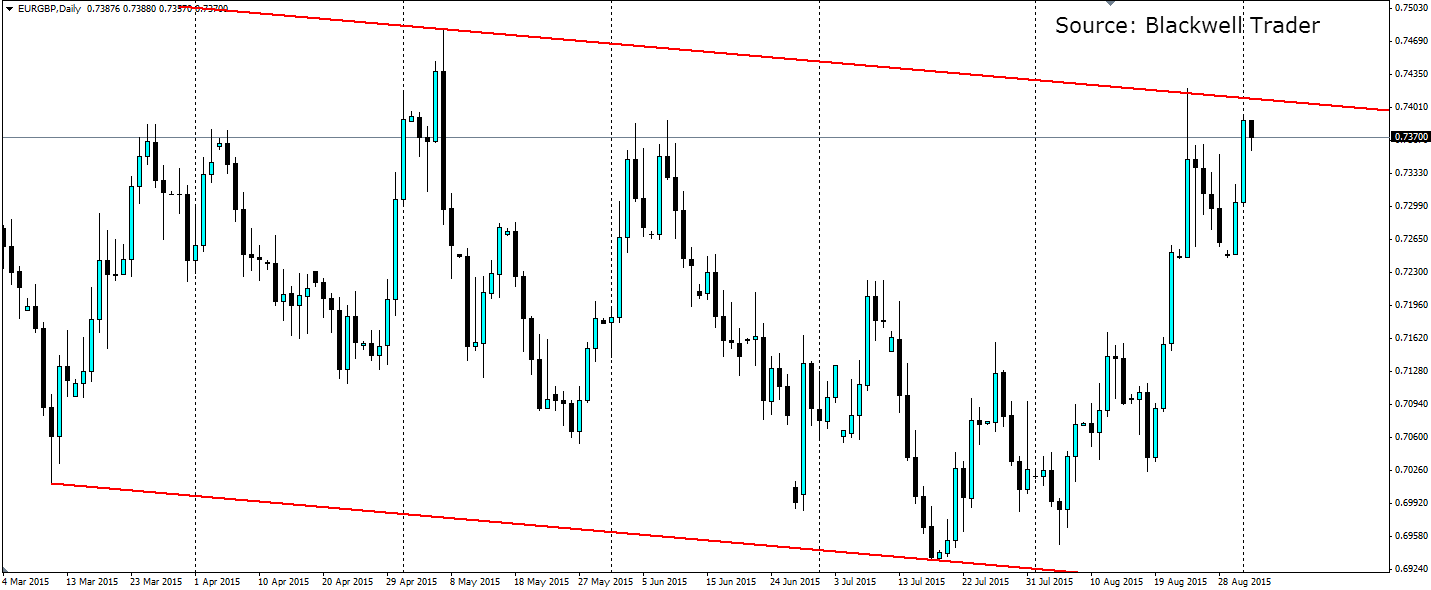

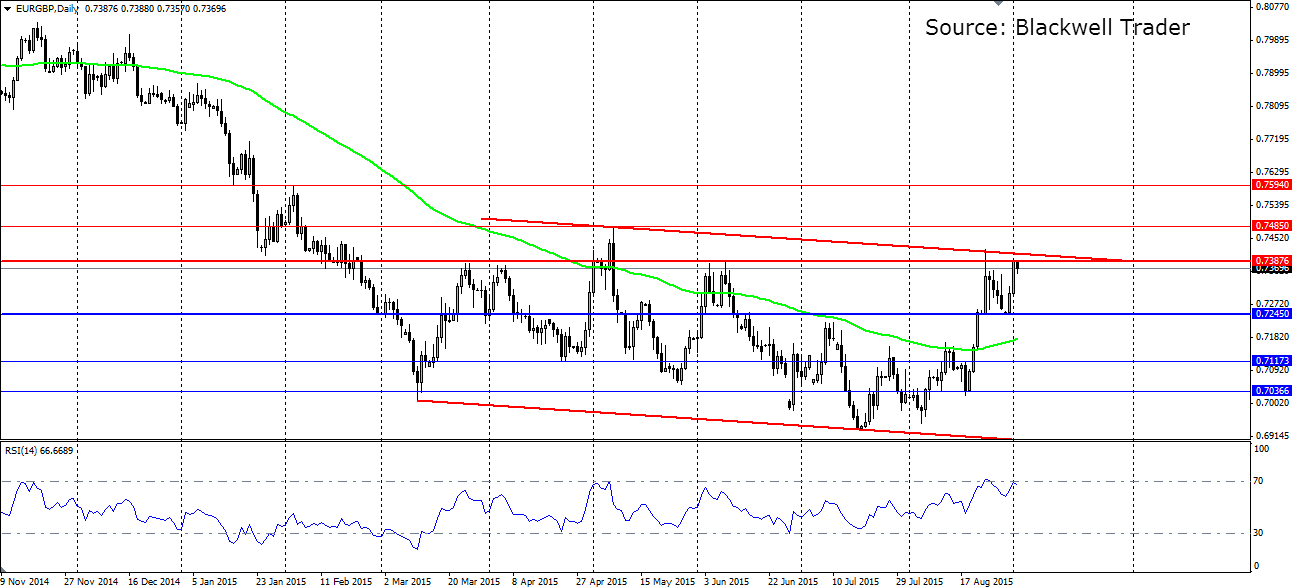

The Euro-Pound pair has found some bids over recent weeks, but all this has served to do is test the channel it has been stuck in for the past 6 months. Can it break the shackles, or will the Pound recover?

The slight bearish bias on the channel is a sign that the market has been favouring the Pound over the Euro in recent months, thanks to the expectation that the Bank of England would raise interest rates sometime this year. That expectation has all but evaporated with the turmoil on global markets and the Euro has taken full advantage.

The recent test of the channel led to a very strong rejection off it, in a sign that the market was willing to defend the short bias on the pair. The RSI pushed into oversold, giving an indication that the move had gone too far, before retreating. The pullback only lasted a week with another charge higher yesterday with a second pullback in the Asian session today.

Both pullbacks are interesting and were largely predictable. They have come in an area of resistance that price has played off several times before. The 0.7387 level acted as resistance in the channel and to support the pair before the channel formed. This level, coinciding with the dynamic resistance, was set up to rejected the pair. The question remains, will the channel hold?

The pattern that is forming currently is a rather classic looking double top. What favours the channel holding firm is the fact that the second ‘top’ is lower than the first, meaning the order flow is favouring the bulls defending the level. A confirmation will come if and when the neckline at 0.7245 is broken and price then uses it as resistance. This is the likely outcome, but not guaranteed.

If the channel holds, look for support to be found at the firm level (the neckline) mentioned above at 0.7245, with further support at 0.7117 and 0.7036. If the channel is breached, a meaningful break of the current resistance at 0.7387 will need to hold, as well as a break of the dynamic resistance along the channel. Further resistance will be found at 0.7485 and 0.7594.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.