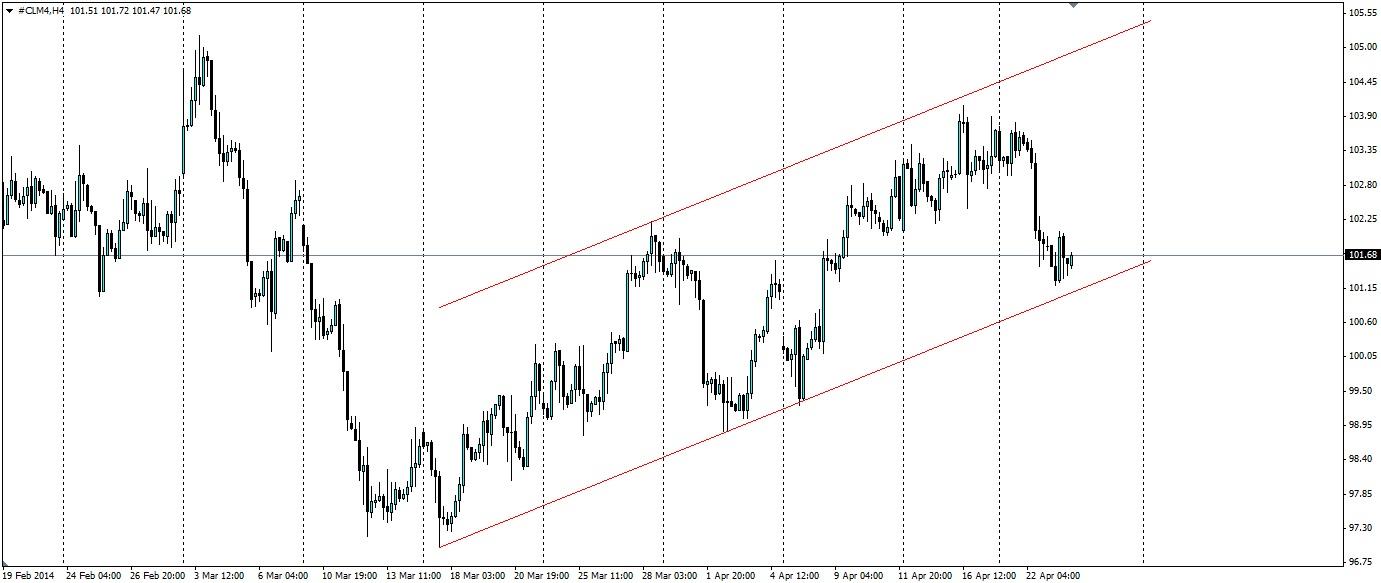

Oil appears to be trading inside a channel and at US$101.57 a barrel, it is quite close to touching the bottom again. There is a clear strategy on Crude Oil futures (#CLM4) here to follow the price up the channel and it should have a fairly low risk/reward ratio.

Volatility

Oil has seen quite a bit of volatility recently, however, it has been trending upwards since mid-March. The recent Chinese PMI report by HSBC and concerns over stockpiles leading to excess supply has caused the price to fall considerably over the last 48 hours, however, between weakness in the US Dollar, renewed concerns over Ukraine, crude oil reserves and US job data, Oil has seen the price movements between $96.99 a barrel and $104.00 a barrel this past month.

Supply Concerns

Concerns over supply are lingering. There is a bit of speculation about the market that Libya may begin to increase Oil exports. Libyan rebels who control one of the ports have agreed to open it up, however, export has not begun yet. Output from the North African nation, which has the largest Crude Oil reserves in Africa, has fallen from 1.4m barrels a day to merely 250,000. Any increase in production from Libya will no doubt have a negative effect on the price.

Furthermore, the boom in the shale industry in the US has led to output from the US being at its highest level for 26 years. This has led to weekly imports of Crude Oil in the US dropping 3.7% from a year earlier. If this trend continues, we could see significant movements lower in the price of Crude Oil.

Reserves, Jobs

Oil reserves in the US are pushing up to 400 million barrels at 397.7m. The latest release this week showed reserves increased by 3.5 million barrels, versus an expected 2.6m. This is the highest reserves have been for 80 years. This result added to the volatility in the crude price. More news to watch that could affect the price is the durable goods and Jobless claims data out later this evening and also the consumer confidence figures due Friday evening. Any result to the positive of what the market is expecting could send the Crude price up because all of these figures give an indication of future consumption and thus demand for Oil.

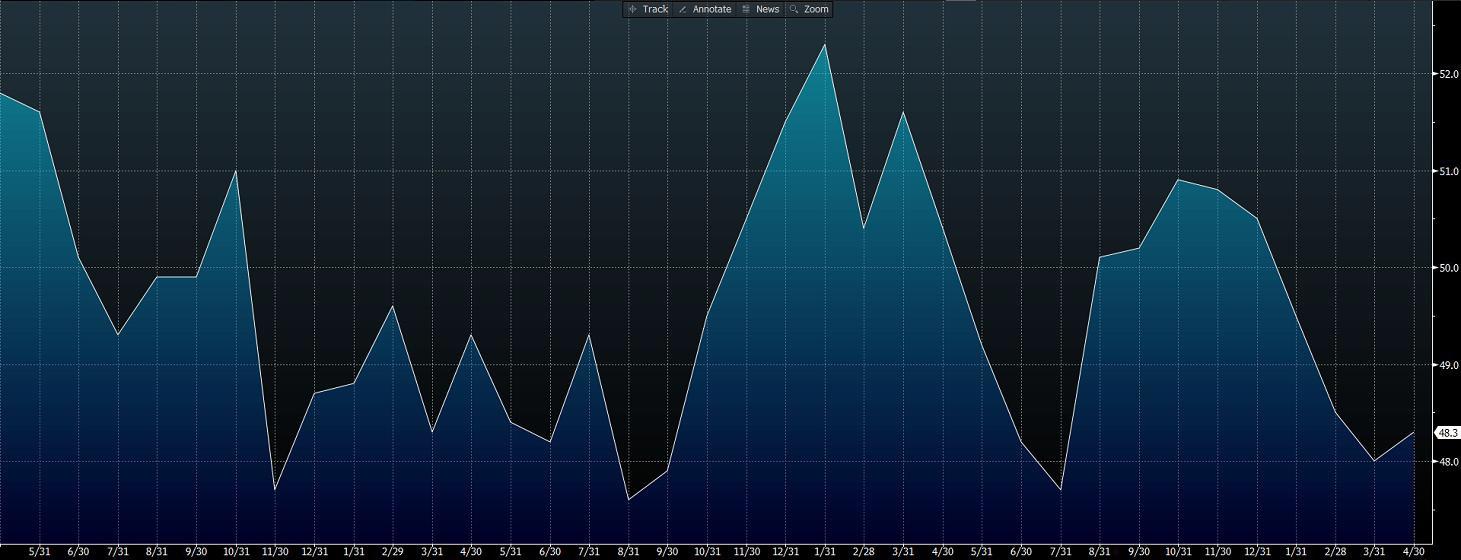

Total US Crude Oil Stockpiles 2009-2014

Ukraine

Something to keep in mind is the tension in Ukraine, and this is certainly having an effect on the markets. This situation has not been resolved by any stretch of the imagination and could flare up at any stage. The Ukraine government in Kiev said it will be resuming operations to remove militants from eastern cities along the border with Russia. The US has also sent troops to countries that border Russia for “training exercises” and Russia already has a full arsenal in the region so tensions could boil over into actions. Any direct conflict will impact the energy sector and any more talk of sanctions against Russia will send the price of Crude Oil up.

China

China is another one to consider with recent economic figures pointing to a slowing down of the contraction in manufacturing. The recent HSBC PMI report showing 48.4, up from 48.0 a month ago, suggesting the decrease in activity may not be as deep as feared. Recently, the GDP figure showed year on year growth of 7.4%, down from 7.7% three months ago, so the world’s second largest economy is still growing at a solid pace. More mixed data out of China includes CPI of 2.4%, however PPI of -2.3%; Retail sales up 12.2% yet imports and exports fell -11.3% and -6.6% respectively from a year earlier. Further signs of a slowdown in demand from the world’s 2nd largest economy will no doubt have an impact on demand for Crude Oil.

HSBC China Manufacturing PMI 2009-2014

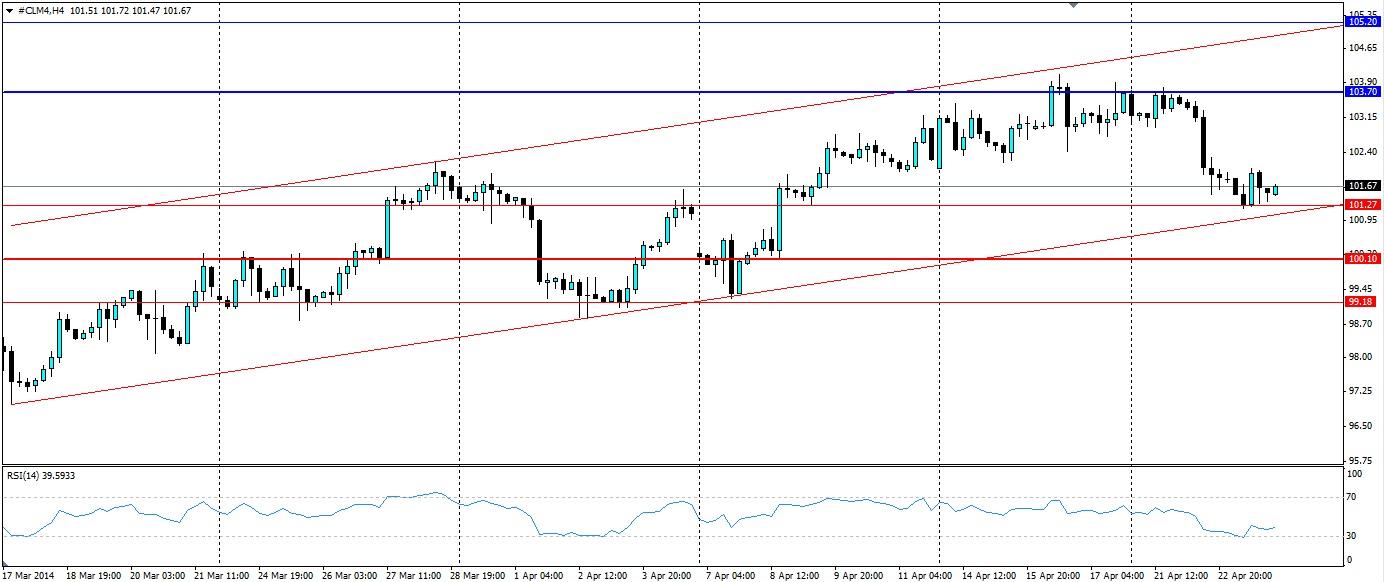

Technicals

Current technicals show a clear channel with a width of 385 pips or $3.85 a barrel. The top of the shape is the dynamic resistance the price has bounced off, as is the lower trend line. If a breakout was to occur, the next levels of support can be found at 100.10 and 99.18, however, a stop loss should be set just under the current bullish trend, hence the downside will not be large given the price is close to this line.

The RSI on Oil futures is currently showing close to oversold. The market does not seem to like the RSI staying around the 30 mark for any length of time and usually results in a swing higher once it touches this level. The RSI has bounced off the 30 level and is now showing movements higher, indicating bullish movements.

Opportunities

If a trader were to play off this channel, they would be looking for the current support around 101.27 to hold and for the price to bounce off this. A target for this strategy could be the first resistance around 103.70 or for a more ambitious approach, look to use the upper line of the channel as dynamic resistance.

Alternatively, if someone believes the price will break out given the fundamentals explained above, a sell stop could be set on the downside of the current channel with a stop loss back inside, just in case it is a false breakout. A target for this strategy could be any of the support levels explained above.

Summary

Clearly, there is a channel in play in the Crude Oil market, and given the potential for fundamental movements in the market, the price should see a movement towards the higher end of the channel. If a breakout occurs, the price could track down quickly.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.