The oil market has been very volatile in recent months, if not weeks. But there is certainly no reason to take your eye off the ball when it comes to oil markets.

There has been a lot of talk about fundamentals in the market, and so far they really have very little impact in the long run apart from the fact that demand is just not there. Many have talked about OPEC and Saudia Arabia and for the most part that should not worry the market unless anything does happen and it has not so far.

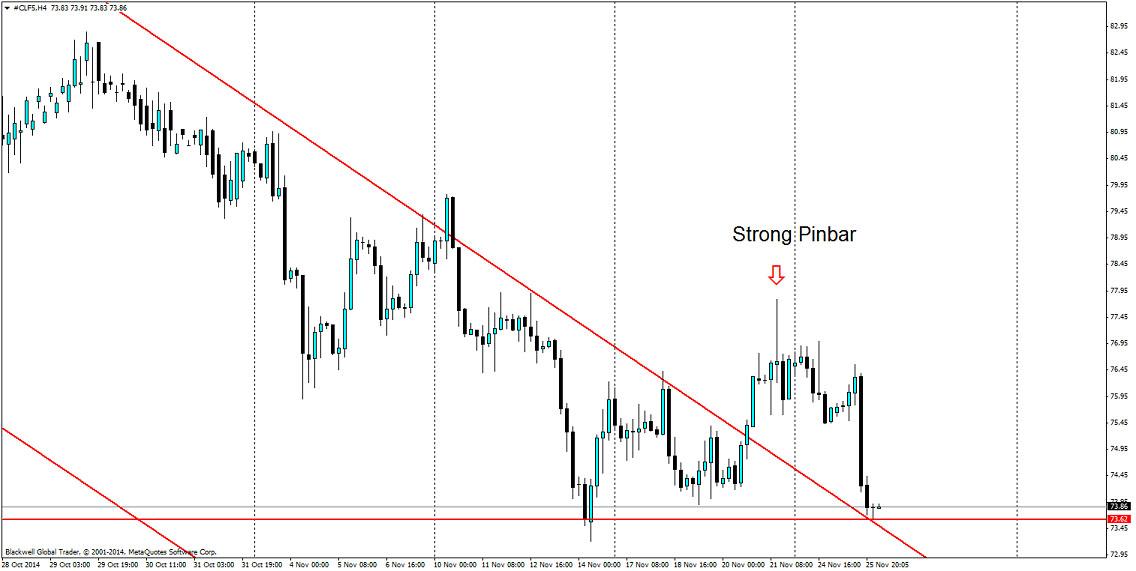

On the charts is where it matters, and what we have seen is a trending market step up the pace and become steeper and more aggressive as of late. However, last week we saw a slight reprieve and a possible false breakout which has since looked to start falling again as demand is still not there in the market.

When looking for price targets 73.62 is the support floor, which is holding up quite nicely at present, it’s likely it may act as solid support for some time. However, market pressure lower is still there and we may be looking for the next major level for oil. This level can be found at 68.56 and is likely to be a strong turning point for oil if we get there, and we may actually find some more bulls in this market for a change.

On the H4 chart, we can see the price action as it pushes the bulls out of the market. We’ve seen a strong pin bar on the charts, followed by aggressive selling as a result and that level holding up as a strong area of resistance.

Overall, oil looks to still be under the pump and until we saw a confirmed amount of momentum driving higher oil looks likely to stay under the bears control. If you’re an oil trader, I would strongly be looking to the sell side of things in the short term, as it looks like the bulls are still not there for traders.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.