Crude oil remained in rout for the second straight day on the basis of the current inventory build within crude storage facilities. Subsequently, WTI CLF6 futures fell strongly and are currently trading around the $42.50/b level.

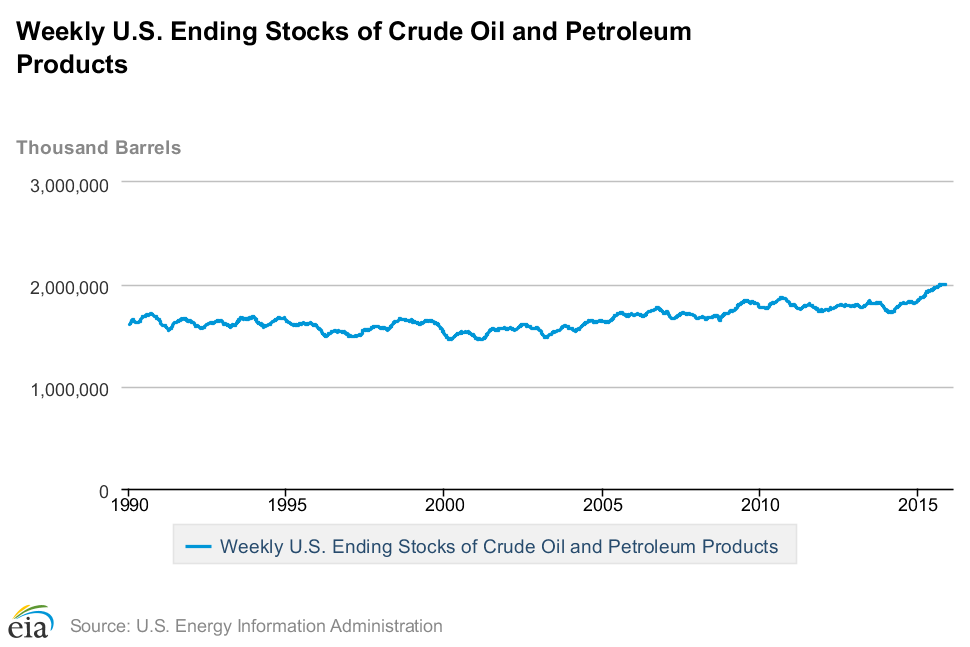

The impetus for the big move was a report by the U.S. Energy Information Administration announcing that crude oil inventory figures rose by 0.90 million barrels. Forecasts had the initial draw at 1.1 million barrels but the result still remained largely negative for oil traders and sent the commodity falling back towards the key $42.00 level. However, the downside is likely to be limited, at least in the short term, as much of the fall has been abated by long positions being taken around $42.00.

However, the inventory numbers are exceedingly bearish and mirror much of the recent supply pressures within global crude markets. Modelling undertaken earlier in the year by the EIA estimated that oil output would continue to drop by over 160,000kb/d throughout 2016. However, these estimations are in conflict with advanced modelling, developed by the Goldman Sachs commodity team, which forecasts growth of 145,000kb/d throughout the latter part of 2015 and into 2016.

The reality is that there are currently many competing interests amongst oil exporters which are clearly evident when you take into account Iran’s recent announcement that there is no requirement for them to consult with OPEC about increased production levels. Subsequently, the over-supply conundrum is likely to remain in the near term as OPEC countries are increasingly relying upon oil revenues to stump up their ailing foreign currency reserves.

In addition, any subsequent price rally is likely to be short term in nature given the risk of the move becoming self-defeating. Increasing oil prices will simply incentivise producers to clamour back into the market to restart production worsening any potential supply glut. Given the large numbers of rig stand downs and well shuttering that has occurred in 2015, the risk of that productive capacity re-entering the market is real.

Subsequently, until OPEC or the West blinks, and adjusts supply accordingly, low crude oil prices are here to stay for the medium term. Subsequently, we still view our price forecasting for crude as accurate with a price target of $41.00/b towards the end of 2015 and reducing to $37.00-$39.00/b by Q2, 2016.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.