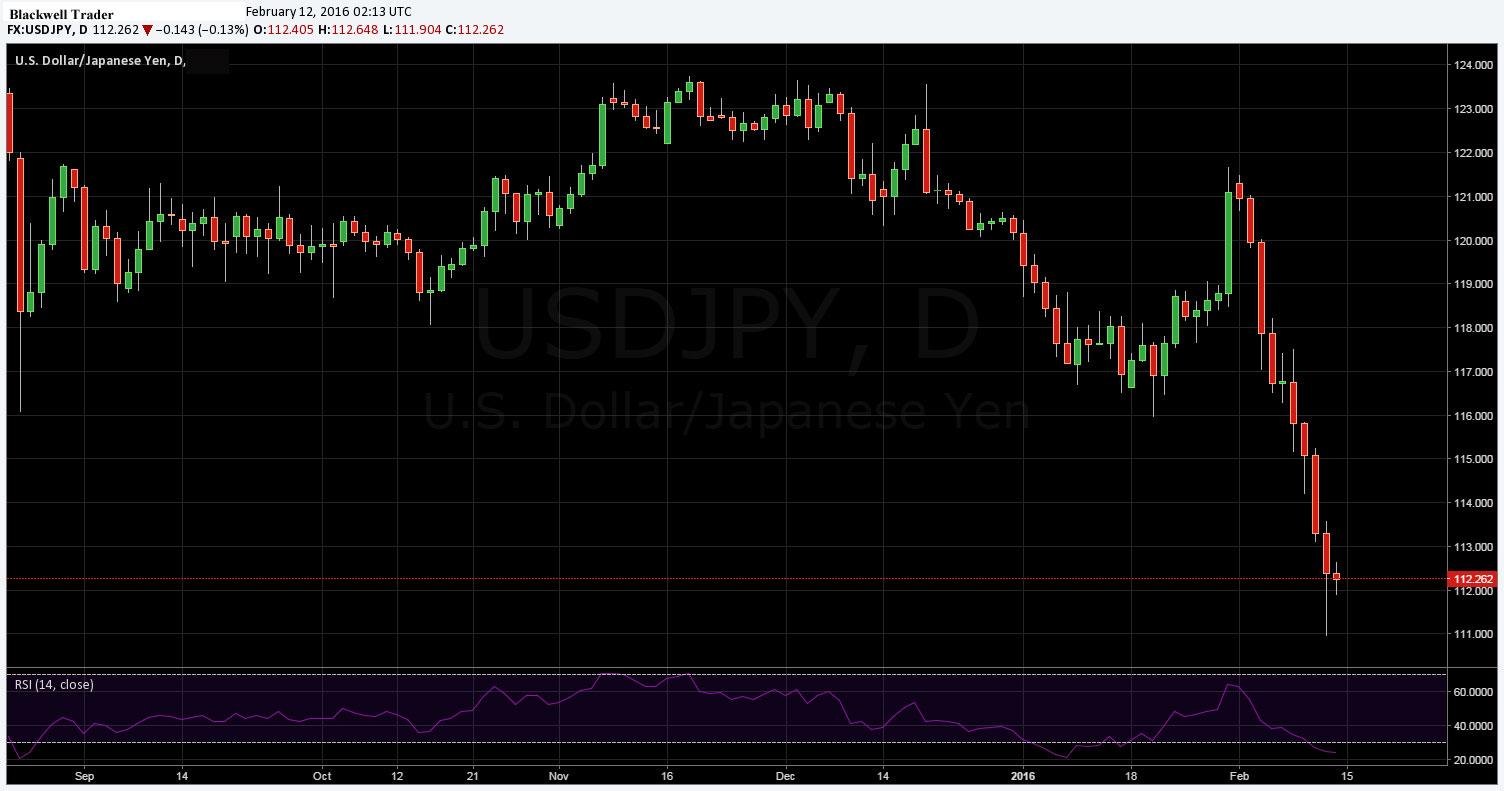

As the USDJPY price continues to collapse towards the 110.00 level the probability of the Bank of Japan intervening to depreciate the Yen is increasing. However, the question remains, what price represents the BoJ’s line in the sand, and can it be defended against a rabidly USD negative market.

Since the start of February, the USDJPY has faced a range of deteriorating conditions that are causing significant consternation in Tokyo. As the USD continues to depreciate sharply against the Yen so too does the affordability of Japanese goods which will have a sharp impact upon Japan’s shrinking export accounts.

Subsequently, the rhetoric emanating from Tokyo today has largely focussed around setting expectations that the government and/or central bank will likely choose to intervene to impact currency valuations in the coming weeks. In fact, Japanese Finance Minister Aso has suggested that the government is standing ready to take appropriate measures in the forex markets, given the recent falls.

The overarching establishment view is that markets are currently much too pessimistic on the US Dollar and that a revaluation is therefore appropriate to support the Japanese economy. Throughout both Minister Aso, and Ishihara’s speeches, it was made patently clear that sudden, sharp FX moves were undesirable and the expectation was subsequently set that any action would be decisive.

The response to the recent strengthening of the Yen has been typical for the Japanese government and central bank as they attempt a ‘verbal intervention’ to alter market expectations. However, given much of the current capital flight within the markets, it is unlikely that this will have much in the way of an impact in the current bearish USD sentiment.

Typically, the Bank of Japan would next attempt to alter expectations by undertaking a round of `rate checks’ with FX dealers with the implication that they could possibly be seeking to sell down the Yen. Subsequently, during yesterday’s Asian session there were some unconfirmed reports of the central bank having done exactly this. However, as expected, the market has been largely focused on the USD fear trade and there has been little in the way of a sentiment change for the Yen.

Subsequently, it is almost a given that the Bank of Japan will now be driven to decisive action and intervene in the currency markets to depreciate the Yen. Last time the markets saw a public intervention from the BoJ was 2011, which saw the bank selling the Yen to re-establish a more appropriate valuation.

Given the continuing falls it’s clear that the central bank will have no choice but to act before the pair faces levels below the psychological 110.00 handle. However, the question remains as to what level the BoJ will attempt to target and some anecdotal rumours doing the rounds point to 116.00 as the forecasted key battleground.

Ultimately, given the unpredictability of the BoJ, predicting a price floor for the Yen is tantamount to selecting the correct power ball numbers. However, regardless of the bank’s targeted level, it will likely cause some sharp volatility and catch plenty of traders unaware. Subsequently, watch your long side risk exposure to the pair closely in the coming days.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.