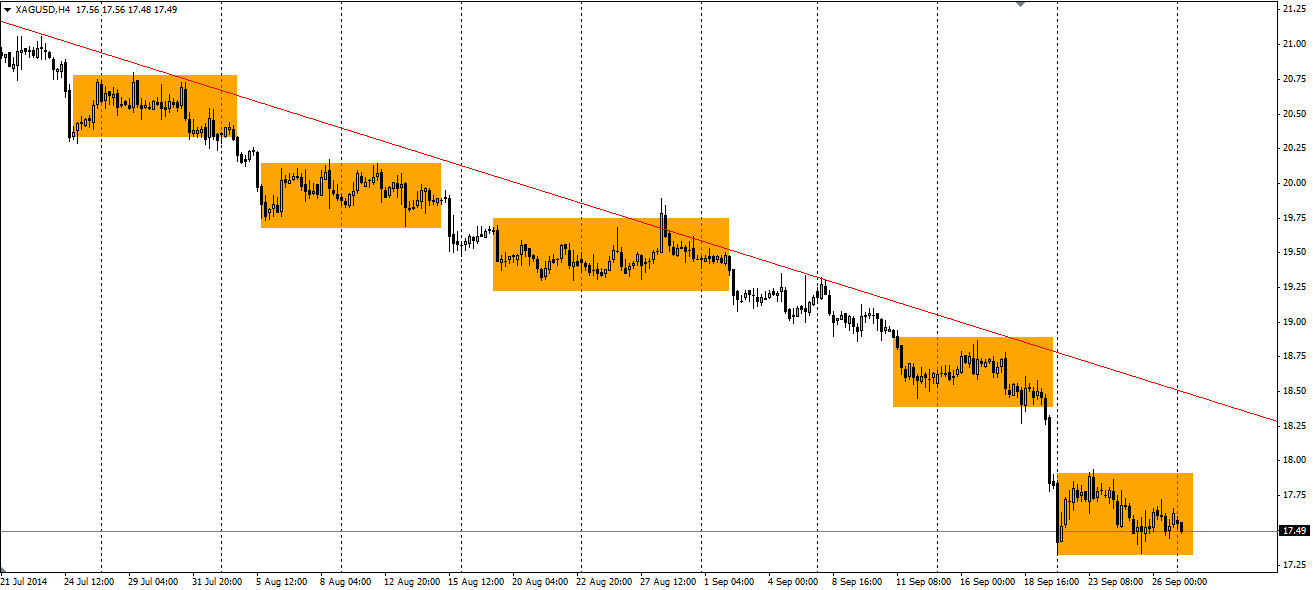

The silver markets make for interesting trading as they go through periods of price consolidation before we see large movements. It looks like we are seeing this pattern repeat itself currently.

Recently the big movements have been bearish, which has led to the formation of a bearish trend, while the consolidation patterns have allowed scalping traders to play the range. The strength in the US dollar and the prospect of tapering ending and interest rates rising has led to metals falling out of favour with investors. This can be seen in gold threatening the $1200 level and silver holding above $17 an ounce.

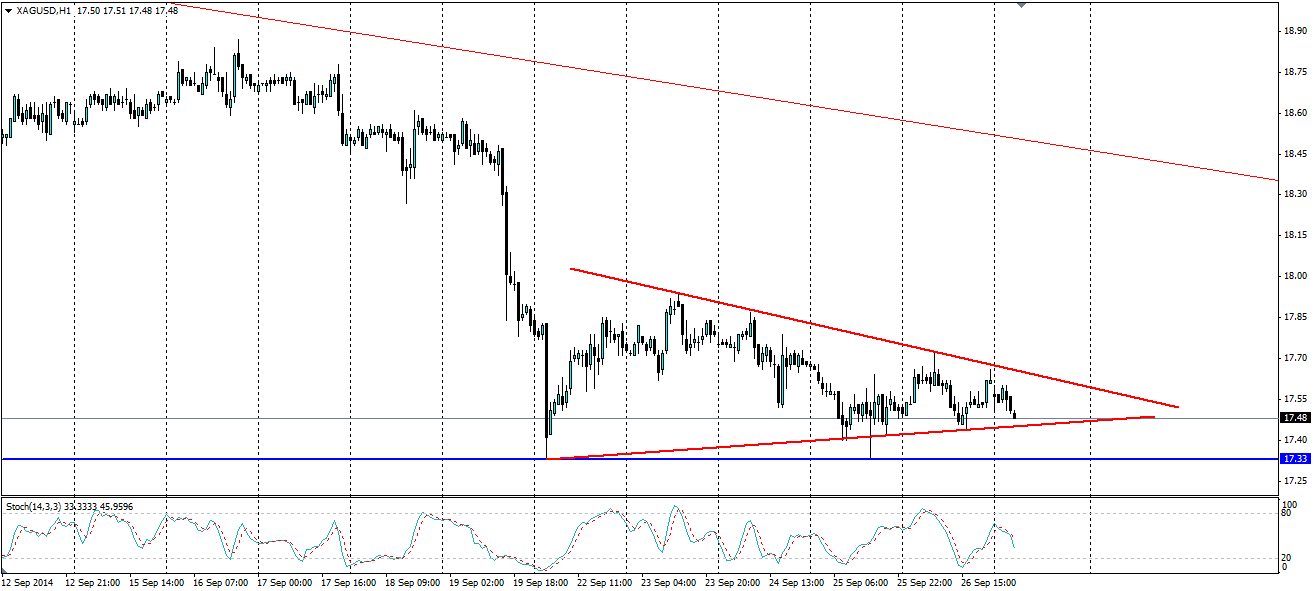

At the moment we have some consolidation in the price of silver between $17.93 and $17.33. The current shape is a pennant which is likely to lead to a bearish breakout around the low $17.40s region. This will be the first breakout as there is heavy support at $17.33, and if this breaks down it is possible we will see $16.50 as the next level of heavy support.

The price of silver has been consolidating in a scenario that has repeated itself as it trends down. Look for a breakout through $17.33 to take the price towards the mid-$16 range.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.