The silver market has seen some surprising bullish activity as of late, and this may last for a little while longer given the recent dovish minutes from the last meeting.

However, I would be surprised to see more support in the market especially for the bulls, and we only have to look at the recent US economic data; especially for unemployment. JOTLS Job Openings are a 4.83M (exp 4.71M) and Unemployment Claims came in at 287k (exp 295K). Solid results in the labour market, and for the US economy. But what is most important is that the FED will be taking notice of the strong job market and Yellen for some time has been telling the market to expect rate rises sooner rather than later.

Yes, world markets have had a downgrade in growth forecasts, but if the US starts to pick up more steam it will likely carry global markets. Which will in turn lead to Yellen lifting rates sooner and forcing the speculators out of metals who are feeding of the recent dovish comments.

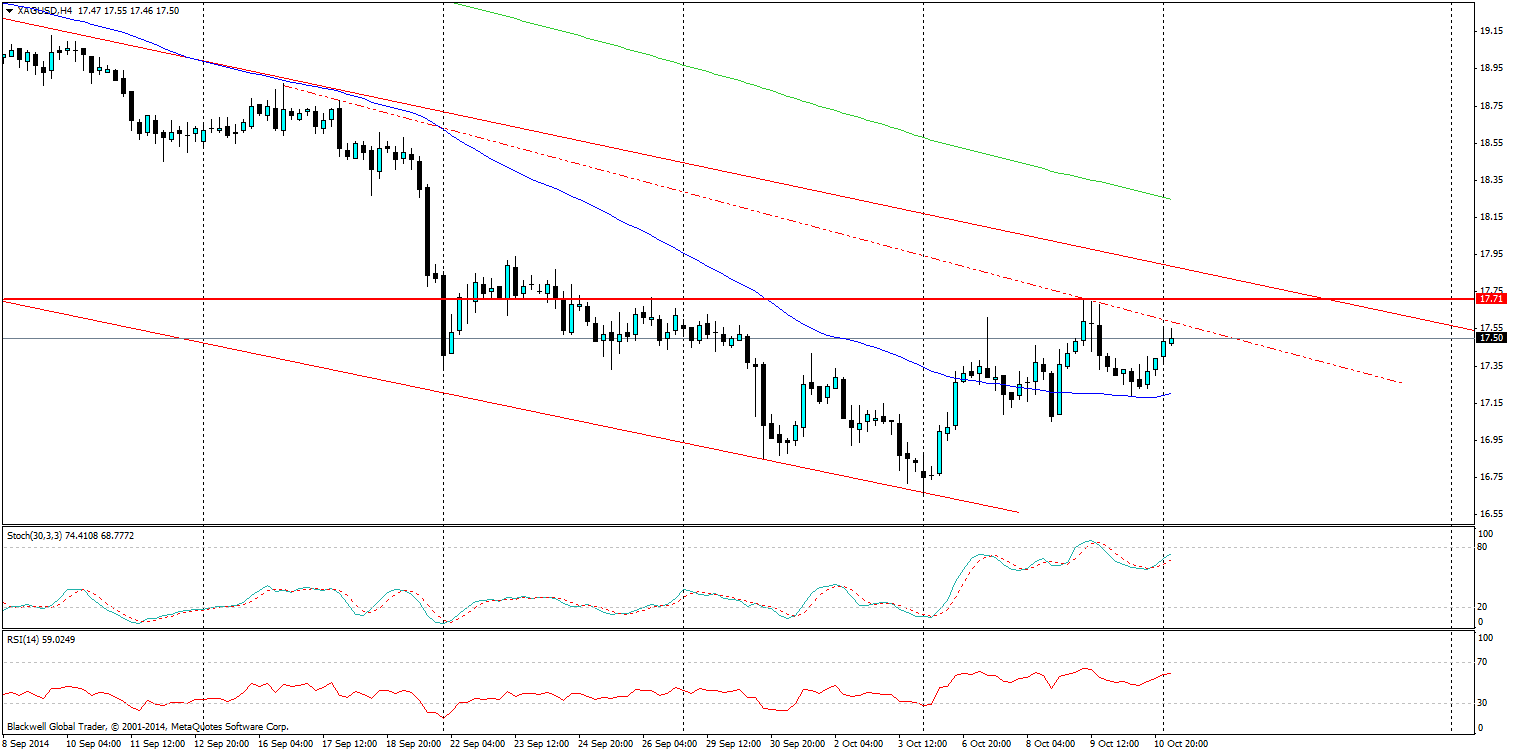

Looking at the technical aspect of silver, it’s quite clear there is a nice trend line on the H4 which starts back in early September. As a trader it has had a few key tests, including during Yellen’s comments and managed to hold! So I will be looking to play of touches and use the 50 day MA as an exit point in the current market.

If this fails, look for resistance at 17.71. A break through this level would signal bullish movement and a need to reassess current patterns in the market.

I will be looking for the bears who are still in the market and still have the momentum to swipe silver lower. If anything, more positive US data could be the catalyst this week to really help push out lower lows.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.